Navigating Medicare Plan B Premiums

Medicare, a cornerstone of healthcare for Americans aged 65 and older, often presents a complex landscape to navigate. One crucial aspect is understanding the costs associated with Medicare Plan B, which covers essential medical services like doctor visits, outpatient care, and preventive services. Understanding the current Medicare Plan B monthly premium is vital for effective financial planning.

Navigating the details of Medicare Plan B premiums can feel like deciphering a complex code. However, breaking down the components and understanding the factors influencing these premiums can empower individuals to make informed decisions about their healthcare coverage. This cost, often referred to as the Medicare Part B premium, represents an important investment in one's well-being.

The Medicare Plan B premium isn't static; it adjusts annually based on various economic factors. Understanding how these adjustments are determined helps beneficiaries anticipate potential changes and adapt their budgets accordingly. For many, the Part B premium is a significant monthly expense, and understanding its nuances is crucial for financial stability in retirement.

Beyond the standard monthly premium, certain factors can influence the actual amount an individual pays. Income levels, enrollment timelines, and late enrollment penalties can all play a role in determining the final cost. This necessitates a thorough understanding of individual circumstances to accurately estimate the Medicare Plan B financial commitment.

Consider the current Medicare Plan B monthly premiums as an investment in accessible healthcare. By exploring the details of coverage, understanding the payment structure, and planning for potential adjustments, individuals can gain a sense of control and confidence in managing their healthcare expenses. This proactive approach empowers beneficiaries to focus on their well-being, knowing they have a solid foundation of coverage.

Medicare Plan B originated as part of the 1965 amendments to the Social Security Act, aiming to provide comprehensive medical insurance coverage for seniors. The importance of Plan B lies in its coverage of medically necessary services, offering financial protection against the high costs of healthcare. A major issue surrounding Plan B premiums is their affordability, especially for beneficiaries with limited incomes.

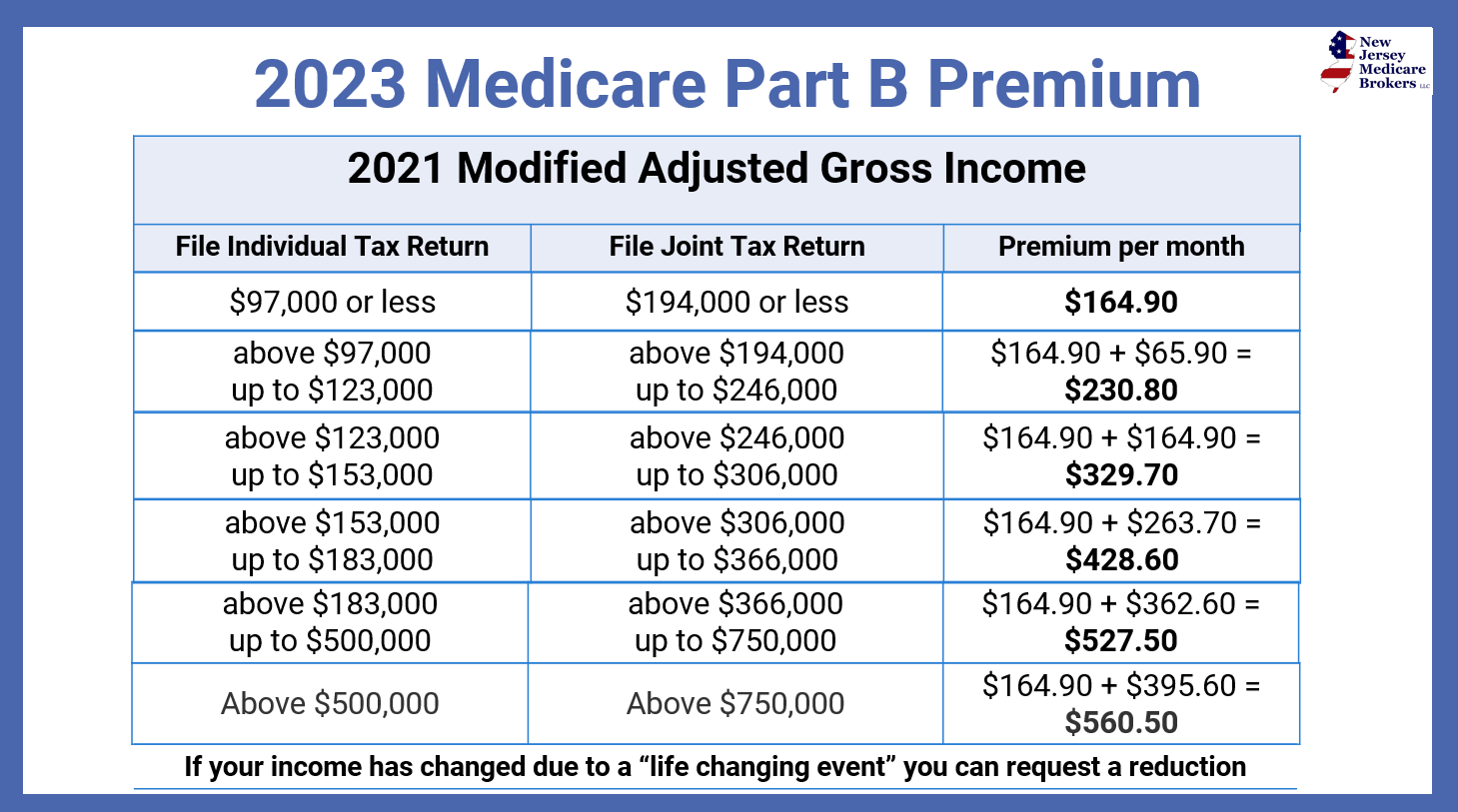

The "Medicare Plan B monthly premium" refers to the standard monthly cost beneficiaries pay for Plan B coverage. For example, in 2023, the standard premium was $164.90. However, this amount can vary based on income. Higher earners may pay a higher Income-Related Monthly Adjustment Amount (IRMAA).

Benefits of Medicare Plan B premiums include access to a wide range of medical services, financial protection against high healthcare costs, and peace of mind knowing essential medical needs are covered. For instance, Plan B covers 80% of the cost of doctor visits after the annual deductible is met. This can significantly reduce out-of-pocket expenses for routine checkups, specialist consultations, and other necessary medical services.

An action plan for managing Medicare Plan B premiums involves understanding your income bracket, estimating your premium, budgeting for the cost, and exploring options for assistance if needed. A successful example would be a beneficiary who accurately budgets for their premium, anticipates potential increases, and explores programs like "Extra Help" if eligible.

Tips and tricks for managing Plan B premiums include reviewing your income annually to assess potential IRMAA changes, exploring Medicare Advantage plans as an alternative, and staying informed about premium adjustments.

Medicare Plan B premiums represent a crucial aspect of healthcare planning for seniors. Understanding the current costs, how they're determined, and available resources empowers individuals to manage their expenses and access essential medical services. By actively engaging with the details of Medicare Plan B, individuals can ensure a secure and healthy future. Investing in one's health through Medicare Plan B provides access to vital medical services, financial protection, and peace of mind. Take the time to understand your options, plan for your expenses, and secure your healthcare future.

current medicare plan b monthly premiums | YonathAn-Avis Hai

How Does Income Affect Medicare Part B Premiums | YonathAn-Avis Hai

Medicare and Social Security updates for 2024 | YonathAn-Avis Hai

2025 IRMAA Brackets And Premiums What You Need To Know | YonathAn-Avis Hai

Medicare Premium is Going Down in 2023 Medicare Annual Enrollment | YonathAn-Avis Hai

IRMAA Brackets For 2025 What They Are And How They Affect Medicare | YonathAn-Avis Hai