Bank of America Business Checking Offers: What's the Deal?

So, you're launching a business, huh? Congratulations! Now, let's talk about something slightly less glamorous, but equally important – your bank account. Specifically, the Bank of America business checking offers that everyone seems to be whispering about. Are they worth the hype? Let's dive in.

Choosing the right bank for your business isn't as simple as picking the one with the cutest logo. You're entrusting them with your hard-earned cash, after all. Bank of America is a behemoth in the banking world, and their business checking accounts come with a certain allure. But are their offers all they're cracked up to be?

Here's the deal: Bank of America business checking offers come in different flavors, each tailored to specific business needs. There's the basic, no-frills option for startups watching every penny, and then there are accounts designed for established businesses with more complex financial needs.

But before you get seduced by promises of free transactions and fancy mobile apps, let's peel back the layers and see what's really going on. Because, as with anything in the financial world, the devil is in the details. Are there hidden fees lurking in the fine print? What kind of customer service can you expect when you need help navigating a banking snafu?

The truth is, the best Bank of America business checking offer for you depends entirely on your individual business needs. A small online retailer might prioritize low transaction fees, while a brick-and-mortar store might need unlimited check writing capabilities. It's all about understanding your own financial flow and finding the account that aligns with your specific goals.

Advantages and Disadvantages of Bank of America Business Checking Offers

| Advantages | Disadvantages |

|---|---|

| Wide network of branches and ATMs | Potentially higher fees compared to online banks |

| Robust online and mobile banking platform | Minimum balance requirements for some accounts |

| Variety of account options to choose from | Customer service can be inconsistent |

| Integration with other Bank of America products and services | Limited perks and rewards compared to some competitors |

So, are Bank of America business checking offers the golden ticket to financial success? Not necessarily. But they do offer a blend of convenience, established reputation, and a range of account options that could be a good fit for certain businesses. Ultimately, the key is to do your homework, compare your options, and choose the account that best aligns with your specific financial needs and priorities.

Remember, your business bank account is the engine room of your operations. Make sure you choose one that's built to power your success.

Bank Of America Business Checking Review: $200 | YonathAn-Avis Hai

Bank of America Cash Rewards Credit Card 2024 Review | YonathAn-Avis Hai

What Banks Offer Checking Accounts at Karen Campbell blog | YonathAn-Avis Hai

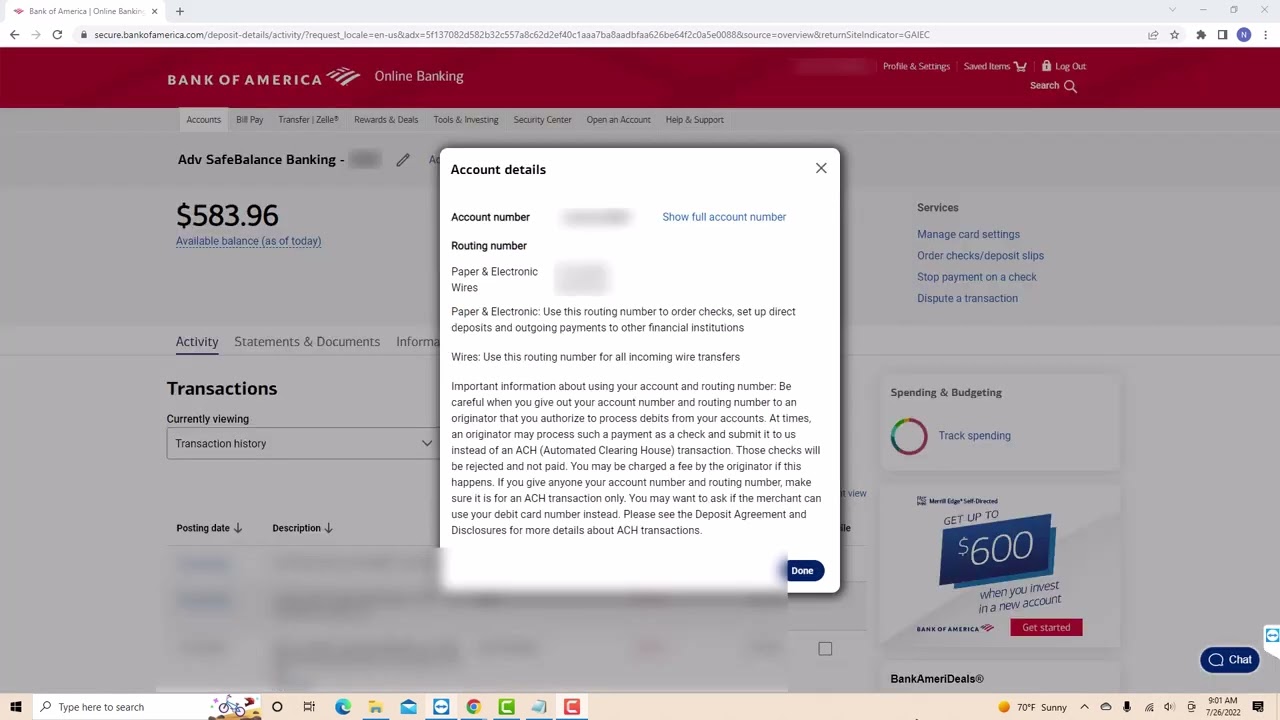

Parts Of A Bank Account Number at Judith Comerford blog | YonathAn-Avis Hai

Bank of America Business Checking $300 + $200 Bonus [In Branch & YMMV | YonathAn-Avis Hai

USA Bank of America bank statement easy to fill template in .xls and | YonathAn-Avis Hai

Bank Of America Business Checking Review: $200 | YonathAn-Avis Hai

Bank Of America Direct Deposit Time | YonathAn-Avis Hai

BANK of America business account statement Word and PDF template by | YonathAn-Avis Hai

Bank of America Business Checking Review: Is It Worth It? (Pros, Cons | YonathAn-Avis Hai

Bank of America Promotions: $100, $150, $200, $300, & $500 Checking | YonathAn-Avis Hai

bank of america business checking offers | YonathAn-Avis Hai

Open Business Checking Account Online Bank Of America | YonathAn-Avis Hai

Bank Of America Statement Template New Bank Statement Bank America Mis | YonathAn-Avis Hai

New 2023 Bank Of America Statement Template | YonathAn-Avis Hai