Unclaimed Money: Your Guide to Pejabat Pendaftar Wang Tak Dituntut

Ever wondered if you might have unclaimed money out there, just waiting to be discovered? It might sound like a myth, but across the globe, millions go unclaimed every year. These forgotten funds can come from a variety of sources, from dormant bank accounts to uncashed checks. In Malaysia, there's a dedicated entity responsible for handling these unclaimed assets: the Pejabat Pendaftar Wang Tak Dituntut (PWTD).

The PWTD is a government body established under the Unclaimed Moneys Act 1965. Its primary function is to safeguard unclaimed funds and facilitate their return to the rightful owners or beneficiaries. This crucial role helps prevent financial losses and ensures that forgotten money finds its way back to its rightful place.

The existence of the PWTD highlights the importance of financial awareness and proactive money management. Many people are unaware of the potential for unclaimed funds, and even fewer know how to check or claim them. This lack of awareness can lead to missed opportunities and leave significant sums of money unclaimed.

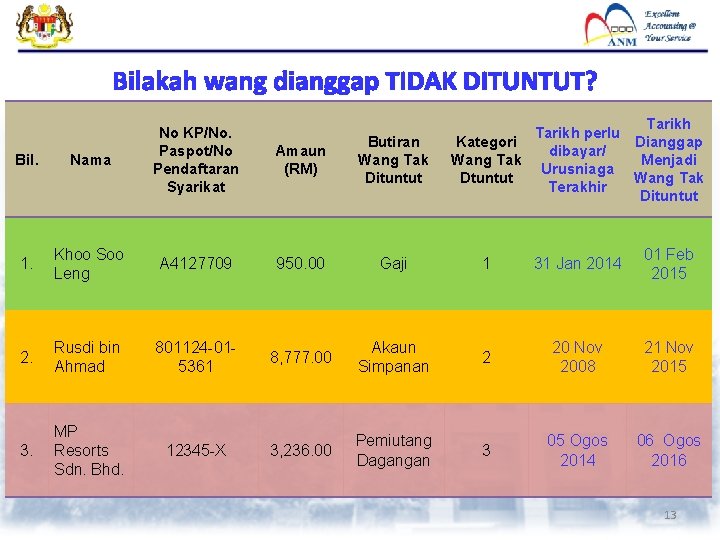

The journey of unclaimed money to the PWTD begins when an asset is deemed "dormant." This typically occurs after a period of inactivity, such as an account with no transactions or contact for a specific duration. The exact timeframe varies depending on the type of asset and the holding institution. Once classified as dormant, financial institutions must make efforts to locate the owner. If these efforts are unsuccessful, the funds are then transferred to the PWTD for safekeeping.

Understanding the role of the PWTD and the process of unclaimed money is essential for anyone who wants to ensure they're not missing out on potential funds. By raising awareness and promoting financial literacy, we can empower individuals to take control of their finances and reclaim what rightfully belongs to them.

Advantages and Disadvantages of PWTD

| Advantages | Disadvantages |

|---|---|

| Offers a central platform for checking for unclaimed money | The process for claiming funds can be lengthy and require documentation |

| Safeguards unclaimed money, preventing its loss | Limited awareness among the public about the existence of PWTD |

Now that we understand what PWTD is and how it works, let's explore some practical aspects.

Best Practices when Dealing with PWTD

- Regularly check for unclaimed money: Make it a habit to check for unclaimed money periodically, even if you believe you don't have any.

- Keep your contact information updated: Ensure your financial institutions have your current contact details to prevent your assets from becoming dormant.

- Be organized with your financial records: Maintain organized records of your accounts, policies, and investments to track any potential unclaimed funds.

- Be patient with the claims process: Understand that the process of claiming unclaimed money can take time, requiring patience and persistence.

- Seek assistance if needed: Don't hesitate to contact PWTD directly if you encounter difficulties or have questions regarding the claims process.

By following these best practices, you can proactively manage your finances and increase your chances of successfully reclaiming any unclaimed money that belongs to you.

Common Questions about PWTD

Here are some of the questions people often ask about PWTD:

- What types of assets can be considered unclaimed money?

- How do I check if I have any unclaimed money with PWTD?

- What documents do I need to claim my unclaimed money?

- How long does it take to receive unclaimed money from PWTD?

- Is there a fee to reclaim my unclaimed money?

- What happens to unclaimed money if no one claims it?

- Can I claim unclaimed money on behalf of a deceased family member?

- How can I contact PWTD for assistance?

For detailed information and answers to these questions, visit the official PWTD website or contact their helpline.

In conclusion, the Pejabat Pendaftar Wang Tak Dituntut plays a vital role in reuniting individuals and businesses with their unclaimed assets. By understanding the importance of financial awareness, regularly checking for unclaimed funds, and following the proper procedures, you can increase your chances of recovering any money that rightfully belongs to you. Don't let your hard-earned money slip through the cracks; take proactive steps today to reclaim what's yours.

Wang Yang Tidak Dituntut : Ramai Tak Tahu, Rupanya Dalam IC Kita Ada | YonathAn-Avis Hai

JABATAN AKAUNTAN NEGARA MALAYSIA PENGURUSAN WANG TAK DITUNTUT | YonathAn-Avis Hai

pejabat pendaftar wang tak dituntut | YonathAn-Avis Hai

pejabat pendaftar wang tak dituntut | YonathAn-Avis Hai

Pendaftar Wang Tak Dituntut ,Jabatan Akauntan Negara Malaysia ,Bahagian | YonathAn-Avis Hai

JABATAN AKAUNTAN NEGARA MALAYSIA PENGURUSAN WANG TAK DITUNTUT | YonathAn-Avis Hai

Cara Semak Wang Tak Dituntut Online 2024 | YonathAn-Avis Hai

Ini Cara Mudah Semak Dan Tuntut "Wang Tak Dituntut" Milik Anda Secara | YonathAn-Avis Hai

Permohonan Bayaran Borang Wang Tak Dituntut | YonathAn-Avis Hai

Semakan Wang Tak Dituntut | YonathAn-Avis Hai

Download Borang UMA 7 eGUMIS | YonathAn-Avis Hai

Tetapkan kriteria jawatan Pendaftar Wang Tidak Dituntut | YonathAn-Avis Hai

JABATAN AKAUNTAN NEGARA MALAYSIA PENGURUSAN WANG TAK DITUNTUT | YonathAn-Avis Hai

Cara semak & dapatkan semula Wang Tak Dituntut | YonathAn-Avis Hai

Permohonan Bayaran Borang Wang Tak Dituntut | YonathAn-Avis Hai