Navigating Your Financial Compass: Cara Menyemak No Cukai Pendapatan

In the tapestry of life, where threads of financial responsibility are interwoven with personal growth, understanding our place in the intricate system of taxation is paramount. This journey begins with a simple yet powerful tool: the income tax number. In Malaysia, this alphanumeric key, known as "no cukai pendapatan," unlocks a realm of civic duty and financial awareness. Just as a compass guides a ship through vast oceans, knowing how to check and understand your income tax number is essential for navigating the complexities of personal finance.

The act of "cara menyemak no cukai pendapatan," which translates to "how to check income tax number" in Malay, is not merely a bureaucratic exercise but a crucial step towards financial literacy and responsible citizenship. It represents a connection between the individual and the state, highlighting the role we all play in contributing to the nation's development.

The history of income tax in Malaysia, much like in many parts of the world, is intertwined with the evolution of the nation itself. From its early forms to its current structure, the system has adapted to the changing economic landscape. As Malaysia transitioned from an agrarian society to a burgeoning economic force, the need for a robust and transparent tax system became increasingly evident. The introduction of the income tax number, a unique identifier for each taxpayer, marked a pivotal moment in this evolution.

However, the journey towards widespread understanding and adoption of this system has not been without its challenges. Language barriers, lack of awareness, and the perceived complexity of financial processes have, at times, hindered individuals from fully engaging with their tax obligations. This is where the significance of "cara menyemak no cukai pendapatan" comes to the fore. It serves as a bridge, connecting individuals with the information and resources they need to navigate the tax system confidently.

The internet age has ushered in an era of unprecedented accessibility, empowering individuals with the tools to take charge of their financial lives. Government portals and online platforms have simplified the process of checking one's income tax number, making it as straightforward as a few clicks. This accessibility is crucial in demystifying the tax system and fostering a culture of informed participation.

The benefits of understanding "cara menyemak no cukai pendapatan" extend far beyond the realm of tax filing. It empowers individuals to engage with government services more effectively, access financial assistance programs, and even contribute to national development through informed financial decisions. In essence, it represents a step towards greater financial empowerment and civic responsibility.

Advantages and Disadvantages of Understanding "Cara Menyemak No Cukai Pendapatan"

| Advantages | Disadvantages |

|---|---|

| Empowers individuals to manage their tax obligations effectively | May require some effort to learn the process initially |

| Facilitates access to government services and assistance programs | Potential for misuse of information if not handled securely |

In conclusion, understanding "cara menyemak no cukai pendapatan" is not just about knowing where to find your income tax number; it's about embracing a mindset of financial awareness and civic responsibility. It's about recognizing the interconnectedness of our individual actions and their impact on the larger societal fabric. By equipping ourselves with the knowledge and tools to navigate the world of taxation, we contribute not only to our own financial well-being but also to the collective progress of our nation.

CARA MENDAPATKAN NO CUKAI PENDAPATAN INDIVIDU DAN SYARIKAT SERTA DAFTAR | YonathAn-Avis Hai

Bajet 2023: Potongan cukai pendapatan, diskaun PTPTN, pengecualian duti | YonathAn-Avis Hai

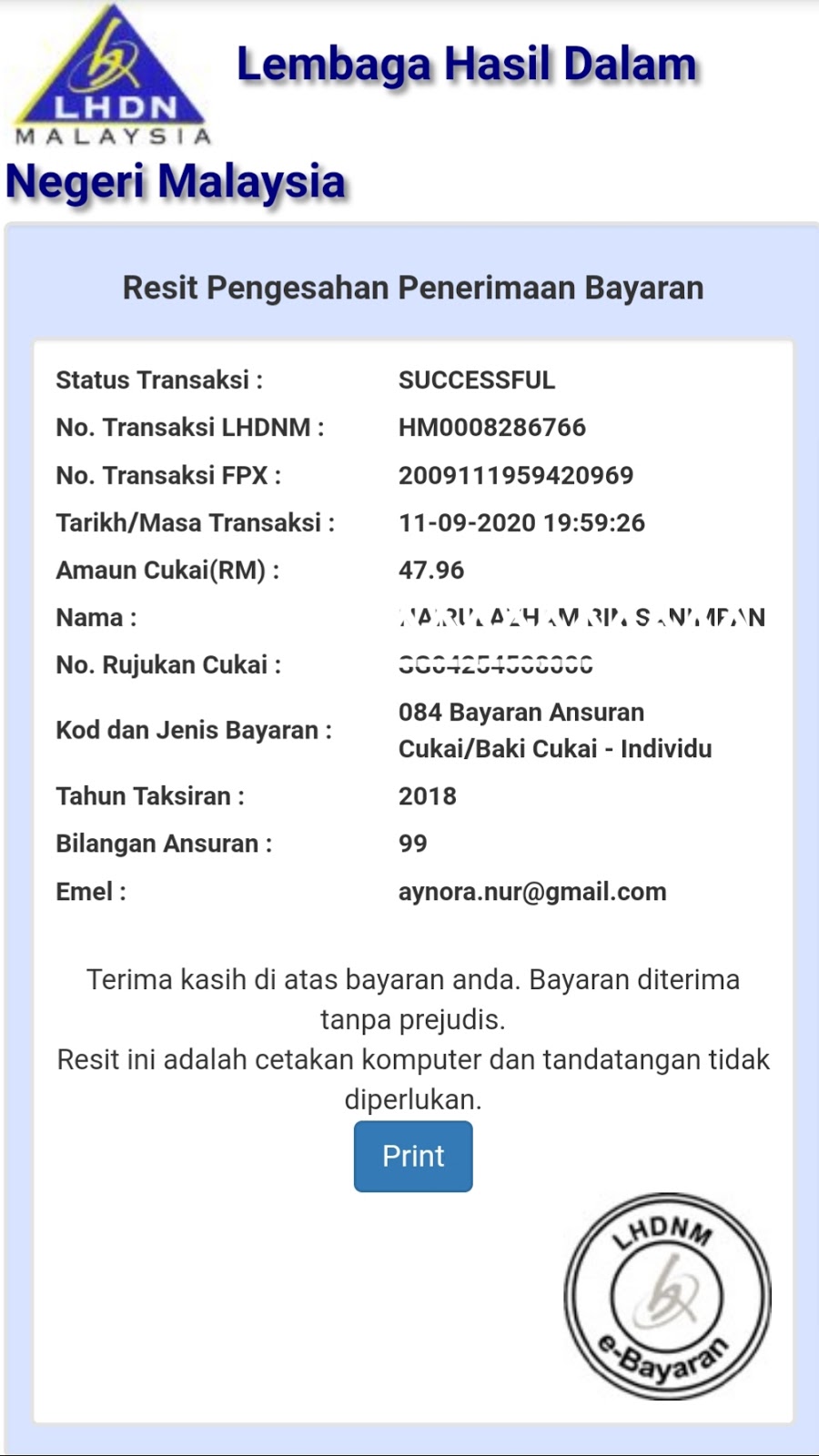

Cara Bayar Baki Cukai Pendapatan Secara Online Yang Mudah | YonathAn-Avis Hai

Cara Semak No Cukai Pendapatan LHDN Number | YonathAn-Avis Hai

Cara,Panduan Dan Langkah Isi Borang Cukai Pendapatan Online (E | YonathAn-Avis Hai

Cara Menyemak Bantuan E | YonathAn-Avis Hai

cara menyemak no cukai pendapatan | YonathAn-Avis Hai

Cara Daftar Cukai Pendapatan di Malaysia | YonathAn-Avis Hai

SEMAK NO CUKAI PENDAPATAN : CARA DAPATKAN NOMBOR INCOME TAX INDIVIDU | YonathAn-Avis Hai

Semakan No Cukai Pendapatan Individu (TIN Hasil) | YonathAn-Avis Hai

ByrHASIL: Cara Mudah Bayar Cukai Pendapatan LHDN Secara Online | YonathAn-Avis Hai

Cara Renew Lesen Memandu Online (MyJPJ / MySikap) | YonathAn-Avis Hai

Cara Daftar Cukai LHDN Untuk e | YonathAn-Avis Hai

Wow! Panduan E Filing Lhdn 2023 Wajib Kamu Ketahui | YonathAn-Avis Hai

e_buletin_hasil_edisi_2_2023.pdf | YonathAn-Avis Hai