Navigating Medicare Part B Costs: A Comprehensive Guide

Are you approaching Medicare eligibility and wondering about the financial implications? Understanding Medicare Part B costs is crucial for planning your healthcare budget and ensuring access to essential medical services. This comprehensive guide breaks down the complexities of Part B expenses, offering insights into premiums, deductibles, and strategies for managing your healthcare costs effectively.

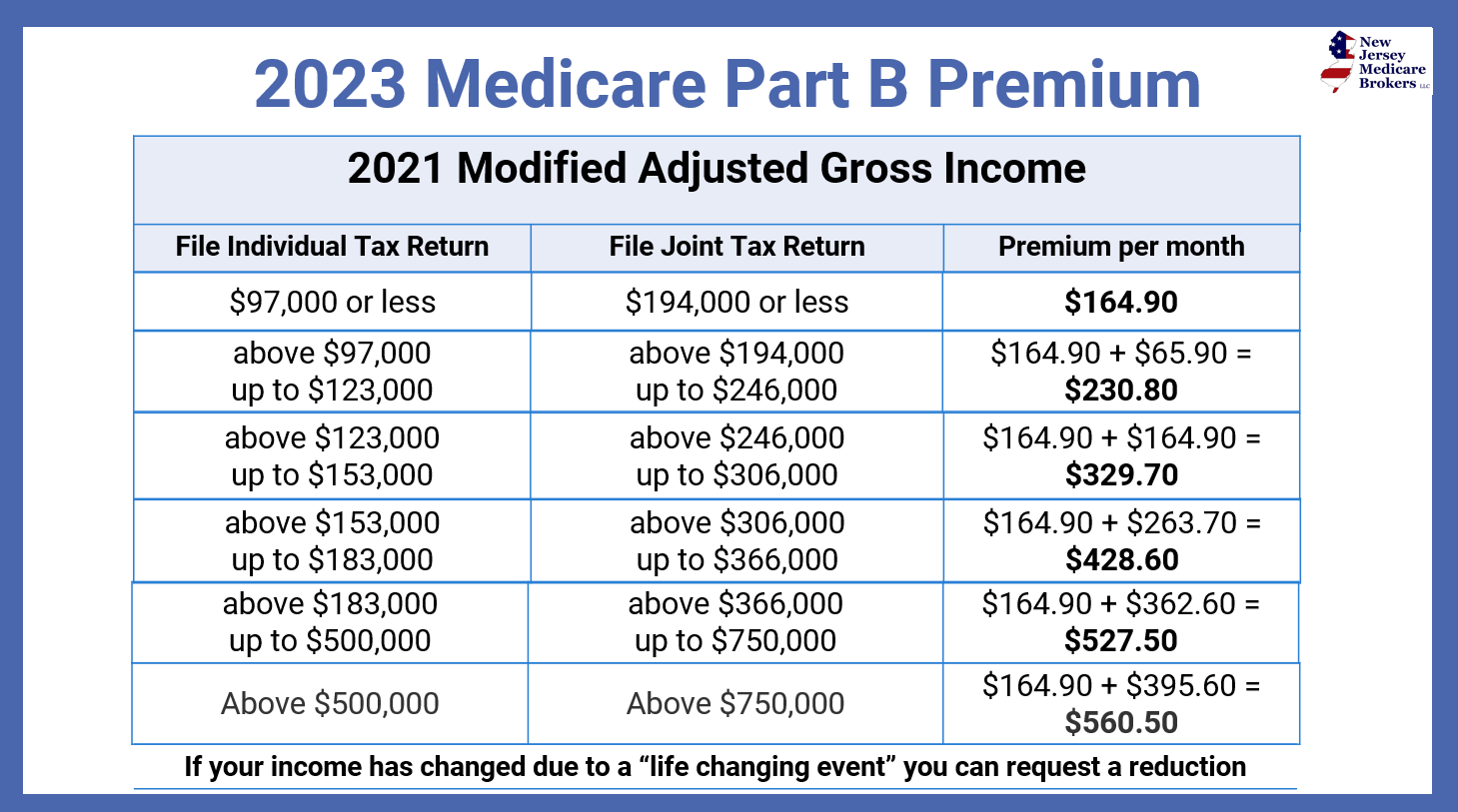

Medicare Part B covers medically necessary services like doctor visits, outpatient care, preventive services, and some home healthcare. Unlike Part A, which covers hospital stays and is generally premium-free for most eligible individuals, Part B requires a monthly premium. The cost of Part B can vary depending on your income and enrollment status. Navigating these expenses can be challenging, but with the right information, you can make informed decisions about your healthcare coverage.

The history of Medicare Part B dates back to the enactment of the Medicare program in 1965. It was designed to fill the gaps in coverage not provided by Part A, offering crucial access to outpatient services. Over the years, the scope of Part B benefits has expanded, reflecting the evolving needs of the aging population and advancements in medical care. The importance of Part B lies in its ability to provide comprehensive coverage for a wide range of medical services, contributing to the overall health and well-being of beneficiaries.

One of the main issues surrounding Medicare Part B insurance costs is affordability. As healthcare costs continue to rise, the financial burden on beneficiaries can be significant. Understanding the various factors that influence Part B premiums, such as income and enrollment status, is essential for planning your budget and exploring potential financial assistance options. Another key issue is navigating the complexities of coverage and understanding which services are included and excluded under Part B.

Let's define some key terms related to Medicare Part B expenses. The "premium" is the monthly amount you pay for Part B coverage. The "deductible" is the amount you pay out-of-pocket for covered services before Medicare begins to pay its share. "Coinsurance" is the percentage of covered services you pay after meeting your deductible. For example, if your Part B deductible is $226 (2023 figure) and your coinsurance is 20%, you would pay the deductible first, and then Medicare would generally pay 80% of the cost of covered services, leaving you responsible for the remaining 20%.

One benefit of Medicare Part B is its comprehensive coverage of medically necessary services, including doctor visits, outpatient care, and preventive services. Another benefit is access to a wide network of healthcare providers. Furthermore, Part B helps protect you from potentially catastrophic medical expenses by sharing the cost of care.

Advantages and Disadvantages of Medicare Part B

| Advantages | Disadvantages |

|---|---|

| Comprehensive coverage of medically necessary services | Monthly premiums |

| Access to a wide network of providers | Deductible and coinsurance costs |

| Protection against catastrophic medical expenses | Coverage gaps for certain services |

Best Practices for Managing Part B Costs:

1. Understand your coverage and benefits.

2. Explore financial assistance programs.

3. Compare Medigap plans to supplement coverage.

4. Consider Medicare Advantage plans as an alternative.

5. Review your coverage annually during the Open Enrollment Period.

Frequently Asked Questions:

1. How do I enroll in Part B? Contact Social Security.

2. How much is the Part B premium? It varies based on income.

3. What is the Part B deductible? Check the current Medicare guidelines.

4. What services are covered by Part B? Doctor visits, outpatient care, etc.

5. What is not covered by Part B? Long-term care, most vision and dental.

6. How can I get help with Part B costs? Explore financial assistance programs.

7. When can I change my Part B coverage? During the Open Enrollment Period.

8. Where can I find more information about Part B? Medicare.gov

Tips and tricks for managing Part B costs include comparing Medigap and Medicare Advantage plans, reviewing your coverage annually, and understanding your benefits thoroughly. By staying informed and proactively managing your healthcare choices, you can make the most of your Medicare Part B coverage.

In conclusion, understanding Medicare Part B costs is essential for effective healthcare planning. From premiums and deductibles to coverage details and financial assistance options, navigating these complexities can empower you to make informed decisions about your healthcare. By taking advantage of available resources, understanding your benefits, and proactively managing your coverage, you can maximize the value of your Medicare Part B benefits and ensure access to the vital medical services you need. Remember to review your coverage regularly and stay informed about changes to Medicare regulations. Take control of your healthcare journey by exploring the available resources and seeking guidance when needed. Your health and financial well-being depend on it.

Medicare Premium is Going Down in 2023 Medicare Annual Enrollment | YonathAn-Avis Hai

Medicare Plans Henderson Nv 2024 | YonathAn-Avis Hai

What Is Cost For Medicare In 2022 | YonathAn-Avis Hai