Navigating New Hampshire Employee Compensation

Are you curious about how employee compensation works in the Granite State? Whether you're a business owner trying to understand legal requirements or an employee seeking information about your earnings, navigating the landscape of New Hampshire employee wages can feel complex. This guide aims to provide a clear and comprehensive overview, breaking down key concepts and offering practical insights.

Understanding compensation in New Hampshire goes beyond simply knowing the minimum wage. It involves understanding various factors that influence pay, including industry standards, experience levels, and the overall economic climate. This understanding is crucial for both employers seeking to attract and retain talent and employees looking to negotiate fair compensation.

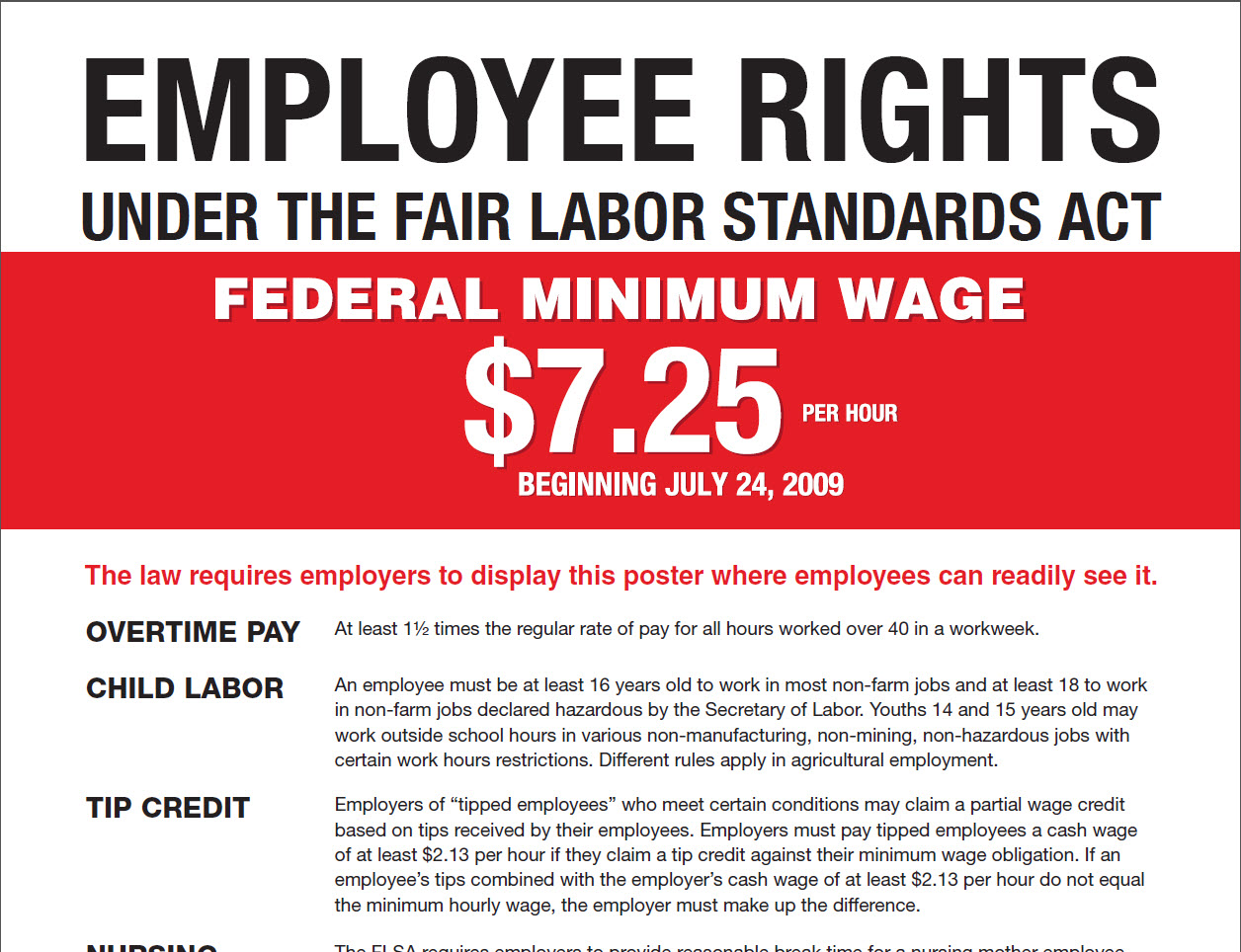

Historically, New Hampshire has followed the federal minimum wage. However, discussions around adjusting this wage occur regularly at the state level, reflecting ongoing debates about the cost of living and fair labor practices. These conversations highlight the importance of staying informed about potential changes in employment law and their impact on both businesses and employees.

Employee wages form the cornerstone of a healthy economy. Fair compensation ensures that individuals can meet their basic needs, contributing to overall economic stability. For businesses, offering competitive wages is essential for attracting and retaining skilled workers, fostering productivity and growth. A clear understanding of wage regulations and best practices is therefore vital for building a thriving business community in New Hampshire.

One of the main issues surrounding employee compensation in New Hampshire, and nationally, is the debate over a living wage. While the state adheres to the federal minimum wage, many argue that this amount is insufficient to cover basic living expenses in the state, particularly in areas with higher costs of living. This raises concerns about economic inequality and the ability of individuals to maintain a reasonable standard of living.

New Hampshire employers are required to comply with federal wage and hour laws, including those related to overtime pay and youth employment. These regulations ensure fair treatment of employees and protect them from exploitation. Understanding these regulations is crucial for maintaining legal compliance and promoting a positive work environment.

Several benefits arise from understanding and implementing fair wage practices in New Hampshire. For example, competitive wages attract a larger pool of qualified candidates, giving businesses a wider selection of talent. This can lead to increased productivity and innovation. Additionally, fair wages improve employee morale and reduce turnover, saving companies the cost of recruiting and training new staff. Finally, investing in employee compensation contributes to the overall economic well-being of the state, fostering a stronger and more sustainable workforce.

Employers looking to navigate New Hampshire employee compensation successfully should familiarize themselves with resources like the New Hampshire Department of Labor website, which offers up-to-date information on wage laws and regulations. Staying informed about changes in legislation and industry best practices is vital for ensuring compliance and fostering a fair and competitive work environment.

Advantages and Disadvantages of a Higher Minimum Wage

| Advantages | Disadvantages |

|---|---|

| Increased consumer spending | Potential for job losses |

| Reduced poverty | Increased prices for goods and services |

Frequently Asked Questions:

1. What is the minimum wage in New Hampshire? (Answer: New Hampshire follows the federal minimum wage.)

2. What are prevailing wages? (Answer: Prevailing wages are generally defined as the average wage paid to similarly employed workers in a particular geographic area.)

3. How is overtime calculated in New Hampshire? (Answer: Overtime is typically calculated at 1.5 times the regular rate of pay for hours worked over 40 in a workweek.)

4. Where can I find information on New Hampshire wage laws? (Answer: The New Hampshire Department of Labor website.)

5. What resources are available for employees seeking wage information? (Answer: Several online resources and worker advocacy groups provide information on employee rights and wages.)

6. How do I report a wage violation? (Answer: Contact the New Hampshire Department of Labor's Wage and Hour Division.)

7. How can I negotiate a higher salary in New Hampshire? (Answer: Research industry salary data and prepare a strong case highlighting your skills and experience.)

8. What are some common benefits offered to employees in New Hampshire? (Answer: Common benefits include health insurance, paid time off, and retirement plans.)

In conclusion, understanding the intricacies of New Hampshire employee compensation is crucial for both employers and employees. From staying up-to-date on legal requirements to effectively negotiating fair wages, knowledge empowers individuals and businesses alike. By fostering open communication, prioritizing fair labor practices, and utilizing available resources, we can create a thriving economic landscape that benefits everyone in the Granite State. Take the time to research and understand your rights and responsibilities; it's an investment that will pay dividends in the long run.

San Jose Minimum Wage 2024 Posting 2024 | YonathAn-Avis Hai

state of nh employee wage | YonathAn-Avis Hai

Career and technical education programs in high demand throughout the | YonathAn-Avis Hai

Career and technical education programs in high demand throughout the | YonathAn-Avis Hai

Federal Government Releases New Salary Table | YonathAn-Avis Hai

state of nh employee wage | YonathAn-Avis Hai