Effortless Tax Management: Your Guide to Employer Tax Number Verification in Malaysia

Navigating the world of taxes can feel like entering a labyrinth, especially when you're unfamiliar with the jargon and processes. One essential aspect of tax management in Malaysia is understanding and verifying your employer's tax number, often referred to as "semakan no cukai majikan." This seemingly small detail plays a significant role in ensuring your income tax deductions are accurate and compliant with Malaysian tax regulations.

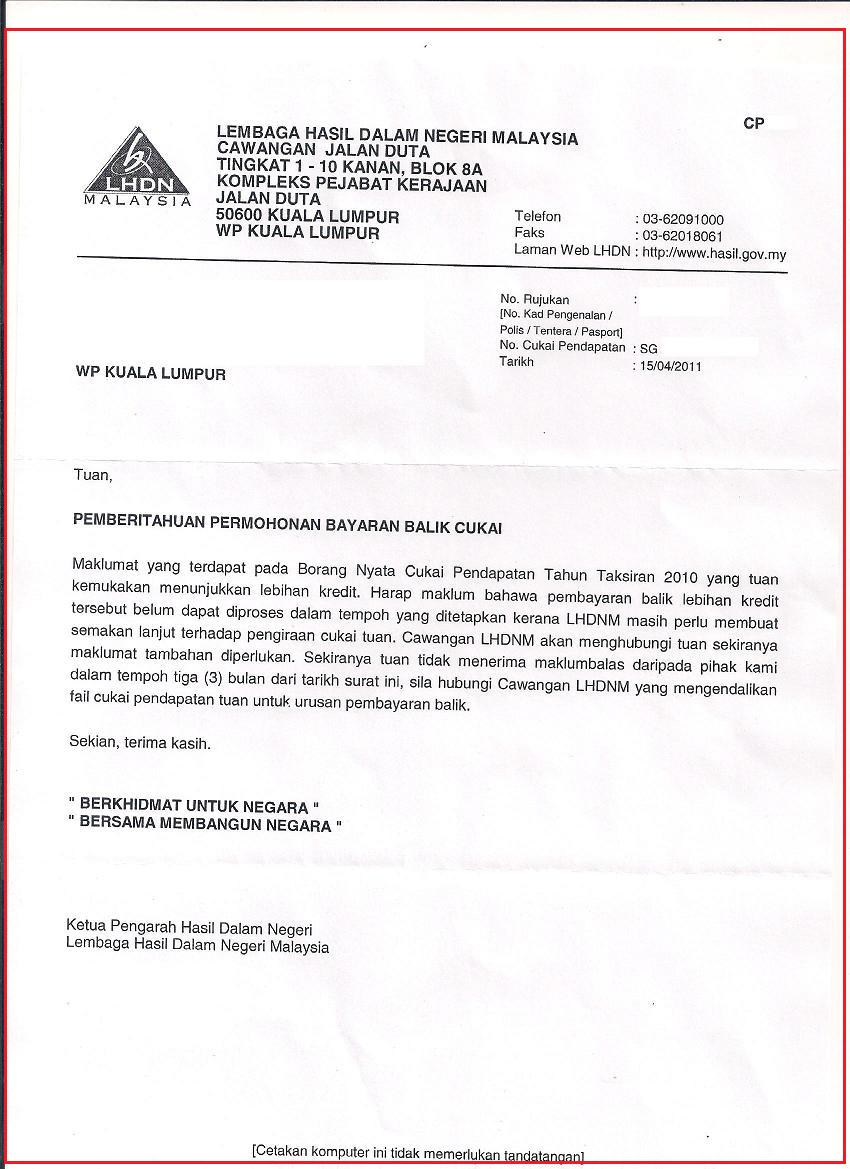

Imagine this: you've diligently filed your tax return, confident that you've dotted your i's and crossed your t's. However, you later receive a notification from the Inland Revenue Board of Malaysia (LHDN) questioning discrepancies in your tax filings. The culprit? An error in your employer's tax number. This scenario highlights the crucial need to understand and verify your employer's tax identification number.

But what exactly is an employer tax number, and why is it so important? Simply put, it's a unique identification number assigned to employers by the LHDN for tax purposes. This number is used to track income tax deductions made by employers on behalf of their employees. When your employer deducts income tax from your salary, they are obligated to remit this amount to the LHDN under your name, linked to your tax file number. This ensures you receive the correct tax credits for the income tax deducted from your salary.

Verifying your employer's tax number (semakan no cukai majikan) is crucial for several reasons. Primarily, it guarantees that your employer is registered with the LHDN and that the taxes deducted from your salary are being remitted correctly. This protects you from potential issues with the tax authorities and ensures your tax records are accurate. Secondly, it helps you avoid any delays or complications during the tax filing process, leading to a smoother experience overall.

Thankfully, the process of verifying your employer's tax number in Malaysia is relatively straightforward and can be done conveniently online. The LHDN provides an online portal where you can easily access this information using your employer's name or tax identification number. This eliminates the need for cumbersome paperwork or time-consuming visits to LHDN branches, making tax management more accessible and efficient.

Advantages and Disadvantages of Employer Tax Number Verification

| Advantages | Disadvantages |

|---|---|

| Ensures tax compliance and accuracy. | Requires a small amount of time and effort for verification. |

| Protects employees from potential tax issues. | |

| Facilitates a smoother tax filing process. |

While "semakan no cukai majikan" might seem like a small detail in the grand scheme of tax management, its impact is significant. By understanding its importance and taking the simple step of verifying your employer's tax number, you contribute to a smoother, more transparent, and hassle-free tax experience in Malaysia.

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

Rahasia Cara Daftar E Filing Mahkamah Terbaik | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai

semakan no cukai majikan | YonathAn-Avis Hai