Is Becoming Pregnant a Qualifying Life Event?

Life throws curveballs – some joyous, some challenging, and some life-changing. Pregnancy undoubtedly falls into the life-changing category, bringing with it a whirlwind of emotions, adjustments, and yes, paperwork. Among the many things expectant parents need to consider, health insurance sits high on the list. Specifically, many wonder: "Is becoming pregnant a qualifying life event?" The answer is a resounding yes. Pregnancy is considered a qualifying life event by both the Affordable Care Act (ACA) and many employer-sponsored health insurance plans.

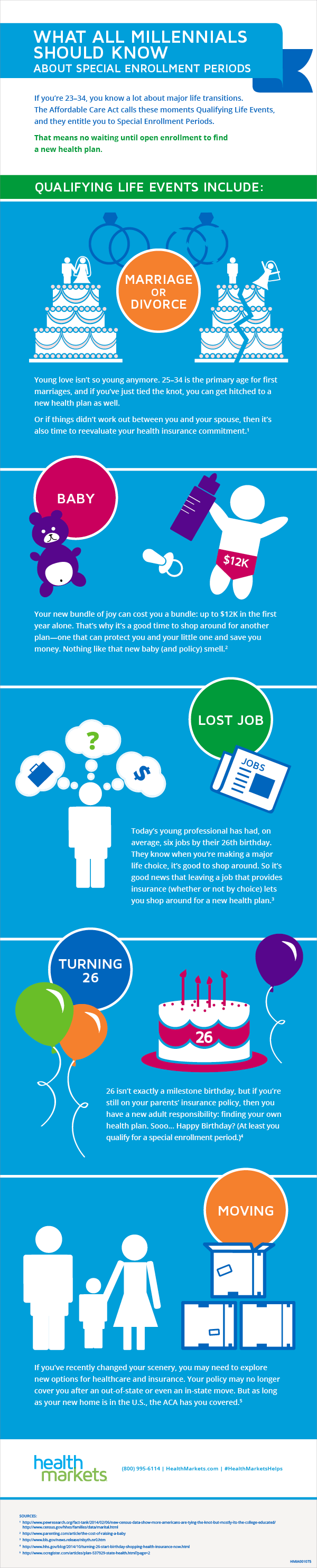

This designation is crucial because it opens a special enrollment period, allowing individuals and families to make changes to their health insurance coverage outside the standard open enrollment timeframe. Typically, open enrollment for health insurance occurs once a year, but qualifying life events like pregnancy provide flexibility to ensure you have the coverage you need when you need it most.

The concept of a qualifying life event stems from the need to provide individuals and families with the ability to adapt their health insurance coverage to significant life changes. These changes often come with new healthcare needs and expenses, making it essential to have appropriate coverage. Pregnancy, with its prenatal care, delivery costs, and potential for complications, fits this definition perfectly.

Navigating the world of health insurance can be daunting, especially during a time as momentous as pregnancy. Understanding the implications of pregnancy as a qualifying life event empowers expectant parents to make informed decisions about their coverage and ensures they have the financial and medical support necessary for a healthy pregnancy and childbirth.

While the specific details and regulations surrounding qualifying life events can vary depending on your state and insurance provider, the core principle remains consistent: Pregnancy is a significant life change that allows you to re-evaluate and adjust your health insurance plan to best suit your family's needs.

Advantages and Disadvantages of Pregnancy as a Qualifying Life Event

While there are numerous advantages to pregnancy being a qualifying life event, it's essential to also acknowledge some potential drawbacks:

| Advantages | Disadvantages |

|---|---|

| Flexibility to enroll in or change health plans outside of open enrollment. | Potential for higher premiums depending on the chosen plan. |

| Opportunity to obtain coverage specifically tailored to pregnancy and childbirth. | Possible waiting periods for certain benefits to kick in after enrollment. |

| Peace of mind knowing you have comprehensive health insurance during pregnancy and postpartum. | Requirement to provide documentation of the qualifying event (e.g., proof of pregnancy). |

Best Practices for Utilizing Pregnancy as a Qualifying Life Event

To make the most of this special enrollment period, consider these best practices:

- Act promptly: You typically have a limited time frame (usually 60 days) from the qualifying event (e.g., the date your pregnancy is confirmed) to enroll in a new plan or make changes to your existing one.

- Research thoroughly: Compare different plans, their coverage for prenatal care, delivery, and postpartum care, as well as their costs.

- Seek guidance: Don't hesitate to contact your insurance provider or a health insurance navigator for assistance in understanding your options.

- Gather documentation: Be prepared to provide proof of your qualifying life event, such as a doctor's note confirming your pregnancy.

- Review and update: After your baby arrives, revisit your health insurance needs and make any necessary adjustments during the next open enrollment period.

Common Questions About Pregnancy as a Qualifying Life Event

Here are answers to some frequently asked questions:

- Q: What types of health insurance plans are affected by qualifying life events? A: Qualifying life events typically affect individual and family health insurance plans, including those purchased through the ACA marketplace and some employer-sponsored plans.

- Q: How long does the special enrollment period last? A: In most cases, you have 60 days from the date of the qualifying event to enroll in a new plan or make changes.

- Q: Can my spouse and dependents also be added to my plan during this time? A: Yes, qualifying life events often allow you to add eligible dependents to your coverage.

- Q: What if my employer doesn't offer health insurance, or I'm self-employed? A: You can explore individual and family plans through the ACA marketplace during the special enrollment period.

- Q: Can I be denied coverage due to pregnancy? A: No, under the ACA, pregnancy is considered a pre-existing condition, and health insurance providers cannot deny you coverage or charge higher premiums based on pregnancy alone.

- Q: Does this apply to Medicaid? A: Pregnancy often makes individuals and families eligible for Medicaid coverage, and different enrollment rules might apply.

- Q: What if I miss the special enrollment period? A: You might have to wait until the next open enrollment period to make changes, unless you experience another qualifying life event.

- Q: Where can I find more personalized information? A: Contact your insurance provider or a health insurance navigator for guidance specific to your circumstances.

Pregnancy, while a time of great joy and anticipation, also requires careful planning, especially when it comes to healthcare. Understanding that pregnancy is a qualifying life event empowers you to make informed decisions about your health insurance coverage. By taking the time to research, compare plans, and understand your options, you can ensure you have the financial and medical support you need throughout your pregnancy journey and beyond. Remember, you're not alone in this process—resources and assistance are available to guide you every step of the way.

Qualifying Life Events and the Impact on Health Insurance | YonathAn-Avis Hai

What is a qualifying life event for health insurance? | YonathAn-Avis Hai

Understanding Qualifying Life Events (QLEs) | YonathAn-Avis Hai

What is a TRICARE Qualifying Life Event? > Air Force Wounded Warrior | YonathAn-Avis Hai

Obtaining citizenship or lawful permanent resident status will trigger | YonathAn-Avis Hai

What is a qualifying life event for health insurance? | YonathAn-Avis Hai

is becoming pregnant a qualifying life event | YonathAn-Avis Hai

What Employers Need to Know About a Qualifying Life Event | YonathAn-Avis Hai

What Is a Qualifying Life Event for Health Insurance? | YonathAn-Avis Hai

:max_bytes(150000):strip_icc()/what-is-a-qualifying-event-for-health-insurance-4174114_4-54f1444bbef84c2aa79485ceffd1cee7.png)

What Is a Qualifying Life Event? | YonathAn-Avis Hai

Updating your benefits through a qualifying status change (life event) | YonathAn-Avis Hai

The Amazing Truth About Qualifying Life Events for Millennials | YonathAn-Avis Hai

Mark Your Calendar: 2017 Open Enrollment Period Need | YonathAn-Avis Hai

Fillable Online IU 2019/20 International Student Health Insurance | YonathAn-Avis Hai

What You Need to Know for Open Enrollment 2022 | YonathAn-Avis Hai