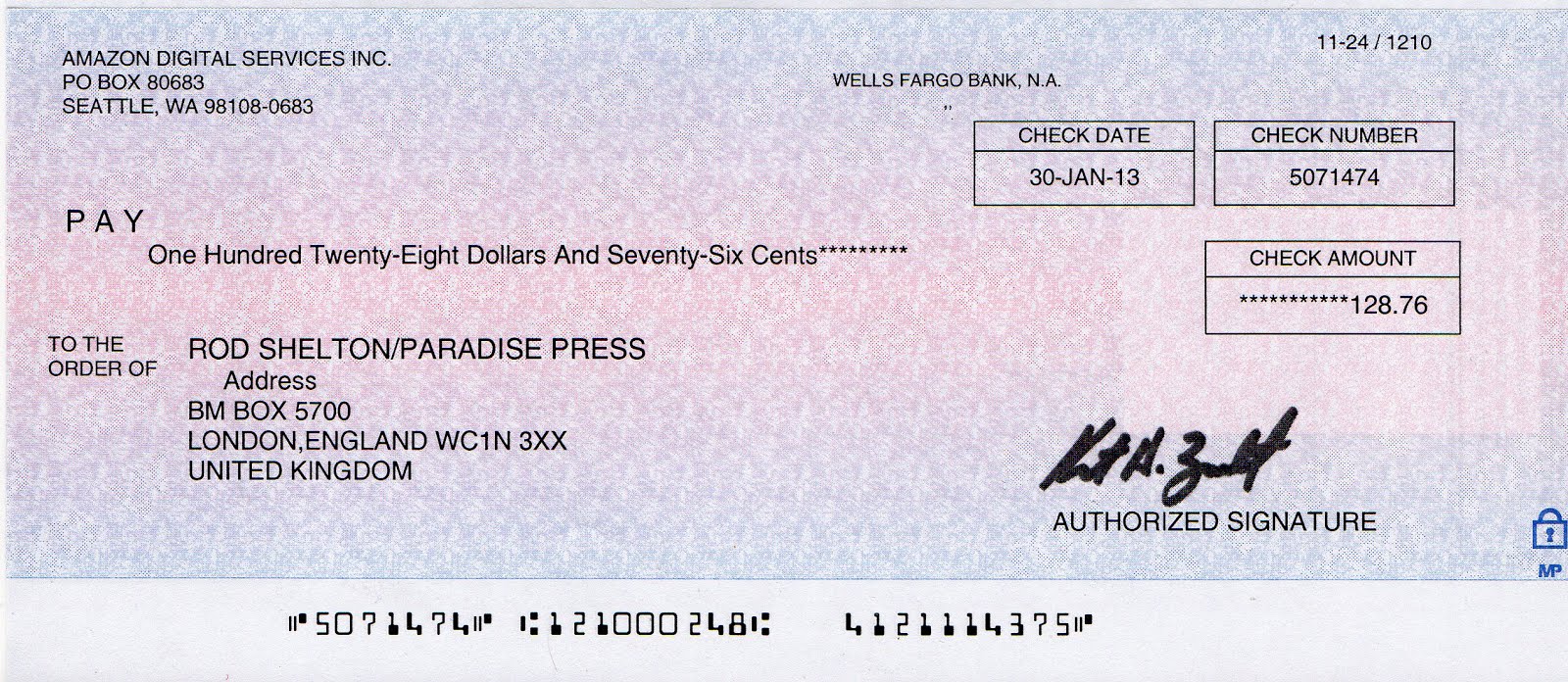

How Much Is Wells Fargo Remediation Check?

You check your mailbox one day and find an unexpected envelope – a check from Wells Fargo. It’s not a typical statement or a promotional offer. It’s labeled as a “remediation check.” A mix of curiosity and apprehension washes over you. What is this about? Why are they sending you money?

If this scenario sounds familiar, you’re not alone. In recent years, Wells Fargo has been at the center of several high-profile scandals involving unfair and unethical practices. These practices led to millions of unauthorized accounts being opened, improper fees being charged, and countless customers facing financial hardships. To right these wrongs, Wells Fargo has been ordered to pay billions of dollars in remediation – essentially, financial restitution to the customers impacted by their actions.

The amount of these remediation checks can vary significantly. It all depends on the specific product or service you were affected by and the extent of the harm you experienced. Some people might receive a small check for a few dollars, while others could get a substantial sum.

It’s important to remember that this check isn’t a bonus or a windfall. It’s an attempt to make amends for the bank’s past mistakes and compensate you for the financial impact you may have suffered. This could include things like unwanted fees, damaged credit scores, or missed financial opportunities.

So, what should you do if you receive a Wells Fargo remediation check? The first step is to carefully review any accompanying documentation to understand what it pertains to. Was it related to an unauthorized account opened in your name? Or perhaps improper fees charged on an existing account? Understanding the context will help you determine the best course of action.

While receiving a remediation check can feel like a small victory, it’s essential to remember that this doesn’t erase the stress and frustration caused by the situation. Many people found themselves entangled in lengthy disputes with the bank, trying to resolve the issues and clear their names. The experience served as a stark reminder of the importance of carefully choosing financial institutions and staying vigilant about protecting your financial well-being.

Advantages and Disadvantages of Receiving a Wells Fargo Remediation Check

| Advantages | Disadvantages |

|---|---|

| Financial compensation for potential losses | May not fully cover all financial or emotional distress caused |

| Acknowledgement of wrongdoing by the bank | Could indicate deeper issues with the bank's practices |

| Opportunity to move on from the situation | May not fully restore trust in the bank |

Receiving an unexpected check, especially one related to a stressful situation, can be confusing. Hopefully, this article has provided some clarity on what Wells Fargo remediation checks are all about.

Wells Fargo Check Template | YonathAn-Avis Hai

Wells Fargo Bank Statement Template Free | YonathAn-Avis Hai

Settlement Letter With Wells Fargo Bank: Client Saved 60% | YonathAn-Avis Hai

Wells Fargo Remediation Check 2024 | YonathAn-Avis Hai

On Floridas, this statutes go doesn forbids alike gender mates instead | YonathAn-Avis Hai

Stop Pulling the Wagon | YonathAn-Avis Hai

7 Strategies for Tips Pay off Student loans | YonathAn-Avis Hai

Wells Fargo Remediation Letter 2024 | YonathAn-Avis Hai

Best Essay Writers Here | YonathAn-Avis Hai

Wells Fargo Check Template | YonathAn-Avis Hai

The Routing Number and Wells Fargo Pany | YonathAn-Avis Hai

How Much Are Wells Fargo Overdraft Fees? A Comprehensive Guide | YonathAn-Avis Hai

Wells Fargo Blank Check Template | YonathAn-Avis Hai

Wells Fargo Printable Checks | YonathAn-Avis Hai

How Much is Wells Fargo Worth? A Comprehensive Analysis | YonathAn-Avis Hai