Claim What's Rightfully Yours: A Guide to Borang Permohonan Bayaran Balik Hasil

Imagine this: you diligently filed your taxes, ensuring every detail was accurate, only to discover later that you overpaid. Frustrating, right? Now, imagine a system where reclaiming those overpaid funds is straightforward and efficient. That's where 'borang permohonan bayaran balik hasil' comes in, providing a clear pathway to get back what's rightfully yours.

In many countries, tax systems are designed to be self-assessing, meaning individuals and businesses calculate their own tax liability. While this system promotes responsibility, it can lead to situations where taxpayers inadvertently overpay, whether due to miscalculations, changes in personal circumstances, or complex tax regulations. This is where the concept of a tax refund emerges as a crucial element of fairness within the system.

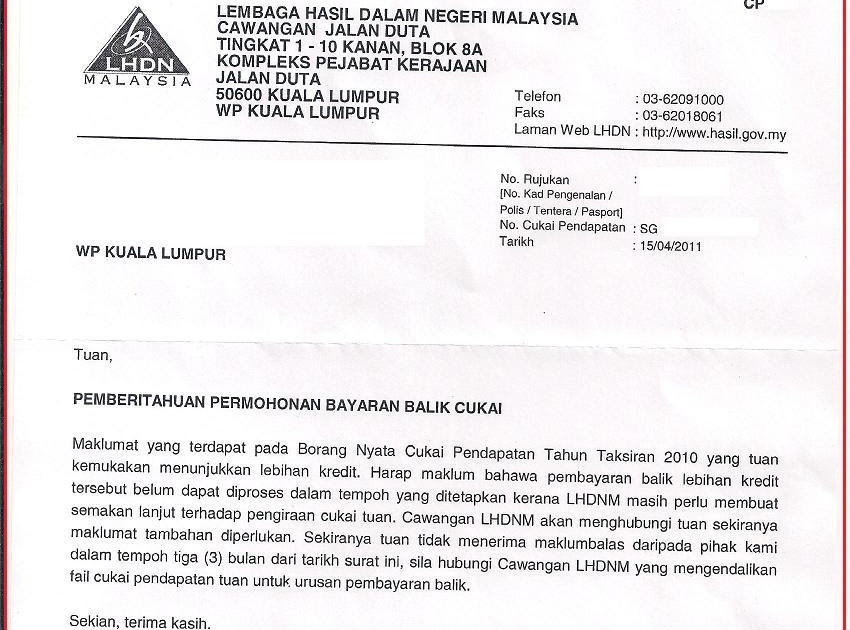

'Borang permohonan bayaran balik hasil,' which translates directly to 'income tax refund application form' in Malay, embodies this mechanism for redress. It serves as a formal request to the tax authorities to review a taxpayer's situation and, if applicable, issue a refund for the overpaid amount. Understanding this form and the process it initiates is paramount for anyone who believes they might be eligible for a tax refund.

This guide will delve into the intricacies of 'borang permohonan bayaran balik hasil,' providing a comprehensive understanding of its significance, the steps involved in filing it, and valuable tips to ensure a smooth and successful refund process. Whether you're a seasoned taxpayer or navigating this process for the first time, this guide aims to empower you to claim your due refund confidently.

Remember, navigating the world of taxes can seem daunting, but with the right information and resources, it doesn't have to be. This guide will equip you with the knowledge to understand your rights as a taxpayer and ensure you're not leaving any money on the table.

Advantages and Disadvantages of Borang Permohonan Bayaran Balik Hasil

| Advantages | Disadvantages |

|---|---|

| Can reclaim overpaid taxes | Can be a time-consuming process |

| Provides financial relief | Requires meticulous documentation |

| Ensures fairness in the tax system | Potential for delays in receiving refunds |

While we can't cover every specific detail within this general guide, it's important to remember that tax laws and regulations are subject to change. Always refer to the official website of your country's tax authority for the most up-to-date information and specific instructions relevant to your situation. Understanding your rights and responsibilities as a taxpayer is crucial for financial well-being. By being proactive and informed, you can ensure you're not overpaying your taxes and, if you are, that you have the tools to reclaim what's rightfully yours.

Surat Permohonan Bayaran Balik Imagesee | YonathAn-Avis Hai

Contoh Surat Permohonan Bayaran Ansuran | YonathAn-Avis Hai

Surat Tuntutan Bayaran Balik | YonathAn-Avis Hai

Fillable Online Borang Bayaran Balik Hasil | YonathAn-Avis Hai

Surat Tuntutan Bayaran Balik | YonathAn-Avis Hai

Borang Permohonan Bayaran Balik Kos Kuarantin akibat Covid19 | YonathAn-Avis Hai

11++ Contoh Surat Rasmi Tarik Balik Laporan Polis | YonathAn-Avis Hai

Borang Permohonan Tuntutan Balik Bayaran Levi Historyploaty | YonathAn-Avis Hai

36+ Contoh Cukai Pintu Selangor Images | YonathAn-Avis Hai

Surat Permohonan Mundur Pembayaran | YonathAn-Avis Hai

borang permohonan bayaran balik hasil | YonathAn-Avis Hai

Surat Permohonan Bayaran Balik Imagesee | YonathAn-Avis Hai