Decoding Maybank Bank Statement Copies: A Practical Guide

In the intricate tapestry of personal finance, bank statements serve as a crucial thread, weaving together a narrative of transactions, balances, and financial health. Specifically, a Maybank bank statement copy, often referred to as "contoh salinan akaun bank Maybank" in Malay, acts as a verifiable record of your financial activity within Maybank, one of Malaysia's leading financial institutions.

Imagine needing to prove your financial standing for a loan application, a visa process, or even a rental agreement. A Maybank bank statement provides that crucial documentation, offering a snapshot of your financial history. This guide delves into the significance of these statements, exploring their various uses, the process of obtaining them, and the crucial role they play in navigating the complexities of modern finance.

Understanding the nuances of your bank statement can empower you to manage your finances more effectively. It allows you to track spending habits, identify potential discrepancies, and gain a clearer picture of your overall financial trajectory. This understanding becomes particularly important when dealing with complex financial procedures, such as applying for mortgages or managing investments.

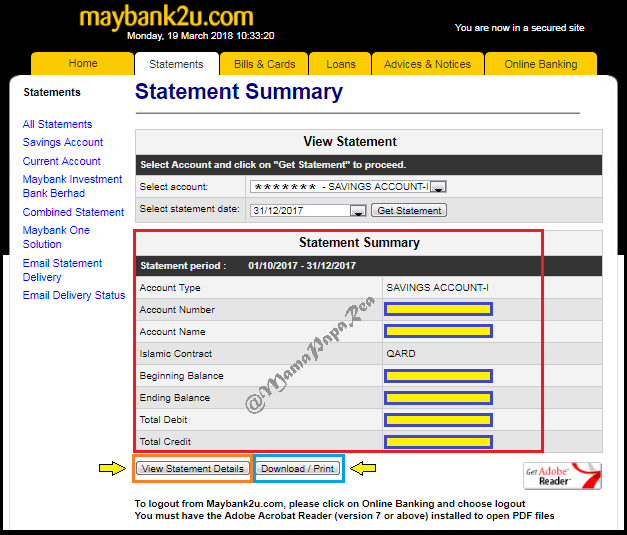

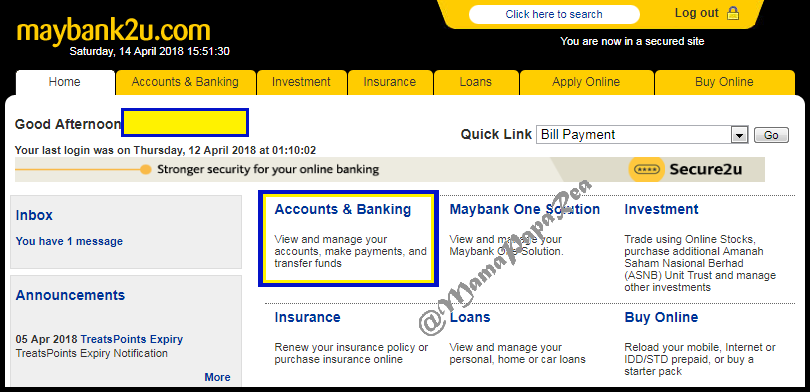

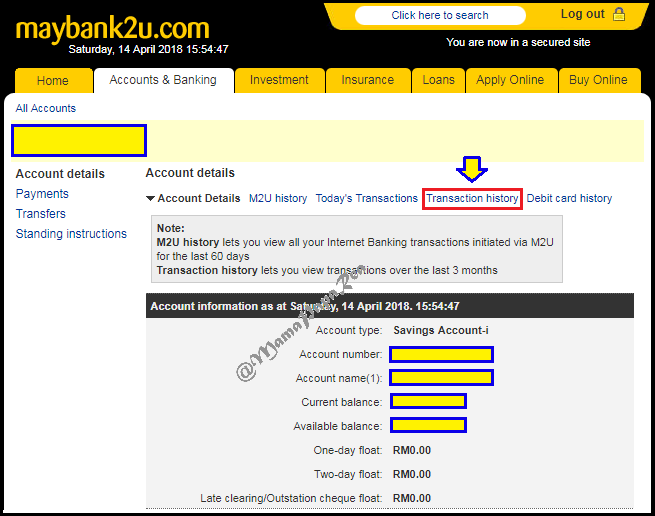

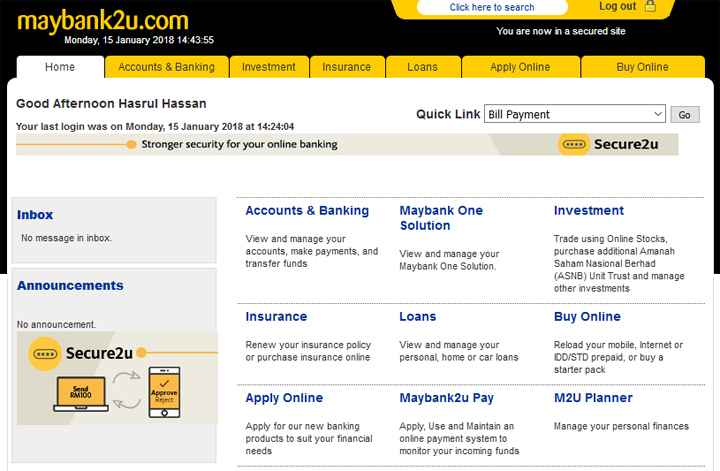

Securing a copy of your Maybank bank statement is generally a straightforward process, with options ranging from online access through Maybank2u to visiting a physical branch. However, it’s essential to understand the different formats available, such as printed statements, electronic copies, and mini statements, each catering to different needs and circumstances. The convenience and accessibility of these options contribute to the statement's overall utility in managing personal and business finances.

Furthermore, ensuring the security and authenticity of your bank statement copies is paramount. Understanding the security measures implemented by Maybank, such as watermarking and unique identifiers, is crucial for protecting yourself against potential fraud and misuse of your financial information. This awareness empowers you to confidently utilize your bank statements while minimizing potential risks.

Historically, bank statements were primarily paper-based documents, delivered periodically to account holders. The evolution of banking technology has led to the rise of electronic statements, offering greater accessibility and convenience. Maybank, in keeping with these advancements, provides various methods for accessing your account information, reflecting the shift towards digital banking.

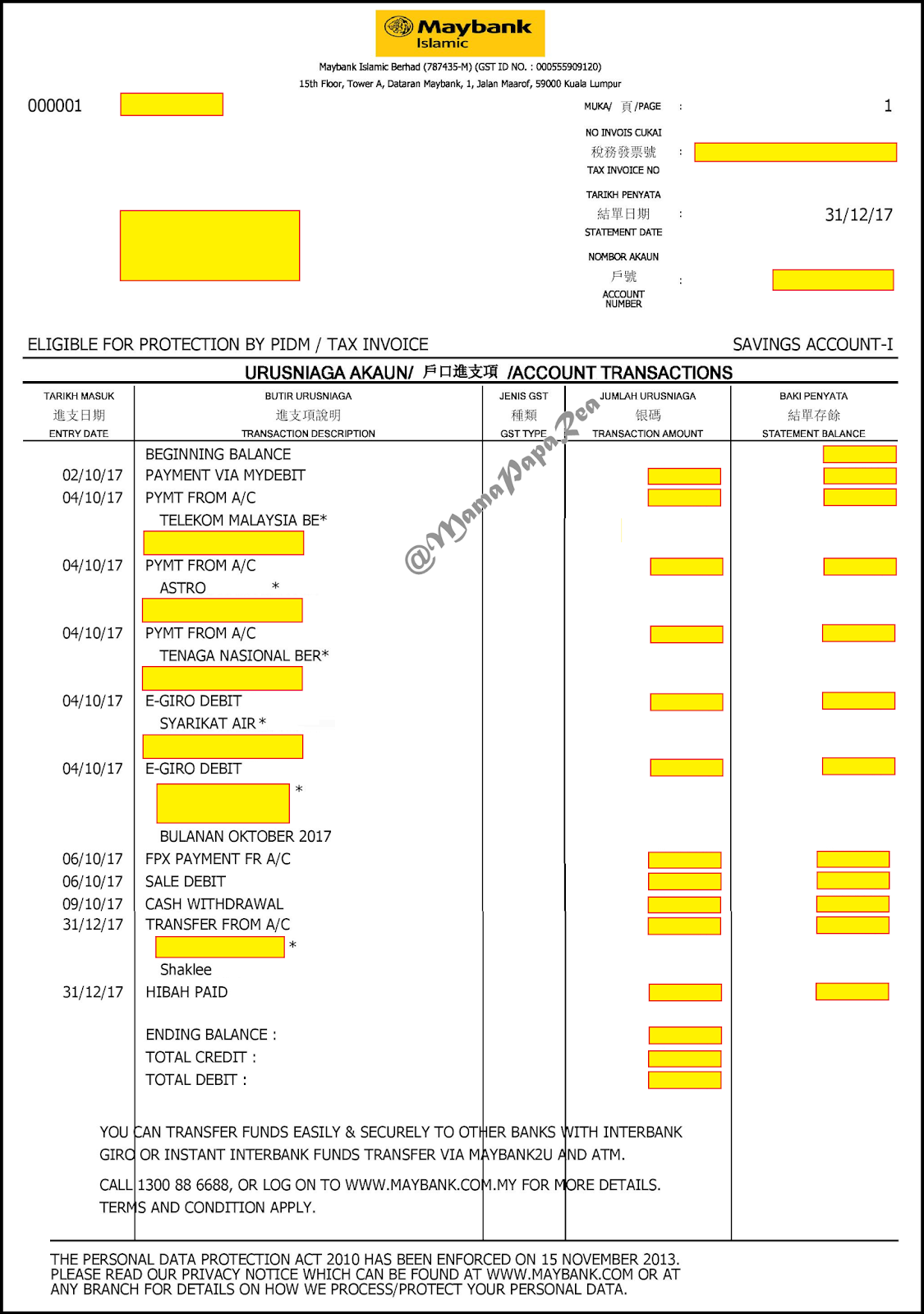

Maybank bank statements provide a record of all transactions, including deposits, withdrawals, transfers, and payments. This detailed account of your financial activities is essential for managing personal budgets, tracking business expenses, and providing evidence of financial stability.

A Maybank bank statement typically includes account details, transaction dates, descriptions, amounts, and running balances. Understanding these components allows you to effectively analyze your spending patterns and reconcile your records.

Benefits of having a copy of your Maybank bank statement include: Proof of income and address for various applications, tracking expenses and managing budgets, and identifying unauthorized transactions or discrepancies. For example, you might need a bank statement to secure a car loan, demonstrating your ability to make regular payments. Similarly, if you notice an unfamiliar transaction, the statement provides the necessary information to report it to the bank.

You can obtain your Maybank bank statement via online banking (Maybank2u), by requesting a printed copy at a branch, or by using the ATM to print a mini statement. Choose the method that best suits your needs and accessibility.

Advantages and Disadvantages of Electronic vs. Printed Statements

| Feature | Electronic Statement | Printed Statement |

|---|---|---|

| Accessibility | Immediate access anytime, anywhere | Requires physical access or delivery |

| Environment | Eco-friendly, reduces paper usage | Contributes to paper consumption |

| Security | Susceptible to online security risks | Physically secure unless lost or stolen |

Best practices for managing your Maybank bank statements include: Regularly reviewing your statements for accuracy, securely storing electronic and printed copies, and promptly reporting any discrepancies or unauthorized transactions. For example, check your statement at least once a month to ensure all transactions are legitimate. Keep your statements in a safe place, either physically or electronically, to protect your financial information.

Frequently Asked Questions about Maybank bank statements: How can I obtain a copy of my statement? What information is included in a statement? How can I report an error on my statement? How long are statements kept by the bank? What security measures are in place to protect my statement information? Can I access my statements online? What are the fees associated with obtaining a statement copy? How can I change my statement delivery preferences?

Tips for utilizing your Maybank bank statement effectively include setting up transaction alerts, utilizing budgeting tools within Maybank2u, and regularly reconciling your statement with your personal financial records. By staying proactive, you can maintain a clear and accurate understanding of your financial health.

In conclusion, the Maybank bank statement, known as "contoh salinan akaun bank Maybank" in Malay, is a cornerstone of personal and business financial management. From providing proof of income to enabling detailed expense tracking, the statement plays a crucial role in various financial endeavors. Understanding the different ways to access and utilize your statement empowers you to take control of your finances. Leveraging the available technology, such as online banking and budgeting tools, allows for proactive financial management and informed decision-making. By actively engaging with your Maybank bank statement, you can gain valuable insights into your spending habits, identify potential issues, and ultimately build a more secure financial future. Take advantage of the resources available and make informed choices to maximize the benefits of your Maybank account.

Penyata Contoh Bank Statement Maybank | YonathAn-Avis Hai

8 Cara Dapatkan Penyata Bank Statement Bank Malaysia | YonathAn-Avis Hai

Salinan Akaun Bank Maybank | YonathAn-Avis Hai

Contoh Nombor Akaun Bank at Cermati | YonathAn-Avis Hai

Salinan Akaun Bank Maybank | YonathAn-Avis Hai

Koleksi Template Akaun Bank | YonathAn-Avis Hai

Salinan Akaun Bank Maybank | YonathAn-Avis Hai

Contoh Statement Bank Maybank at Cermati | YonathAn-Avis Hai

Cara Download Bank Statement Maybank Cara download bank statement mohon | YonathAn-Avis Hai

Cara Dapatkan Bank Statement Maybank | YonathAn-Avis Hai

Penyata Contoh Bank Statement Maybank | YonathAn-Avis Hai

Contoh Salinan Akaun Bank Islam | YonathAn-Avis Hai

Contoh Nombor Akaun Hong Leong Bank at Cermati | YonathAn-Avis Hai

Contoh Surat Penutupan Akaun Bank Contoh Surat Pengesahan Untuk Buka | YonathAn-Avis Hai

Contoh Salinan Akaun Bank | YonathAn-Avis Hai