Borang Permohonan Pulangan Balik Hasil: Your Guide to Tax Refunds

Ever felt like you overpaid on something and wished you could get some money back? Well, in the world of taxes, it's not just a wish – it's a right! In Malaysia, the "borang permohonan pulangan balik hasil" is your key to unlocking potential refunds and getting back what's rightfully yours. Let's dive into the intricate world of Malaysian tax refunds, demystify the process, and empower you to claim your due diligence.

Many people find taxes intimidating, and the idea of navigating unfamiliar terms like "borang permohonan pulangan balik hasil" can be daunting. But fear not! Think of this as your friendly, jargon-free guide to understanding the ins and outs of Malaysian tax refunds.

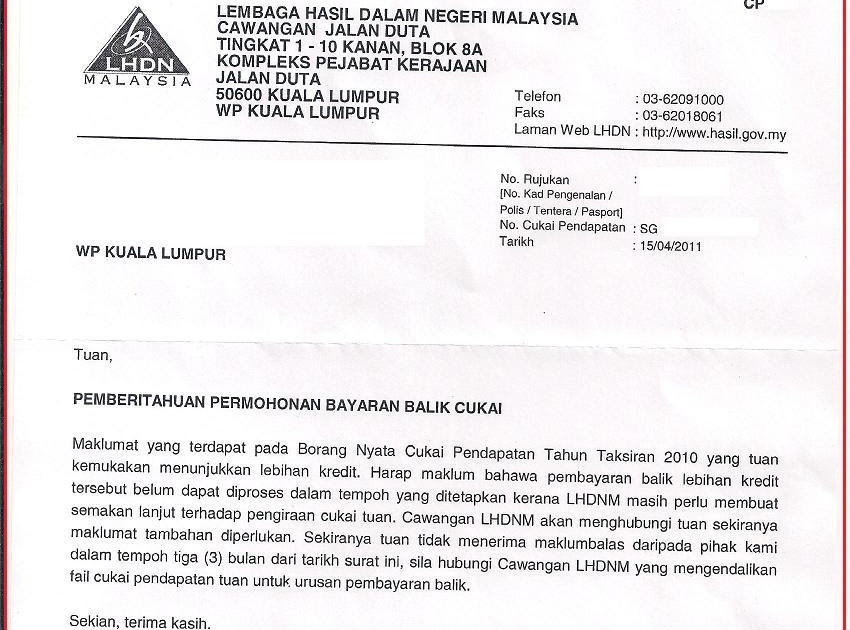

"Borang permohonan pulangan balik hasil" simply translates to "income tax return form" in Malay. It's the official document used to report your income to the Inland Revenue Board of Malaysia (LHDN) and potentially claim a refund if you've overpaid your taxes.

This form is more than just a piece of paperwork – it's your passport to claiming back overpaid taxes. Overpaying taxes can occur for various reasons, such as having too much tax deducted from your salary or making incorrect tax payments.

By understanding the "borang permohonan pulangan balik hasil," you're taking control of your finances and ensuring you're not leaving any money on the table. It's about understanding your rights as a taxpayer and ensuring you're not paying more than your fair share.

Advantages and Disadvantages of Borang Permohonan Pulangan Balik Hasil

| Advantages | Disadvantages |

|---|---|

| Potential to receive a tax refund | Can be a complex and time-consuming process for some individuals |

| Ensures you're only paying your fair share of taxes | Requires gathering and organizing financial documents |

| Allows you to claim deductions and exemptions you're eligible for | Possibility of errors if not filled out correctly |

While the concept of tax refunds is globally applicable, the specific form and process differ from country to country. The "borang permohonan pulangan balik hasil" is specific to Malaysia and reflects the country's tax laws and regulations. Understanding these nuances is crucial for a smooth and successful refund process.

The history and evolution of this form are intertwined with Malaysia's own economic development and tax system reforms. Over time, the form has been revised and updated to adapt to changing economic landscapes and ensure fairness and efficiency in tax collection and refunds.

Navigating the world of taxes and refunds doesn't have to be overwhelming. By understanding the basics, staying informed about the latest regulations, and seeking professional help when needed, you can confidently approach your tax obligations and maximize your chances of receiving any refunds due. Remember, it's your money, and claiming what's rightfully yours is simply smart financial management.

Borang Permohonan Pulangan Balik Cukai Taksiran | YonathAn-Avis Hai

Borang Permohonan Tuntutan Balik Bayaran Levi Historyploaty | YonathAn-Avis Hai

Surat Permohonan Bayaran Balik Imagesee | YonathAn-Avis Hai

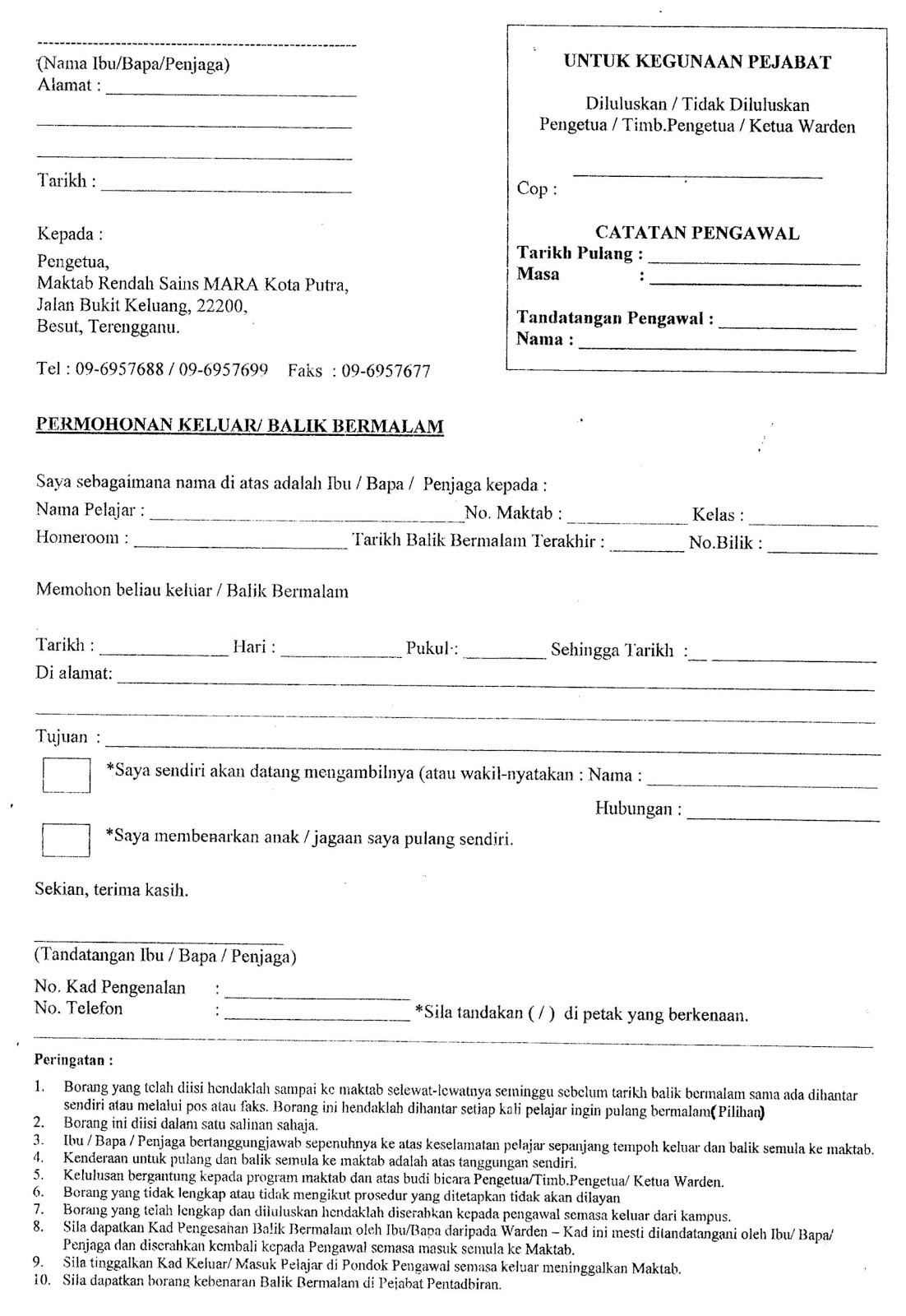

Surat Memohon Kebenaran Balik Bermalam | YonathAn-Avis Hai

Surat Tuntutan Bayaran Balik | YonathAn-Avis Hai

Borang Permohonan Tuntutan Balik Bayaran Levi Historyploaty | YonathAn-Avis Hai

Contoh Surat Rayuan Cukai Lhdn | YonathAn-Avis Hai

borang permohonan pulangan balik hasil | YonathAn-Avis Hai

Surat Rasmi Permohonan Balik Bermalam Contoh Yo | YonathAn-Avis Hai