Demystifying Payroll: A Guide to Understanding Salary Calculation

Imagine this: it's payday, and your employees are excitedly checking their accounts, eager to see the fruits of their hard work. But what goes on behind the scenes to ensure those numbers are accurate and fair? Welcome to the world of salary calculation, a critical yet often overlooked aspect of running a business.

Whether you're a seasoned HR professional or a small business owner handling payroll for the first time, understanding the ins and outs of how employee wages are determined is crucial. It's not just about crunching numbers; it's about building trust, fostering a positive work environment, and ensuring your team feels valued and respected.

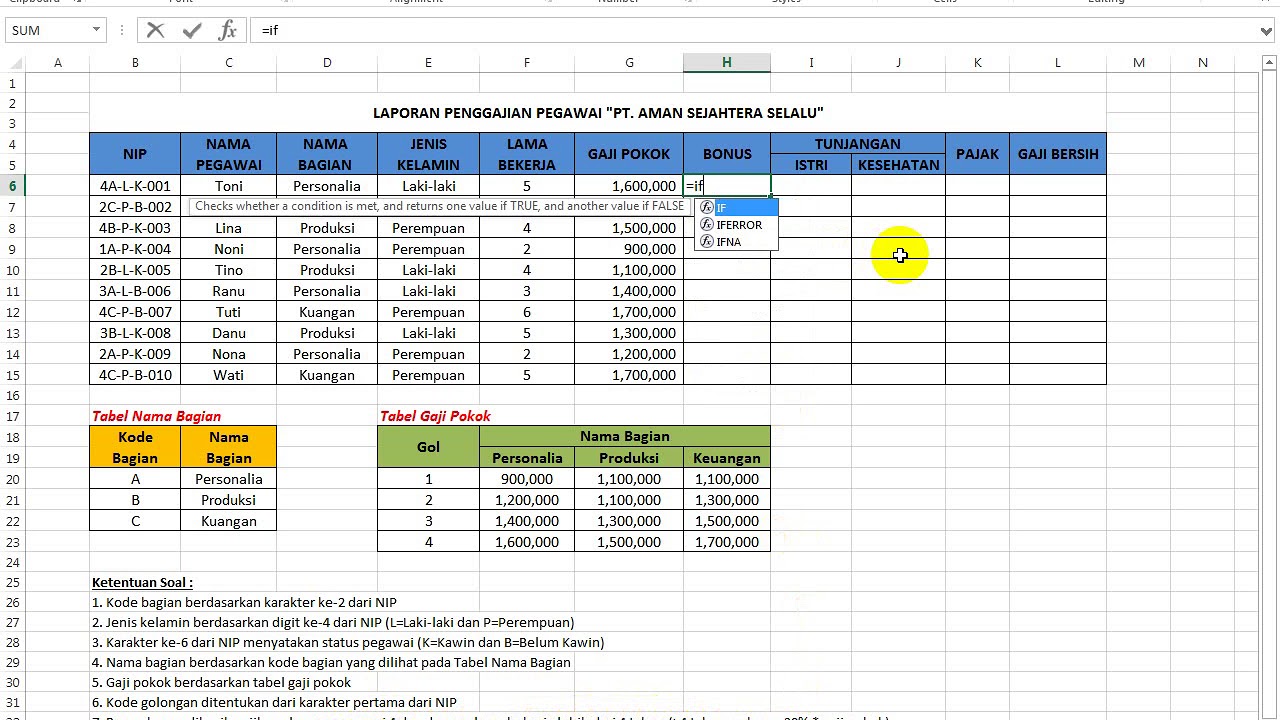

Calculating salaries might seem like a straightforward process at first glance - hourly rate multiplied by hours worked, right? But the reality is far more nuanced. Factors like overtime, bonuses, taxes, benefits, and deductions all come into play, creating a complex equation that requires careful attention to detail and adherence to legal regulations.

The importance of accurate salary calculation cannot be overstated. Errors can lead to disgruntled employees, legal disputes, financial penalties, and damage to your company's reputation. Conversely, a streamlined and transparent payroll system can boost employee morale, increase productivity, and contribute to a positive company culture.

This guide will take you on a journey through the intricacies of salary calculation, equipping you with the knowledge and tools to navigate this essential aspect of business management with confidence. We'll delve into various methods, explore best practices, and provide real-world examples to illuminate the path towards fair and accurate compensation for your valuable team members.

Advantages and Disadvantages of Different Salary Calculation Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Hourly Wage | Simple to calculate, suitable for variable hours | May not incentivize productivity, can lead to overtime costs |

| Fixed Salary | Predictable for both employer and employee, simplifies budgeting | May not reflect individual performance, can be inflexible for varying workloads |

| Performance-Based Pay | Motivates high performance, aligns employee goals with company objectives | Can be complex to implement fairly, may foster unhealthy competition |

This is a basic framework for the article. Please note that "cara perhitungan gaji karyawan" translates to "employee salary calculation method" in English. You can expand on these sections and add other relevant sections to complete the article and reach your desired word count. Remember to keep your target audience in mind and use a conversational and engaging tone, as exemplified by the A Cup of Jo writing style.

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

Dasar Pengenaan Pajak Pph 21 | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai

cara perhitungan gaji karyawan | YonathAn-Avis Hai