Lost Your Wallet? The Lowdown on Temporary Cards Wells Fargo Offers

Imagine this: you're about to grab coffee and realize your wallet is missing. Panic sets in as you mentally retrace your steps, the sinking feeling growing with each passing moment. A lost or stolen card can throw your financial life into a tailspin. Suddenly, everyday purchases become hurdles, and online shopping feels impossible. But don't despair! While you wait for your replacement card, a temporary solution can help you navigate the financial limbo – temporary cards. And if you're a Wells Fargo customer, you're in luck.

Temporary cards act as stand-ins for your primary debit or credit card, providing a temporary lifeline to your funds. These cards typically come with a different card number and a shorter validity period, usually until your permanent replacement arrives. While the concept of temporary cards isn't new, their evolution and integration into the digital age have been remarkable. In the past, getting a temporary card often involved a frantic phone call or a trip to a branch.

But the rise of mobile banking has transformed the game. Today, many banks, including Wells Fargo, allow customers to instantly generate a temporary debit card directly through their mobile app. For Wells Fargo customers, temporary cards offer a practical solution to bridge the gap between losing your card and receiving a replacement.

This seamless approach minimizes disruption to your financial life, allowing you to continue making essential purchases without missing a beat. But temporary cards are more than just a stopgap; they offer several benefits that go beyond convenience.

Let's delve deeper into the world of temporary cards Wells Fargo provides, exploring their benefits, how to obtain one, and crucial considerations to keep in mind.

One of the most significant advantages of Wells Fargo temporary cards is their ability to provide immediate access to your funds. Imagine needing to pay for groceries or fill up your gas tank after losing your wallet. Instead of being stranded, a temporary card empowers you to continue with your day, minimizing disruption to your routine. This accessibility is particularly crucial when traveling, where a lost card could otherwise derail your plans.

Another crucial benefit is enhanced security. Wells Fargo temporary cards typically come with different card numbers than your primary card, providing an extra layer of protection against fraudulent activity. This feature minimizes the risk associated with using your regular card details while waiting for a replacement, offering peace of mind during a stressful situation.

Advantages and Disadvantages of Temporary Cards

| Advantages | Disadvantages |

|---|---|

| Immediate access to funds | Limited validity period |

| Enhanced security with different card numbers | May not be accepted by all merchants |

| Convenient for online and in-person purchases | Potential fees associated with issuance or usage |

While temporary cards offer undeniable convenience and security, it's essential to be aware of potential limitations.

For instance, some merchants might not accept temporary cards, particularly for transactions requiring a physical card, like renting a car. Always have a backup payment method handy to avoid potential hiccups. Additionally, familiarize yourself with any fees associated with obtaining or using the temporary card, as these can vary depending on your bank and account type.

In conclusion, temporary cards from Wells Fargo are a valuable tool for navigating unexpected financial disruptions. Their ability to provide immediate access to funds and enhanced security makes them essential for anyone who relies on debit or credit cards for their daily transactions.

By understanding the benefits, limitations, and steps to obtain one, you can confidently face the unexpected and ensure your finances remain on track.

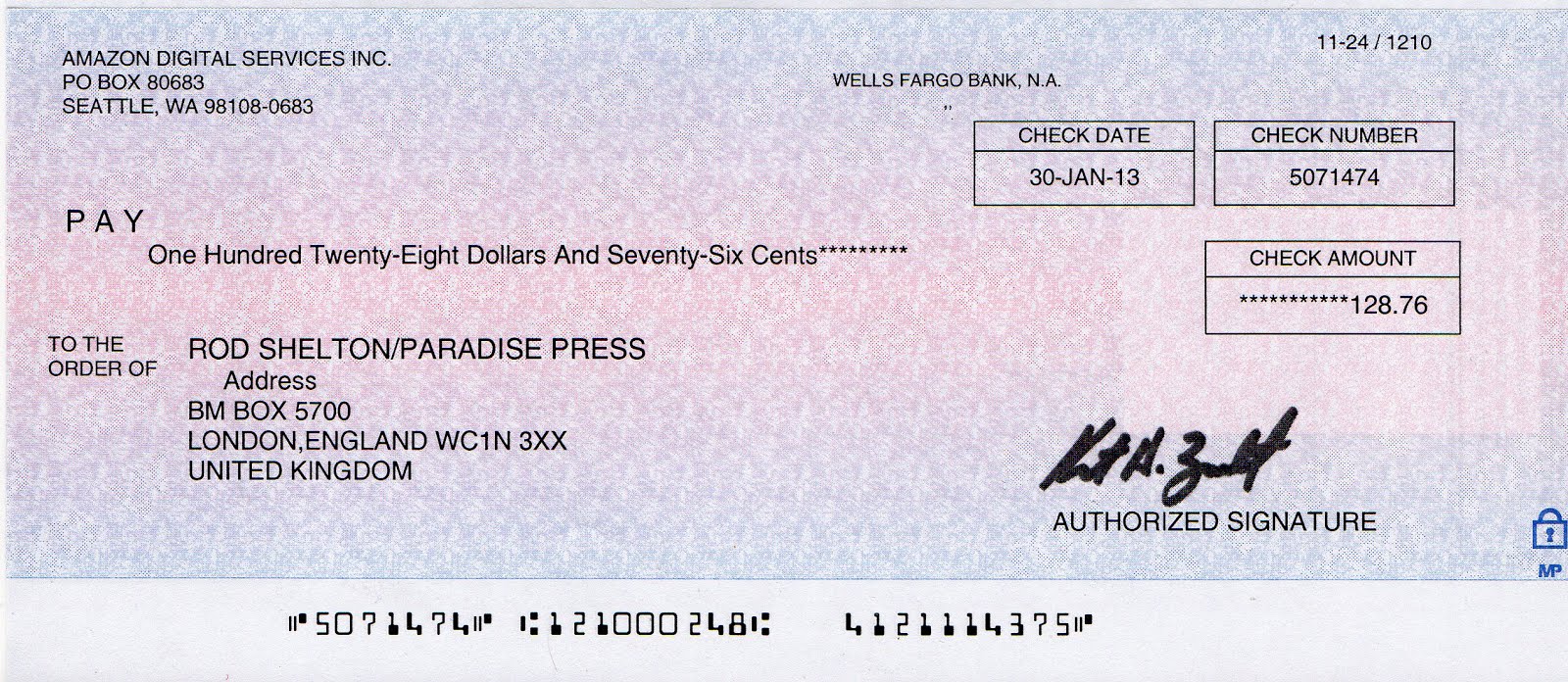

Wells Fargo Blank Check Template | YonathAn-Avis Hai

Credit score needed for the Wells Fargo Reflect | YonathAn-Avis Hai

Temporary Structures Go Outside Wells Fargo Editorial Stock Photo | YonathAn-Avis Hai

What credit cards are issued by Wells Fargo? Leia aqui: What cards are | YonathAn-Avis Hai

temporary cards wells fargo | YonathAn-Avis Hai

temporary cards wells fargo | YonathAn-Avis Hai

Does Wells Fargo Give Temporary Debit Cards? | YonathAn-Avis Hai

Wells Fargo brings contactless payments to the wild west | YonathAn-Avis Hai

Wells Fargo Active Cash® Card Review: Unlimited 2% Cash Back Credit Card | YonathAn-Avis Hai

Wells Fargo Reflect® Card review: 0% intro APR | YonathAn-Avis Hai

Printable Editable Texas Temporary Paper Id Template | YonathAn-Avis Hai

Wells Fargo Autograph Card | YonathAn-Avis Hai

Wells Fargo begins rollout of contactless cards for payments, ATM | YonathAn-Avis Hai

U.S. Bank Platinum Temporary Card Number: How to Get Yours | YonathAn-Avis Hai

Wells Fargo Debit Card Designs 2024 | YonathAn-Avis Hai