Navigating the Brazilian Invoice Labyrinth: A Guide to "Entrega de Notas Fiscais"

Okay, imagine this: you've just scored the most amazing pair of vintage platforms from a Brazilian boutique online (because honestly, where else would you find such treasures?). The excitement is palpable. You refresh the tracking page more times than you'd like to admit. But wait, what's this? The package seems stuck. Then, you notice an email notification mentioning something cryptic - "Nota Fiscal." Suddenly, your dream shoes feel miles away.

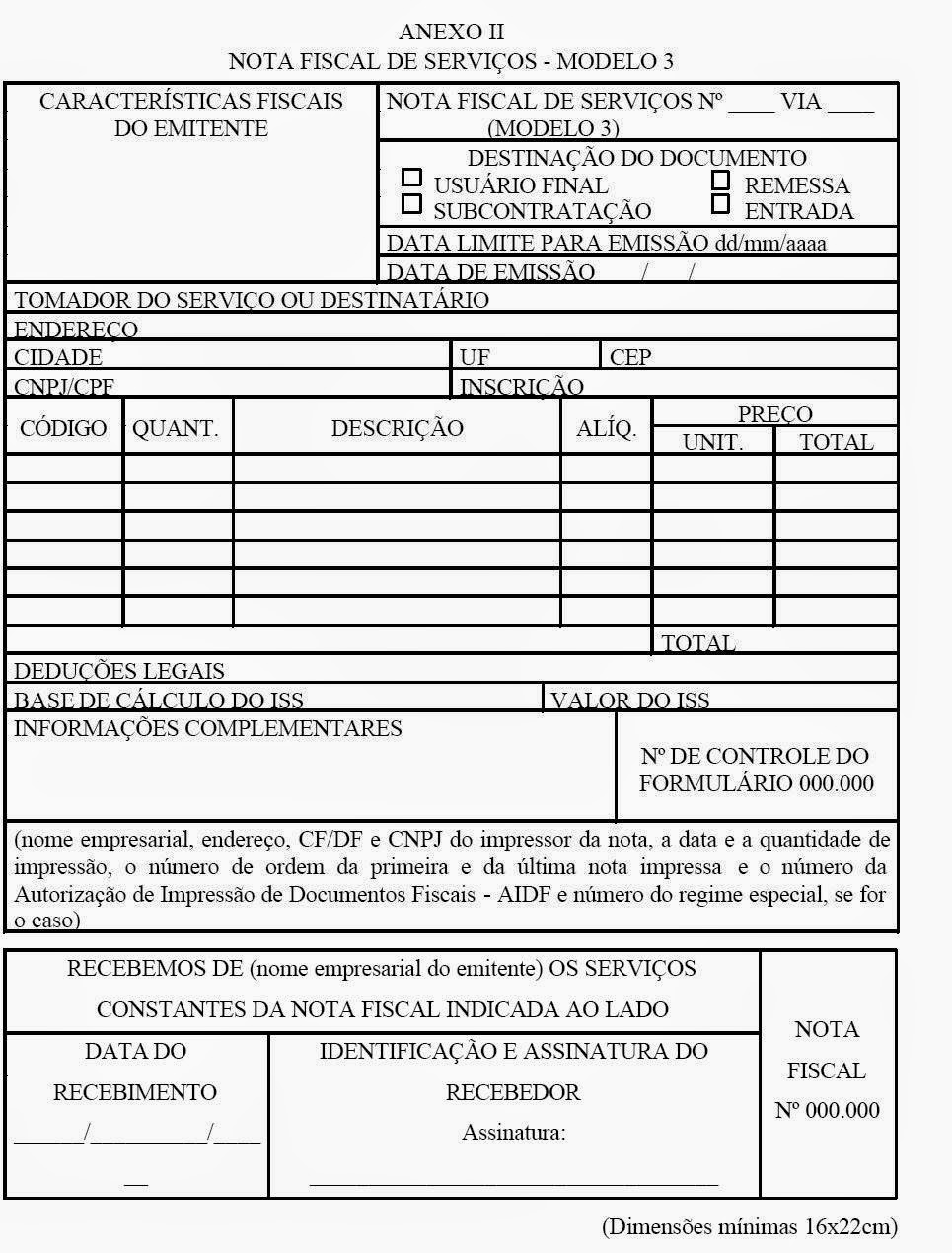

Fear not, fellow fashion enthusiast! This is where understanding the intriguing world of "Entrega de Notas Fiscais" comes in. Essentially, it translates to "Electronic Invoice Delivery" - yes, Brazil takes its invoices seriously, making them digital. It's like the VIP pass your purchase needs to smoothly sashay its way through customs and into your eagerly awaiting hands.

Think of "Entrega de Notas Fiscais" as the ultimate bureaucratic gatekeeper of Brazilian commerce. No online shopping spree or business transaction is complete without it. This intricate system, implemented and regulated by the Brazilian tax authorities, ensures transparency and accountability in every purchase. Every single transaction generates an electronic invoice (NF-e) with a unique identification number, allowing the government to track goods, collect taxes, and maintain order in the bustling Brazilian marketplace.

Now, you might be thinking, "This sounds complicated!" And, well, it can be. "Entrega de Notas Fiscais" comes with its own set of rules, regulations, and even its own special language (XML, anyone?). But don't worry, we're here to break it down, step-by-stylish-step. After all, knowledge is power, especially when it comes to conquering international shipping hurdles and finally rocking those statement shoes.

Getting your head around "Entrega de Notas Fiscais" is crucial, whether you're a seasoned entrepreneur importing the latest trends from Brazil or a dedicated fashionista on the hunt for that one-of-a-kind piece. It's a system that touches every aspect of buying and selling in Brazil, and understanding its nuances can be the difference between a smooth transaction and a logistical nightmare.

Advantages and Disadvantages of "Entrega de Notas Fiscais"

| Advantages | Disadvantages |

|---|---|

| Increased transparency and reduced risk of fraud | Potential technical difficulties and the need for specialized software |

| Improved efficiency and reduced paperwork | Strict regulations and potential penalties for non-compliance |

| Easier for businesses to track sales and inventory | Language barrier and understanding complex tax regulations |

Mastering the art of "Entrega de Notas Fiscais" might seem like navigating a fashion week after-party guest list – a little intimidating at first. However, with a little patience and the right information, you'll be well on your way to conquering the Brazilian marketplace, one perfectly documented transaction at a time. So go ahead, indulge in that online shopping spree. Your future, stylish self will thank you.

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

Planilha Para Imprimir Nota Fiscal Em A4 | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

Aprender sobre 73+ imagem manifesto modelo | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai

entrega de notas fiscais | YonathAn-Avis Hai