Transferring Your Wealth-Building Shares? You Need This Form!

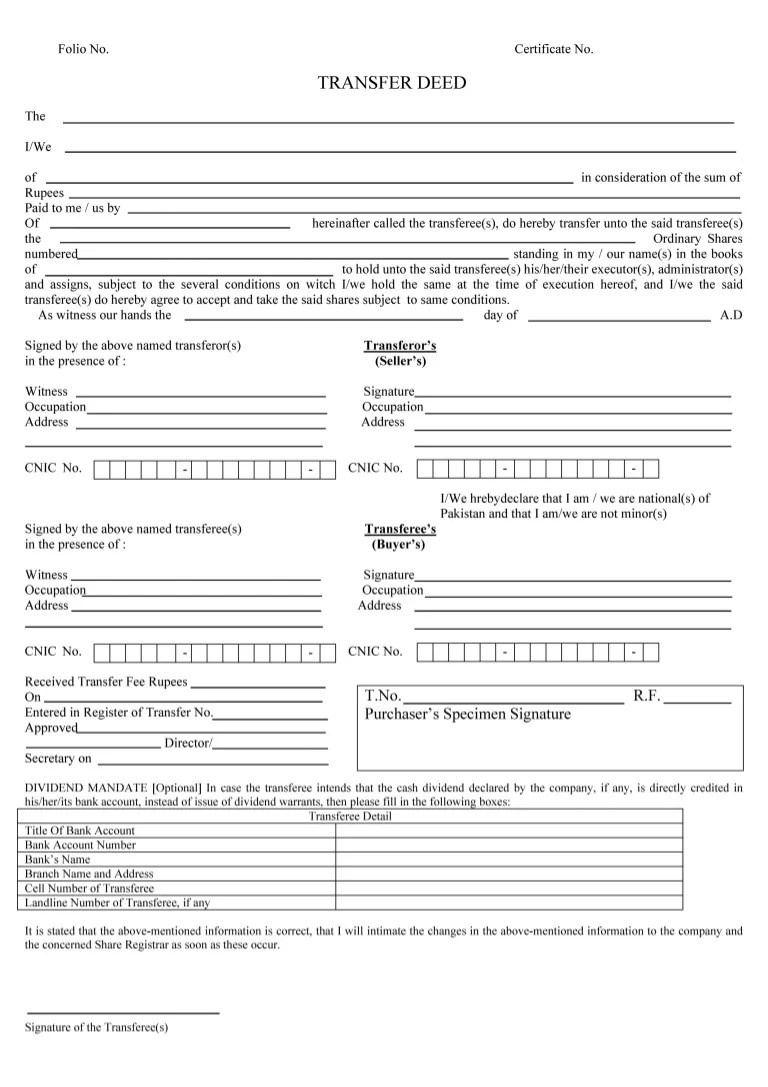

Ever dreamt of owning a piece of something big? Maybe you're already building your empire, one carefully chosen share at a time. Now, imagine wanting to share that slice of the pie, whether it's passing on wealth or letting go of a part of your stake. That's where the often-overlooked but oh-so-crucial "Deed of Transfer of Shares" form steps in.

We're not talking about splitting your pizza here, folks. This is about the legal transfer of ownership, and it's got to be airtight. Forget complicated legal jargon – we're diving into the practical side of things. What is this form, why should you care, and how can you navigate it without pulling your hair out?

This isn't just about big-shot CEOs and Wall Street hotshots. Even if you're just starting to dip your toes into the world of investing, understanding this form is like having a secret weapon in your financial arsenal. It's about taking control, being prepared, and making your money work for you, not the other way around.

So, whether you're a seasoned shareholder or just starting to build your investment portfolio, buckle up. We're breaking down the Deed of Transfer of Shares form – from its origins and importance to the nitty-gritty details you need to know to use it effectively. It's time to ditch the financial jargon and empower yourself with knowledge, one share transfer at a time.

Let's face it, nobody wants to wade through legalese. But understanding the basics of this form can save you headaches, potential disputes, and even money in the long run. Plus, it gives you the confidence to navigate the exciting, ever-evolving world of investing like a pro.

Advantages and Disadvantages of Deed of Transfer of Shares Form

Here's a quick look at the pros and cons to give you a clearer picture:

| Advantages | Disadvantages |

|---|---|

| Provides legal proof of ownership transfer. | Can be time-consuming to complete correctly. |

| Helps avoid future disputes over ownership. | May require additional documentation depending on the company and jurisdiction. |

| Essential for maintaining accurate company records. | Fees may be associated with the transfer process, varying by jurisdiction and company. |

Best Practices for Using a Deed of Transfer of Shares Form

- Accuracy is Key: Double-check every detail on the form, including names, addresses, and share details. Errors can lead to delays and disputes.

- Seek Professional Advice: When in doubt, consult with a legal professional or financial advisor. They can guide you through the process and ensure everything is in order.

- Understand Company Regulations: Different companies may have specific requirements for share transfers. Review their articles of association or consult with their company secretary for guidance.

- Keep Copies: Always retain copies of the completed and signed Deed of Transfer of Shares form for your records. This can be crucial for future reference or in case of any discrepancies.

- Consider Tax Implications: Depending on your jurisdiction, capital gains tax or other taxes may apply to share transfers. Consult with a tax professional to understand your obligations.

Common Questions and Answers

Q: What happens if a Deed of Transfer of Shares form isn't used?

A: Without a properly executed form, the transfer of ownership may not be legally recognized, potentially leading to disputes and complications down the line.

Q: Can I transfer shares as a gift?

A: Yes, shares can be gifted. However, specific regulations and tax implications may apply, so it's crucial to seek professional advice.

Q: What is a 'consideration' in the context of share transfer?

A: Consideration refers to the value exchanged for the shares. This could be monetary or any other agreed-upon form of compensation.

Q: Is witnessing the signatures mandatory?

A: While not always mandatory, it's generally recommended to have the signatures witnessed by an independent third party to add an extra layer of validity.

Q: Where can I find a Deed of Transfer of Shares form?

A: You can usually obtain a copy from the company itself, legal publishers, or online legal document providers. Some companies may also have templates available on their websites.

Conclusion

Navigating the world of share transfers doesn't have to be intimidating. Understanding the Deed of Transfer of Shares form empowers you to manage your investments efficiently and securely. By following best practices, seeking professional advice when needed, and staying informed about relevant regulations, you can approach share transfers with confidence. Remember, whether you're a seasoned investor or just starting, every step you take towards financial literacy brings you closer to achieving your financial goals.

Transfer of shares by way of GIFT | YonathAn-Avis Hai

Deed Of Undertaking Sample | YonathAn-Avis Hai

Real Estate Deed Template | YonathAn-Avis Hai

Shares Transfer Deed Form | YonathAn-Avis Hai

Format For Deed of Indemnity with Sureties to the Company for Transfer | YonathAn-Avis Hai

Approval and Register of Transfer of Shares | YonathAn-Avis Hai

deed of transfer of shares form | YonathAn-Avis Hai

deed of transfer of shares form | YonathAn-Avis Hai

deed of transfer of shares form | YonathAn-Avis Hai

10+ Certificate of Stocks and Transfer of Shares Free Printables | YonathAn-Avis Hai

deed of transfer of shares form | YonathAn-Avis Hai

Share Transfer Deed PDF: Complete with ease | YonathAn-Avis Hai

FREE 9+ Sample Deed Transfer Forms in MS Word | YonathAn-Avis Hai

Stock Transfer Agreement Template | YonathAn-Avis Hai

FREE 9+ Sample Deed Transfer Forms in MS Word | YonathAn-Avis Hai