Tax Refunds in Malaysia: Demystifying "Borang Bayaran Balik Hasil"

Ever feel like you've given the Malaysian government a bit too much of your hard-earned Ringgit? You know, that feeling when you see your monthly paycheck and wonder if maybe, just maybe, there's a way to get some of that back. Well, buckle up because the "Borang Bayaran Balik Hasil" — yes, that's Malay for tax refund form — might just be your ticket to financial redemption.

Let's be real, navigating the world of taxes can feel like walking through a bureaucratic jungle. Forms, deadlines, regulations — it's enough to make anyone's head spin. But what if we told you that getting a tax refund in Malaysia doesn't have to be a headache-inducing nightmare?

That's where "Borang Bayaran Balik Hasil" comes in. This unassuming form holds the key to potentially reclaiming overpaid taxes and putting some extra cash back in your pocket.

In this article, we're diving deep into the world of Malaysian tax refunds. We'll break down the jargon, guide you through the process, and arm you with the knowledge to tackle your "Borang Bayaran Balik Hasil" like a pro.

Whether you're a seasoned taxpayer or a newbie just starting, this is your one-stop shop for everything you need to know about claiming your rightful refund in Malaysia. Ready to potentially unlock some hidden cash? Let's get started!

Advantages and Disadvantages of "Borang Bayaran Balik Hasil"

| Advantages | Disadvantages |

|---|---|

| Potentially receive a refund for overpaid taxes. | Can be a time-consuming process. |

| Relatively straightforward process for most taxpayers. | Requires careful record-keeping throughout the year. |

Best Practices for "Borang Bayaran Balik Hasil"

1. Keep Meticulous Records: The key to a smooth refund process is documentation. Keep all your income statements, receipts for deductible expenses, and any other relevant financial documents organized throughout the year.

2. File On Time: Don't wait until the last minute! Filing your "Borang Bayaran Balik Hasil" before the deadline ensures you'll avoid late penalties and potential delays in processing your refund.

3. Double-Check Your Forms: Mistakes happen, but they can cost you time and money. Carefully review all information on your form before submitting to avoid errors or omissions.

4. Seek Professional Help: Tax laws can be complex. If you're unsure about any aspect of the process, consider consulting with a qualified tax professional for personalized guidance.

5. Go Digital: Embrace the convenience of online filing. The Inland Revenue Board of Malaysia (LHDN) offers e-filing options, making the process faster and more efficient.

Common Questions and Answers About "Borang Bayaran Balik Hasil"

1. Who is eligible for a tax refund in Malaysia?

Generally, you might be eligible for a refund if you've overpaid your taxes, had excess tax deductions from your salary, or are eligible for certain tax reliefs.

2. How do I file for a refund?

You can file your "Borang Bayaran Balik Hasil" online through the LHDN's e-filing system or manually by downloading the form from their website.

3. When is the deadline for filing?

The deadline varies depending on your income type and filing method. Refer to the LHDN website for the most up-to-date deadlines.

4. How long does it take to receive a refund?

Refund processing times can vary, but it typically takes between two to six months from the date of filing your complete and accurate return.

5. What if I disagree with the LHDN's assessment?

You have the right to appeal the assessment within 30 days of receiving the notice. Details on the appeals process can be found on the LHDN website.

6. What is the difference between "bayaran balik hasil" and "pelepasan cukai"?

"Bayaran balik hasil" specifically refers to a tax refund, while "pelepasan cukai" refers to tax reliefs or deductions that can reduce your overall tax liability.

7. How do I check the status of my refund?

You can track your refund status online through the LHDN's website using your tax identification number.

8. Can I amend my "Borang Bayaran Balik Hasil" after I've submitted it?

Yes, you can submit an amended return if you've made errors or omissions within a certain timeframe. Refer to the LHDN website for specific guidelines.

Conclusion: Embrace Your Inner "Borang Bayaran Balik Hasil" Master

Navigating the world of taxes doesn't have to be a daunting experience. Understanding the ins and outs of "Borang Bayaran Balik Hasil" empowers you to potentially reclaim overpaid taxes and put that money back where it belongs — in your pocket. While the process may seem complex at first glance, with a bit of preparation and the right resources, you'll be well on your way to mastering the art of the Malaysian tax refund. Remember, knowledge is power, and in this case, it could also mean some extra Ringgit for you! So, embrace your inner "Borang Bayaran Balik Hasil" master, and happy filing!

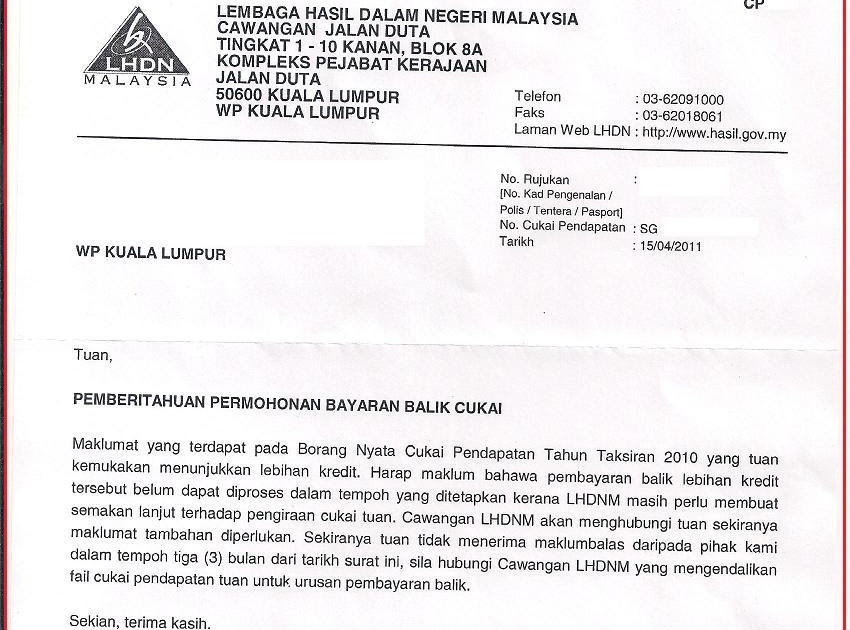

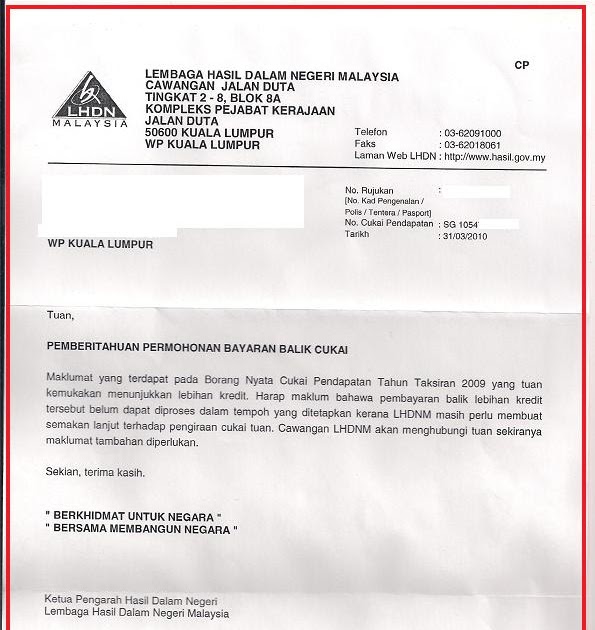

Surat Tuntutan Bayaran Balik | YonathAn-Avis Hai

Borang Bayaran Balik Hasil & Amanah MdI.docx | YonathAn-Avis Hai

Cukai Pendapatan Contoh Surat Rayuan Lembaga Hasil Dalam Negeri | YonathAn-Avis Hai

Surat Tuntutan Bayaran Balik | YonathAn-Avis Hai

Surat Tuntutan Bayaran Balik | YonathAn-Avis Hai

36+ Contoh Cukai Pintu Selangor Images | YonathAn-Avis Hai

4 Kelebihan Bayar Cukai Yang Menguntungkan Rakyat | YonathAn-Avis Hai

Surat Permohonan Pembayaran Balik Maranatha Music | YonathAn-Avis Hai

Fillable Online Borang Bayaran Balik Hasil | YonathAn-Avis Hai

Borang Kebenaran Bayaran Balik Pinjaman Latihan Kemahiran Melalui | YonathAn-Avis Hai