Simplify Your Finances: Understanding Wells Fargo Bank Check Deposit

In a world increasingly driven by digital transactions, the gentle rustle of a paper check might seem like a relic of the past. However, many of us still receive them, whether it's a birthday gift from a relative or a payment for a freelance project. This is where understanding the process of check deposits becomes essential, and when it comes to banking, Wells Fargo is a name synonymous with trust and reliability.

Imagine this: you've just received a check, and the anticipation of seeing those funds reflected in your account fills your mind. Instead of making a trip to a physical branch, what if you could deposit that check from the comfort of your own home? Wells Fargo's check deposit options provide that very convenience.

This article delves into the world of Wells Fargo bank check deposits, exploring the different avenues available, the advantages they offer, and some practical tips to ensure your transactions are smooth sailing. Whether you're a seasoned Wells Fargo customer or new to the world of banking, understanding how to navigate check deposits can simplify your financial life significantly.

Gone are the days of meticulously planning your day around a bank visit. Wells Fargo's commitment to providing a seamless banking experience extends to its check deposit options, allowing you to deposit checks at your own pace and convenience.

Let's embark on this journey of financial exploration, demystifying the process of Wells Fargo bank check deposits and empowering you to make the most of your banking experience.

Advantages and Disadvantages of Wells Fargo Check Deposits

| Advantages | Disadvantages |

|---|---|

| Convenience of mobile and online deposits | Potential hold times on deposited funds |

| Wide network of ATMs for check deposits | Limited availability for depositing large checks via mobile deposit |

| Option to receive assistance at physical branches | Transaction limits for mobile and ATM deposits |

Best Practices for Wells Fargo Bank Check Deposits

1. Endorse Your Check Properly: Sign the back of the check and write "For mobile deposit at Wells Fargo" above your signature.

2. Ensure Adequate Lighting: When taking pictures of your check for mobile deposit, use good lighting to prevent blurry images.

3. Keep Check Until Funds Clear: Hold onto the physical check for a few days after your deposit is processed, just in case any issues arise.

4. Review Deposit Limits: Be aware of the deposit limits for mobile and ATM check deposits. You can find this information on the Wells Fargo website or mobile app.

5. Report Any Discrepancies Immediately: If you notice any errors in your deposit, contact Wells Fargo customer service as soon as possible.

Common Questions and Answers About Wells Fargo Bank Check Deposits

1. What is the mobile check deposit limit at Wells Fargo? The mobile check deposit limit varies depending on your account history and other factors. Check the Wells Fargo app or website for your specific limit.

2. How long does it take for a Wells Fargo check deposit to clear? Typically, mobile and ATM check deposits take 1-2 business days to clear. However, some deposits may take longer depending on the check amount and other factors.

3. Can I deposit a check made out to someone else into my Wells Fargo account? No, you can only deposit checks that are made payable to you or a joint account holder.

4. What if I don't have a Wells Fargo account? Can I still cash a check there? Wells Fargo typically only cashes checks for their account holders. Non-customers may face fees or restrictions.

5. Are there any fees for depositing a check with Wells Fargo? Wells Fargo generally does not charge fees for mobile or ATM check deposits. However, fees may apply for certain account types or deposit methods. It's always a good idea to check with your bank to confirm.

6. Can I deposit international checks with Wells Fargo? Wells Fargo accepts certain international checks for deposit. However, there may be additional processing time and fees associated with international deposits.

7. What should I do if my mobile check deposit is rejected? If your mobile check deposit is rejected, review the error message in the Wells Fargo app for instructions. You may need to retake the check image or contact customer service for assistance.

8. Can I schedule a check deposit in advance with Wells Fargo? At this time, Wells Fargo does not offer the option to schedule check deposits in advance.

Tips and Tricks for Wells Fargo Check Deposits

- Take clear photos of your check for mobile deposits to avoid rejections.

- Deposit checks promptly to minimize the risk of loss or damage.

- Enable mobile deposit notifications to stay updated on your deposit status.In a world where time is our most valuable asset, Wells Fargo bank check deposits offer a blend of convenience and security. By understanding the available options, following best practices, and staying informed about your account details, you can navigate the world of check deposits with ease. As with any financial transaction, a little knowledge goes a long way in ensuring a smooth and hassle-free experience.

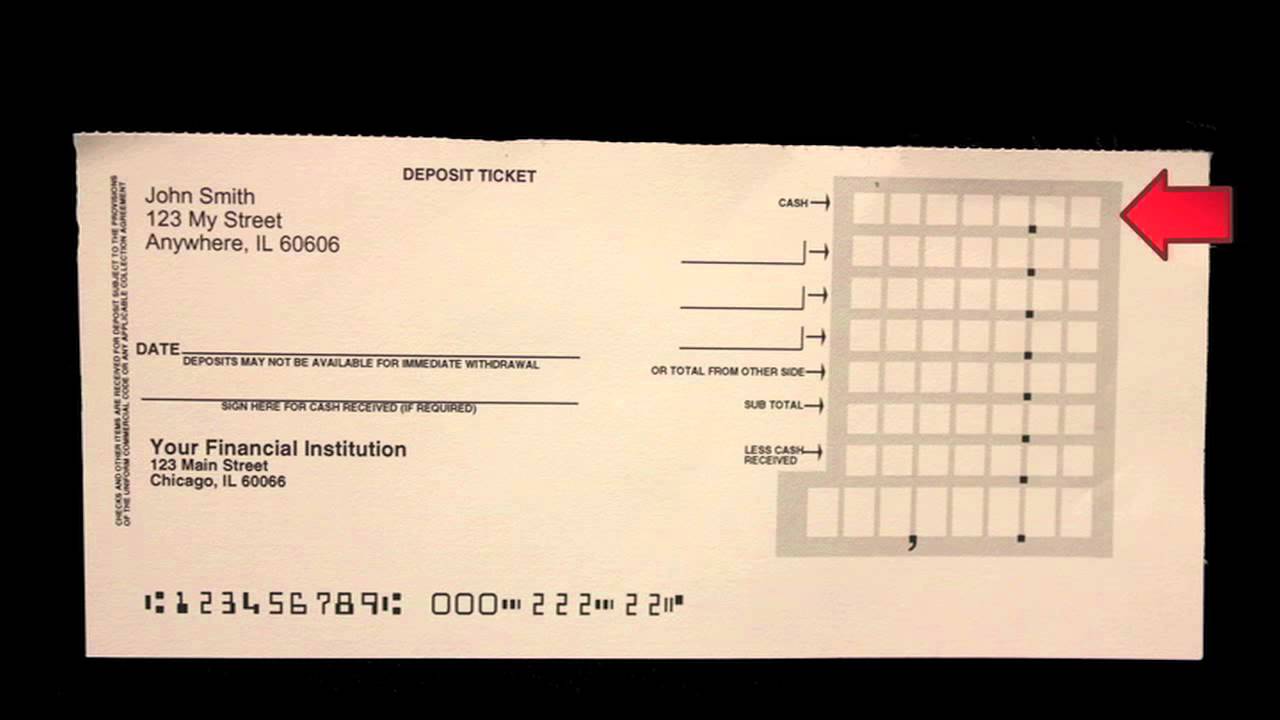

Printable Deposit Slip Wells Fargo | YonathAn-Avis Hai

Wells Fargo Deposit Slip Printable | YonathAn-Avis Hai

/VoidedCheck-5a73c34bba6177003739388b.png)

wells fargo bank check deposit | YonathAn-Avis Hai

Wells Fargo Deposit Slip | YonathAn-Avis Hai

Top 8 how do i find my routing number on wells fargo 2022 2022 | YonathAn-Avis Hai

Wells Fargo Routing Number | YonathAn-Avis Hai

Printable Wells Fargo Deposit Slip | YonathAn-Avis Hai

/FilledOutDepositSlip-5a0da7e022fa3a0036621626.png)

Wells Fargo Deposit Slip Printable | YonathAn-Avis Hai

Wells Fargo Blank Deposit Slip Printable | YonathAn-Avis Hai

![Free Printable Bank Deposit Slip Examples [Filled Out] +PDF](https://i2.wp.com/www.typecalendar.com/wp-content/uploads/2023/05/Bank-Deposit-Slip-1.jpg)

Free Printable Bank Deposit Slip Examples [Filled Out] +PDF | YonathAn-Avis Hai

Diagram Of A Wells Fargo Check | YonathAn-Avis Hai

Diagram Of A Wells Fargo Check | YonathAn-Avis Hai

Wells Fargo Check Template | YonathAn-Avis Hai

Blank Wells Fargo Deposit Slips Pdf | YonathAn-Avis Hai

Mailing A Check To Bank at Floyd Gartner blog | YonathAn-Avis Hai