Mastering Your Finances: A Guide to Understanding Jadual Kiraan Cukai Pendapatan (Income Tax Calculation Table)

Are you tired of feeling lost and confused when it comes to filing your income tax in Malaysia? Does the thought of deciphering complex tax tables fill you with dread? Understanding the Malaysian income tax system, and specifically the "Jadual Kiraan Cukai Pendapatan" (Income Tax Calculation Table), can seem daunting. But it doesn't have to be. With the right knowledge and resources, you can confidently navigate your tax obligations and potentially even reduce your tax burden.

Imagine having a clear understanding of how your income is taxed, what deductions and exemptions you qualify for, and the tools to calculate your tax liability accurately. This newfound clarity can empower you to make informed financial decisions throughout the year, not just during tax season.

In this comprehensive guide, we will demystify the "Jadual Kiraan Cukai Pendapatan" and provide you with the knowledge and resources you need to master your Malaysian income tax obligations. Whether you're a seasoned taxpayer or filing for the first time, this article will equip you with the insights to confidently approach tax season.

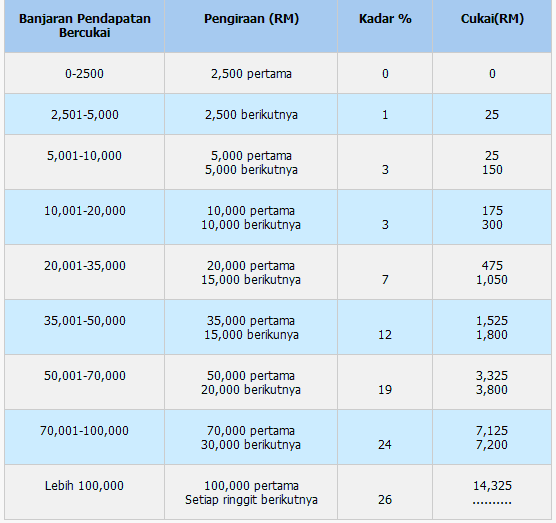

Let's start by understanding the foundation of the Malaysian income tax system. It operates on a progressive tax system, meaning the more you earn, the higher the percentage of tax you pay. The "Jadual Kiraan Cukai Pendapatan" is your roadmap to understanding how your taxable income is divided into tax brackets and taxed accordingly.

Navigating the "Jadual Kiraan Cukai Pendapatan" might seem complex at first glance, but it's essentially a structured table that outlines different income ranges and their corresponding tax rates. By identifying your income bracket, you can quickly determine the applicable tax rate for your earnings. But it's not just about the numbers; understanding the various deductions, reliefs, and rebates available to taxpayers is crucial for optimizing your tax liability.

Advantages and Disadvantages of Utilizing Jadual Kiraan Cukai Pendapatan

While the "Jadual Kiraan Cukai Pendapatan" might seem like just another tax document, understanding its nuances can offer significant advantages:

Advantages:

| Feature | Benefit |

|---|---|

| Transparency | Provides a clear structure for calculating tax liability. |

| Accessibility | Easily accessible online and through official government channels. |

| Structured Approach | Simplifies tax calculation by breaking down income into manageable brackets. |

Disadvantages:

| Challenge | Explanation |

|---|---|

| Complexity for High-Income Earners | Individuals with diverse income streams might find it challenging to apply the table effectively. |

| Potential for Updates | The table is subject to annual revisions, requiring taxpayers to stay informed. |

jadual kiraan cukai pendapatan | YonathAn-Avis Hai

jadual kiraan cukai pendapatan | YonathAn-Avis Hai

Hanya Pendapatan Bercukai Tahunan lebih RM230,000 alami kenaikan cukai | YonathAn-Avis Hai

Lhdn Refund, Semakan Cara Kira Lebihan Bayaran Balik Tax | YonathAn-Avis Hai

Jangan Lupa Bayar Zakat Pendapatan Tahun 2020. Ini Cara Kiraannya Yang | YonathAn-Avis Hai

Kadar cukai individu pemastautin | YonathAn-Avis Hai

Jabatan Akauntan Negara Malaysia (JANM) | YonathAn-Avis Hai

Senarai Pelepasan Cukai 2022 Untuk E | YonathAn-Avis Hai

Cara Daftar Cukai LHDN Untuk e | YonathAn-Avis Hai

Kadar Cukai Jalan(Road Tax) dan Kalkulator Untuk Kiraan | YonathAn-Avis Hai

Maksud B40, M40, T20, Miskin Tegar | YonathAn-Avis Hai

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti | YonathAn-Avis Hai

Pengiraan Zakat Pendapatan 2024 Cara Bayar Jadual Kiraan | YonathAn-Avis Hai

jadual kiraan cukai pendapatan | YonathAn-Avis Hai

Panduan Lengkap Cukai Pendapatan 2023 (Taksiran 2022) | YonathAn-Avis Hai