Decoding Bank of America Cashier's Checks: A Comprehensive Guide

Navigating the world of financial instruments can feel daunting. One such instrument, the cashier's check, often raises questions about its purpose and usage. This comprehensive guide delves into the specifics of Bank of America cashier's checks, providing a clear understanding of their function and how they fit into your financial toolkit.

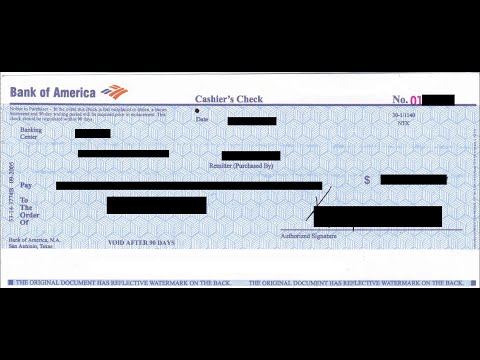

A cashier's check, sometimes referred to as an official check, offers a level of guarantee that a personal check doesn't. Unlike a personal check drawn against your own funds, a cashier's check is issued by the bank, drawing on the bank's own funds. This essentially pre-pays the specified amount, assuring the recipient that the funds are available.

This guaranteed payment makes Bank of America cashier's checks a popular choice for large transactions, such as real estate purchases, down payments on vehicles, or situations where a guaranteed form of payment is required. They eliminate the risk of bounced checks and provide both payer and payee with a greater sense of security.

While the concept of a cashier's check predates modern banking, its form has evolved over time. Historically, such checks provided a more secure method of transferring large sums of money compared to carrying cash. Today, they still serve this function in a digital age, offering a tangible and secure payment method, especially for significant transactions where trust is paramount. The core function remains the same: to provide a guaranteed form of payment backed by the issuing financial institution.

One potential issue to be aware of is the possibility of counterfeit cashier's checks. Scammers may attempt to create fraudulent checks, attempting to deceive individuals into believing they have received legitimate payment. Verifying the authenticity of a Bank of America cashier's check is crucial. Contacting the issuing branch directly to confirm the check's validity is a recommended practice.

A Bank of America cashier's check is a check issued by the bank, guaranteed by the bank's funds. It differs from a personal check, as it's not drawn against an individual's account. A simple example is using a cashier's check for a down payment on a house. The seller is assured that the funds are available, unlike with a personal check which could potentially bounce.

One benefit of a Bank of America cashier's check is guaranteed payment. Another benefit is increased security for both parties. Finally, they are often preferred for large transactions. For example, in a car sale, a cashier's check offers peace of mind to both buyer and seller.

To obtain a Bank of America cashier's check, you would typically visit a branch, request the check, provide identification, and pay the specified amount plus any applicable fees. The bank then issues the check made out to the recipient you designate.

Advantages and Disadvantages of Bank of America Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Potential for Fraud |

| Increased Security | Fees Involved |

| Preferred for Large Transactions | Requires a Trip to the Bank |

Best practices for using cashier's checks include verifying authenticity, storing the check securely, and keeping a record of the transaction. Always ensure the check is properly endorsed when depositing or cashing it.

Challenges in using cashier's checks can include difficulty obtaining a refund if the check is lost or stolen, and the potential delays in processing. Solutions include contacting the bank immediately to report a lost or stolen check and confirming processing timelines with the recipient.

Frequently Asked Questions: What is a cashier's check? How do I obtain one? Can I stop payment on a cashier's check? What if my cashier's check is lost or stolen? How do I verify the authenticity of a cashier's check? How much does a cashier's check cost? Where can I cash a cashier's check? What are the benefits of using a cashier's check?

(General answers would follow each question, providing concise explanations).

Tips for using Bank of America cashier's checks include keeping a copy of the check, confirming the recipient's information is accurate, and understanding the bank's policies regarding cashier's checks.

In conclusion, Bank of America cashier's checks offer a secure payment method for significant transactions, providing guaranteed funds and peace of mind for both buyers and sellers. Understanding the process of obtaining, using, and verifying these checks is crucial for navigating financial transactions effectively. While there are potential drawbacks, such as fees and the risk of counterfeiting, the benefits of secure payment often outweigh these concerns. By following best practices and staying informed, you can confidently utilize cashier's checks to facilitate smooth and secure transactions. Take the time to learn more about Bank of America's specific procedures for cashier's checks, and don't hesitate to contact a banking professional with any further questions. Utilizing cashier's checks strategically can empower you to manage your finances effectively and confidently navigate various financial situations.

Blank Cashier Check Template To Print | YonathAn-Avis Hai

Bank of america check wire transfer status | YonathAn-Avis Hai

What Is The Starting Check Number at Krystle Jordan blog | YonathAn-Avis Hai

Fake Cashiers Check Template | YonathAn-Avis Hai

Bank Of America Cashiers Check How Bank Of America Cashiers Check Can | YonathAn-Avis Hai

Fintech giant The Clearing House joins open | YonathAn-Avis Hai

Printable Blank Cashiers Check | YonathAn-Avis Hai

Bank Of America Cashier S Check Template | YonathAn-Avis Hai

bank of america cashier's check sample | YonathAn-Avis Hai

Pin by Evan Michael on Quick Saves | YonathAn-Avis Hai

Bank Of America Cashier S Check Template | YonathAn-Avis Hai

Bank Of America Check Template | YonathAn-Avis Hai

Bank Of America Cashier S Check Template | YonathAn-Avis Hai

Printable Blank Cashiers Check | YonathAn-Avis Hai

Pin on A Los Angeles Padres diego san francisco diablo | YonathAn-Avis Hai