Cara Check No Cukai Pendapatan: Your Guide to Malaysian Tax Filing

Navigating the world of taxes can feel like stepping into a labyrinth. Forms, deadlines, and unfamiliar terms can leave you feeling overwhelmed. In Malaysia, understanding your tax obligations and knowing your 'no cukai pendapatan' (income tax number) is essential. Whether you're a seasoned professional or just starting your career, having a firm grasp of your tax ID and the processes surrounding it is crucial for a smooth financial journey.

But where do you even begin? How do you find this crucial number, and what can you do with it? This comprehensive guide is here to demystify the world of Malaysian income tax. We'll walk you through the ins and outs of your 'no cukai pendapatan,' from its significance to how it plays a role in your financial life.

Imagine this: You've landed your dream job, but filling out the paperwork has you stumped. You're unsure about certain tax-related sections, particularly the one requesting your 'no cukai pendapatan.' Or perhaps you're due for a tax refund but need help figuring out where to start. These are just a couple of situations where knowing your tax ID is vital.

Your 'no cukai pendapatan' is more than just a random string of numbers. It's your unique identifier within the Malaysian tax system, connecting you to your financial history with the Inland Revenue Board of Malaysia (LHDN). Think of it as your financial fingerprint, playing a pivotal role in tax filing, refunds, and even certain financial transactions.

Throughout this article, we'll delve into the various aspects of the 'no cukai pendapatan.' We'll explore how to obtain this number for the first time, the steps to retrieve it if you've misplaced it, and the many ways it impacts your financial well-being. By the end of this guide, you'll feel empowered to confidently handle your tax obligations and navigate the Malaysian tax system with ease. Let's get started!

Advantages and Disadvantages of Knowing Your 'No Cukai Pendapatan'

While knowing your tax ID might seem like a given, let's weigh the benefits and drawbacks:

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Managing Your 'No Cukai Pendapatan'

- Memorize it: While it's tempting to rely solely on digital storage, memorizing your tax ID adds an extra layer of security.

- Store it securely: Avoid writing it down on random pieces of paper. Use a password manager or a secure location in your home.

- Be cautious online: Only share your tax ID on official government or financial institution websites.

- Report lost or stolen IDs immediately: Contact LHDN right away if you suspect your tax ID has been compromised.

- Regularly check your tax records: Stay informed about any discrepancies or suspicious activity related to your tax account.

Common Questions and Answers About 'No Cukai Pendapatan'

Q: What if I lose my tax ID?

A: Don't panic! You can retrieve it by contacting LHDN, visiting their branch, or using their online portal.

Q: I'm a foreigner working in Malaysia. Do I need a 'no cukai pendapatan'?

A: Yes, if you're employed in Malaysia, you'll need to register for a tax ID to comply with tax regulations.

Q: How often do I need to renew my 'no cukai pendapatan'?

A: Your tax ID doesn't expire. Once you have it, it remains yours.

Q: What are the consequences of not having a tax ID?

A: Not having a tax ID can lead to penalties, complications with financial transactions, and difficulty accessing government assistance.

Q: Can I use my passport number instead of my 'no cukai pendapatan'?

A: No, your tax ID is a distinct identifier used solely for tax purposes and cannot be substituted with your passport number.

Tips and Tricks

* Keep digital copies of your tax ID and related documents for easy access.

* Mark important tax deadlines on your calendar to avoid late fees.

* Familiarize yourself with tax relief options to maximize your deductions.

Understanding the nuances of your 'no cukai pendapatan' is essential for anyone navigating the Malaysian financial landscape. By taking the time to learn about its significance, safeguarding your information, and staying informed about tax procedures, you can ensure a smoother experience with your financial obligations. Remember, your 'no cukai pendapatan' is more than just a number; it's your key to financial peace of mind in Malaysia.

Cara Daftar Cukai Pendapatan di Malaysia | YonathAn-Avis Hai

Semak No Cukai Pendapatan Pekerja | YonathAn-Avis Hai

Cara Daftar Cukai LHDN Untuk e | YonathAn-Avis Hai

Cara Mengisi E Filing Pajak Ceritas | YonathAn-Avis Hai

Semakan No Cukai Pendapatan Syarikat | YonathAn-Avis Hai

Cukai Pintu, Cukai Tanah dan Cukai Petak? | YonathAn-Avis Hai

CHECK NO CUKAI PENDAPATAN/SYARIKAT MALAYSIA | YonathAn-Avis Hai

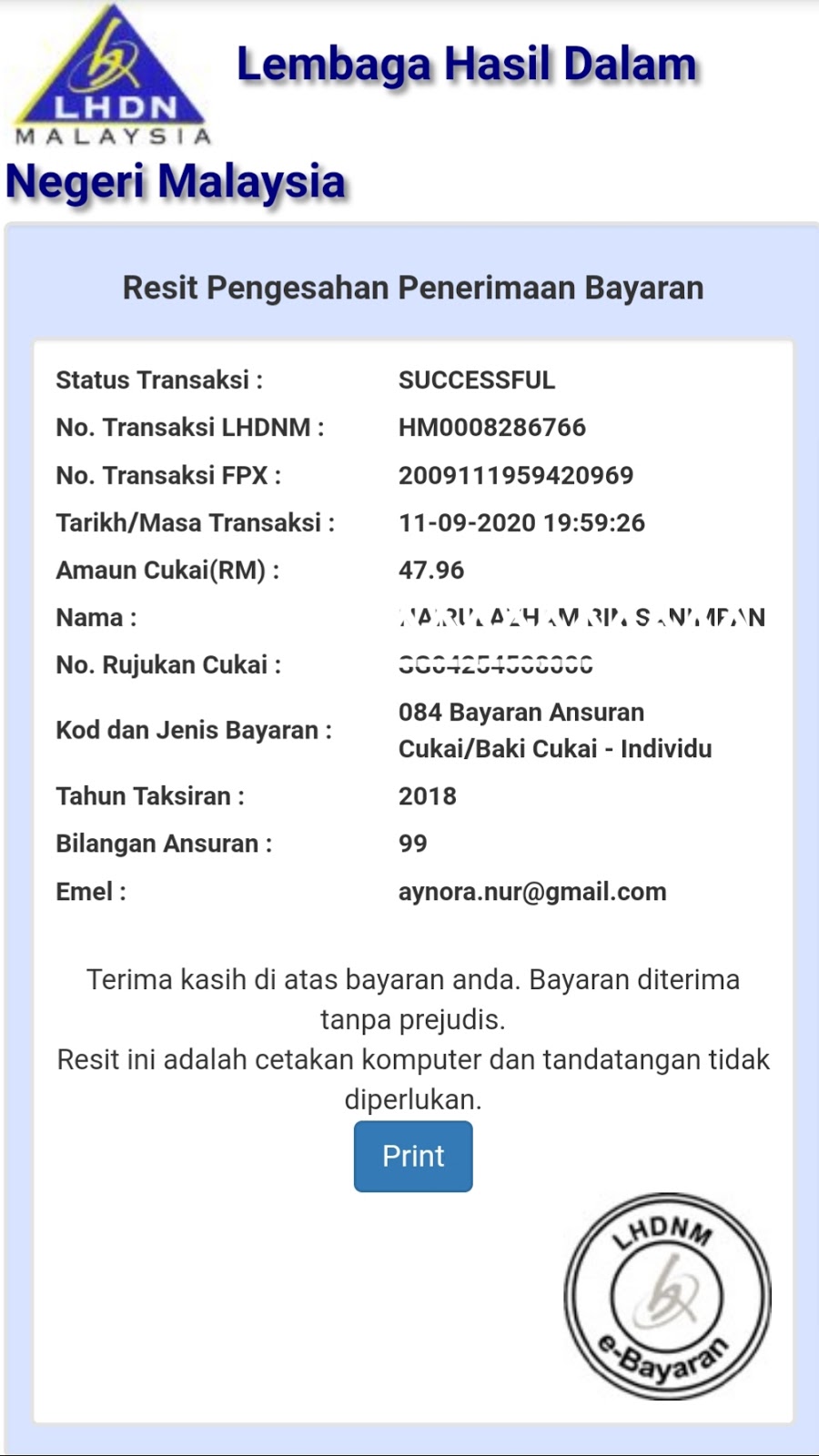

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah | YonathAn-Avis Hai

Cara Semak Cukai Tanah & Bayar Online Setiap Negeri, Tak Perlu Beratur | YonathAn-Avis Hai

Panduan Lengkap Cara Isi eFiling Bagi Pengiraan Cukai Pendapatan | YonathAn-Avis Hai

Oh, Ni Rupanya Cara Untuk Bayar Cukai Taksiran | YonathAn-Avis Hai

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU | YonathAn-Avis Hai

Semakan No Cukai Pendapatan Individu (TIN Hasil) | YonathAn-Avis Hai

Panduan Lengkap Cara Isi E Filing Cukai Pendapatan Individu | YonathAn-Avis Hai

CARA MENDAPATKAN NO CUKAI PENDAPATAN INDIVIDU DAN SYARIKAT SERTA DAFTAR | YonathAn-Avis Hai