Navigating Your Wells Fargo Insurance Check Endorsement

Receiving an insurance check often brings a mix of relief and perhaps a touch of confusion. It signifies the beginning of the recovery process after an unforeseen event. Understanding how to correctly endorse, or sign, your insurance check is crucial for a smooth and secure transaction. This is particularly true when dealing with a large financial institution like Wells Fargo.

While the concept of signing a check might seem straightforward, insurance checks, especially those issued by a major bank like Wells Fargo, often come with specific instructions and requirements. This guide aims to demystify the process of Wells Fargo insurance check endorsements, providing clarity and practical advice to help you navigate this important financial step.

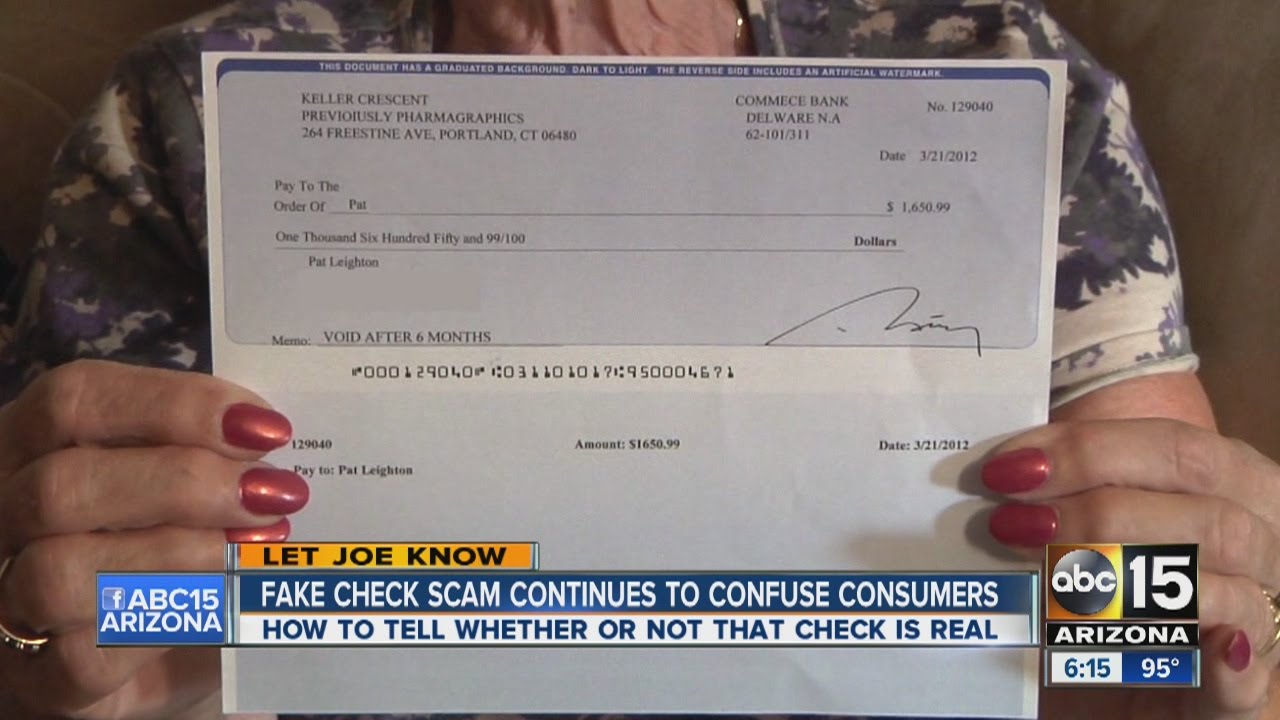

Insurance checks are not your average checks. They represent the settlement of a claim, whether it’s related to your home, car, or health. Due to the higher value of these checks and the potential for fraud, Wells Fargo, like many financial institutions, has specific procedures in place to ensure that the funds are received by the intended recipient.

One key aspect of this process is the endorsement. It might involve specific wording, multiple signatures if there are multiple payees, or restrictions on how the check can be deposited or cashed. Failure to follow the proper endorsement instructions could lead to delays in processing, or even worse, the check being rejected.

Navigating the world of insurance and banking procedures can feel overwhelming. By understanding the nuances of Wells Fargo insurance check endorsements, you can approach this process with confidence, ensuring a smoother and more efficient experience. This guide will equip you with the knowledge to handle your insurance check effectively, allowing you to focus on what truly matters: your recovery and peace of mind.

Advantages and Disadvantages of Wells Fargo Insurance Check Endorsements

While receiving an insurance check is generally positive, there are advantages and disadvantages to consider, especially regarding Wells Fargo's specific processes:

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Wells Fargo Insurance Check Endorsements

To ensure a seamless experience, consider these best practices:

- Read Carefully: Thoroughly review the check and any accompanying instructions from Wells Fargo or your insurance company.

- Verify Payee Information: Ensure all payee names are spelled correctly on the check.

- Use Black or Blue Ink: Legibly endorse the check using black or blue ink. Avoid other colors or pencils.

- Contact Wells Fargo: If you have any doubts or questions regarding the endorsement, don't hesitate to contact Wells Fargo directly for clarification.

- Keep Records: After depositing or cashing the check, retain a copy for your records.

Common Questions and Answers about Wells Fargo Insurance Check Endorsements

Here are some frequently asked questions to provide further clarity:

- Q: What if my name is misspelled on the check?

- Q: Can someone else endorse the check on my behalf?

- Q: What if the check is for more than my insurance deductible?

- Q: Can I deposit the check online?

- Q: What if I lose the check?

- Q: What does "For Deposit Only" mean on an endorsement?

- Q: Why does the check need to be endorsed?

- Q: How long are insurance checks valid?

A: Contact your insurance company immediately to request a corrected check. Do not attempt to alter the payee information yourself.

A: Generally, no. Endorsements typically require the signature of the named payee(s). Special circumstances might exist, so it's best to contact Wells Fargo for guidance.

A: You should receive two separate checks: one for your deductible amount, which you endorse and keep, and another for the remaining amount, which is often made payable to both you and your repair shop (if applicable).

A: Yes, Wells Fargo typically allows mobile check deposits. Ensure you follow their online endorsement procedures, which might involve taking pictures of both the front and back of the endorsed check.

A: Contact both your insurance company and Wells Fargo immediately to report the lost check. They will guide you through the process of obtaining a replacement, which might involve placing a stop payment on the original check.

A: This restrictive endorsement limits the check to being deposited into your account. It enhances security by preventing anyone else from cashing it.

A: Endorsements serve as legal proof that you, the payee, received and authorized the transfer of funds. They are crucial for financial security and record-keeping.

A: Check with your insurance company and Wells Fargo, as policies can vary. Some checks have expiration dates, typically within 6 months to a year.

Tips and Tricks for a Smooth Endorsement

- Double-check everything. Ensure all names, dates, and amounts are correct before endorsing.

- Keep a copy. Make a photocopy or take a picture of the endorsed check for your records.

- Don't delay. Deposit or cash the check promptly to avoid potential issues or delays.

Successfully navigating a Wells Fargo insurance check endorsement might seem like a small victory, but it signifies a crucial step towards financial recovery after an unexpected event. By understanding the nuances, best practices, and potential challenges, you can approach this process with confidence and efficiency. Remember, knowledge is power, and being well-informed empowers you to make the most of your insurance settlement, allowing you to focus on what truly matters: getting back on track.

Wells fargo insurance claim check: Fill out & sign online | YonathAn-Avis Hai

Chase Bank Check Template | YonathAn-Avis Hai

High Security Laser Draft Check | YonathAn-Avis Hai

New Bank of america home insurance claim check Trend in 2022 | YonathAn-Avis Hai

Wells Fargo Printable Checks | YonathAn-Avis Hai

wells fargo insurance check endorsement | YonathAn-Avis Hai

Create fake bank statement template suntrust | YonathAn-Avis Hai

How To Deposit A Check At Wells Fargo Bank | YonathAn-Avis Hai

Equity Insurance File A Claim | YonathAn-Avis Hai

Everything You Need to Know About Cashing a Third Party Check | YonathAn-Avis Hai

Printable Back Of Check Template | YonathAn-Avis Hai

Wells Fargo Printable Checks | YonathAn-Avis Hai

Wells fargo insurance claim check: Fill out & sign online | YonathAn-Avis Hai

Blank Wells Fargo Deposit Slips Pdf | YonathAn-Avis Hai

Wells Fargo Foundation Minnesota | YonathAn-Avis Hai