Mastering Debits and Credits: Your Guide to Accounting Fundamentals

Ever wondered how businesses keep track of their financial transactions? The answer lies in a fundamental accounting concept: double-entry bookkeeping. At the heart of this system are debits and credits, the building blocks of accurate financial record-keeping. This comprehensive guide dives deep into the world of debits and credits, providing clear examples and practical advice to help you master this essential accounting principle.

Understanding debits and credits is like learning the language of business finance. It's more than just pluses and minuses; it’s about maintaining a balanced equation that reflects the financial health of an organization. While seemingly complex at first glance, the core principle is straightforward: every transaction affects at least two accounts, with one account debited and another credited. This balanced approach ensures that the accounting equation (Assets = Liabilities + Equity) always remains true.

The history of double-entry bookkeeping dates back to 1494, with the publication of "Summa de Arithmetica, Geometria, Proportioni et Proportionalita" by Luca Pacioli. This system revolutionized accounting practices, providing a more accurate and reliable method for tracking financial transactions. Its enduring relevance underscores the importance of understanding debit and credit entries for anyone involved in managing finances, whether for a small business or a large corporation.

The importance of understanding debit and credit entries cannot be overstated. Accurate record-keeping is the foundation of sound financial management. By correctly applying the principles of double-entry bookkeeping, you can gain a clear picture of your financial position, track the flow of money, and make informed business decisions. This understanding is crucial not only for accountants but also for business owners, managers, and anyone seeking to improve their financial literacy.

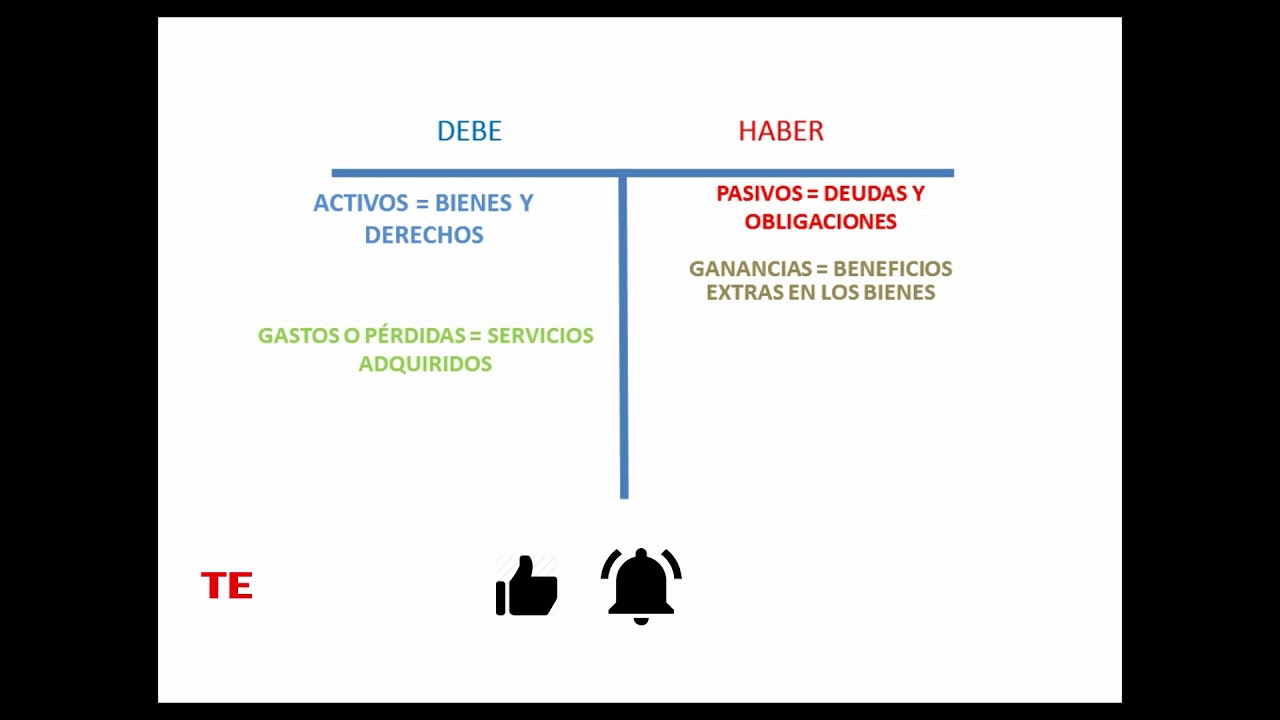

In essence, a debit increases asset, expense, and dividend accounts, while decreasing liability, owner's equity, and revenue accounts. Conversely, a credit increases liability, owner's equity, and revenue accounts, while decreasing asset, expense, and dividend accounts. This seemingly counterintuitive relationship is key to maintaining the balance of the accounting equation. For instance, if you purchase office supplies with cash, the asset account "Office Supplies" is debited (increased), while the asset account "Cash" is credited (decreased). This reflects the exchange of one asset for another, preserving the overall balance.

One of the main benefits of using a double-entry system is its ability to provide a more accurate and complete picture of a company's financial health. This improved accuracy helps in preventing errors and detecting fraud, as any discrepancies in the balance sheet will be readily apparent. Additionally, this organized approach simplifies the process of generating financial reports, providing stakeholders with a clear understanding of the company's performance.

A simple example: Imagine purchasing inventory worth $100. You debit the "Inventory" account (increasing the asset), and credit the "Cash" account (decreasing the asset). Another example: Receiving $500 for services rendered involves debiting "Cash" (increasing the asset) and crediting "Revenue" (increasing owner's equity). These examples illustrate the fundamental principle of duality: for every debit, there is a corresponding credit.

Benefits of understanding debits and credits: 1) Enhanced accuracy in financial reporting, leading to better decision-making. 2) Improved fraud detection through the balanced nature of the system. 3) Simplified tax preparation with well-organized financial records.

Advantages and Disadvantages of Double-Entry Bookkeeping

| Advantages | Disadvantages |

|---|---|

| Improved Accuracy | More Complex than Single-Entry |

| Better Fraud Detection | Requires More Time and Effort |

| Comprehensive Financial View | Steeper Learning Curve |

A practical example of recording a sales transaction: A company sells goods for $200 in cash. The journal entry would be: Debit "Cash" $200 and Credit "Sales Revenue" $200.

FAQ: What is the difference between a debit and a credit? A debit increases asset, expense, and dividend accounts and decreases liability, owner's equity, and revenue accounts. A credit does the opposite.

In conclusion, understanding the principles of debits and credits is fundamental to effective financial management. By mastering this seemingly complex concept, you gain a powerful tool for accurate record-keeping, informed decision-making, and ultimately, financial success. Take the time to study these principles, practice with examples, and you will unlock a deeper understanding of the language of business. This knowledge will empower you to navigate the complexities of finance with confidence and clarity.

Debe y Haber en Contabilidad Diferencia | YonathAn-Avis Hai

Aprende qué es el libro mayor en contabilidad y por qué es importante | YonathAn-Avis Hai

Cuenta De Fletes Y Acarreos En Contabilidad | YonathAn-Avis Hai

Debe y Haber en Contabilidad Diferencia | YonathAn-Avis Hai

Debe y haber en contabilidad qué son exactamente | YonathAn-Avis Hai

Origen del debe y el haber | YonathAn-Avis Hai

Asientos contables debe y haber ejercicios | YonathAn-Avis Hai

Que Es Debe Y Haber Ejemplos Coleccion De Ejemplo Images | YonathAn-Avis Hai

Debe y haber en contabilidad | YonathAn-Avis Hai

INTRODUCCIÓN AL DEBE Y EL HABER EN COMPRAS | YonathAn-Avis Hai

El debe y haber en contabilidad | YonathAn-Avis Hai

Qué es el libro mayor y para qué sirve en la empresa | YonathAn-Avis Hai

Que Es Debe Y Haber Ejemplos Coleccion De Ejemplo Images | YonathAn-Avis Hai

Pin en Contabilidad General | YonathAn-Avis Hai

Plantilla 2 para control de movimientos de cuentas anotaciones etc | YonathAn-Avis Hai