Decoding the Cashier's Check: Your Bank of America Guide

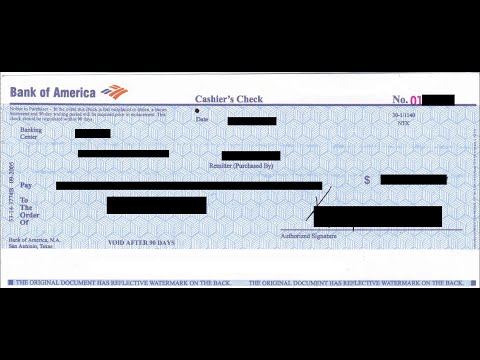

Ever found yourself in a situation needing a guaranteed payment method, especially for a large sum? Maybe you're buying a car, making a down payment on a house, or closing another significant transaction. That's where a cashier's check, sometimes called an official check, comes into play. This article serves as a comprehensive guide to understanding and utilizing cashier's checks from Bank of America.

A cashier’s check from Bank of America is a form of payment guaranteed by the bank itself. Unlike a personal check, where funds are drawn from your individual account, a cashier’s check is drawn directly from the bank's funds. This provides a higher level of security for the recipient, assuring them that the funds are available. Think of it as the bank vouching for the payment.

So, why might you opt for a Bank of America official check over other payment methods? The guaranteed nature of the check is a major advantage. It eliminates the risk of insufficient funds, a concern often associated with personal checks. This is particularly important in large transactions where a bounced check could have significant consequences. This assurance makes official checks from Bank of America a preferred method of payment in many scenarios, particularly real estate and legal settlements.

Obtaining a cashier's check from Bank of America is a relatively straightforward process. Typically, you'll visit a local branch, request the check, and pay the amount plus any applicable fees. You might need to provide identification and specify the payee's name. Bank of America may also offer online options for requesting an official check, streamlining the process for busy individuals.

It's crucial to understand the fees associated with Bank of America official checks. While the exact amount can vary, it's a good idea to factor this cost into your budget. Checking the bank's current fee schedule online or inquiring at your local branch is advisable before requesting a check. Keeping the check secure is paramount. Treat it like cash, as it essentially is. If lost or stolen, obtaining a replacement can involve a lengthy process.

The history of cashier's checks parallels the development of banking itself, serving as a trusted payment method for centuries. For Bank of America specifically, official checks have played a significant role in facilitating large transactions for their customers, mirroring the bank's growth and evolution.

Let's clarify a few common terms. A "cashier's check from Bank of America" refers specifically to an official check issued by Bank of America. "Bank of America official check" is another way of saying the same thing. Understanding these terms helps ensure clear communication when discussing this payment method.

Benefits of a Bank of America Cashier's Check: 1. Guaranteed Funds, 2. Increased Security, 3. Wide Acceptance.

Action Plan for Obtaining a Cashier's Check: 1. Gather necessary information (payee name, amount), 2. Visit a Bank of America branch or explore online options, 3. Pay the amount and fees, 4. Secure the check.

Advantages and Disadvantages of Bank of America Cashier's Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed Payment | Fees Involved |

| Increased Security | Requires a Trip to the Bank (or online access) |

Best Practices: 1. Verify the check's authenticity, 2. Store it securely, 3. Keep a record of the check number, 4. Confirm receipt with the recipient, 5. Report any lost or stolen checks immediately.

FAQs: 1. What is a cashier's check?, 2. How do I get a cashier's check from Bank of America?, 3. What are the fees?, 4. What if my check is lost or stolen?, 5. Can I stop payment on a cashier's check?, 6. Who can cash a cashier's check?, 7. Is a cashier's check the same as a money order?, 8. How long is a cashier's check valid?

Tips: Keep a copy of the check and receipt. Confirm the check's authenticity with Bank of America if you have any doubts.

In conclusion, a cashier's check from Bank of America offers a secure and reliable payment method for large transactions. While fees are involved, the peace of mind provided by guaranteed funds is often invaluable. By understanding the process of obtaining, using, and securing a cashier's check, you can confidently navigate important financial transactions. Whether you're purchasing a car, making a down payment on a house, or settling other significant payments, a Bank of America cashier's check can provide the assurance and security you need. Take the time to familiarize yourself with the details and benefits discussed in this guide to make informed financial decisions. Contact a Bank of America representative for the most up-to-date information and personalized assistance.

Resultado de imagen para bank of america usa cashiers check samples | YonathAn-Avis Hai

cashier's check from bank of america | YonathAn-Avis Hai

cashier's check from bank of america | YonathAn-Avis Hai

cashier's check from bank of america | YonathAn-Avis Hai

What is a cashiers check | YonathAn-Avis Hai

Fake Cashiers Check Template | YonathAn-Avis Hai

cashier's check from bank of america | YonathAn-Avis Hai

cashier's check from bank of america | YonathAn-Avis Hai

Bank of America Cashiers Check | YonathAn-Avis Hai

Chase Bank Check Template Fresh 12 Cashier Check Template In 2020 | YonathAn-Avis Hai

Fintech giant The Clearing House joins open | YonathAn-Avis Hai

Bank Of America Printable Checks | YonathAn-Avis Hai

:max_bytes(150000):strip_icc()/what-difference-between-cashiers-check-and-money-order-FINAL-9a54f3bddd144fd8af92fbe3aed9512b.png)

Can you pay with a credit card to get a money order Leia aqui Can you | YonathAn-Avis Hai

Do Bank Checks Cost Money at Darcy Lopez blog | YonathAn-Avis Hai

Bank Of America Cashier S Check Template | YonathAn-Avis Hai