Understanding Salinan Penyata Akaun Bank Islam: A Comprehensive Guide

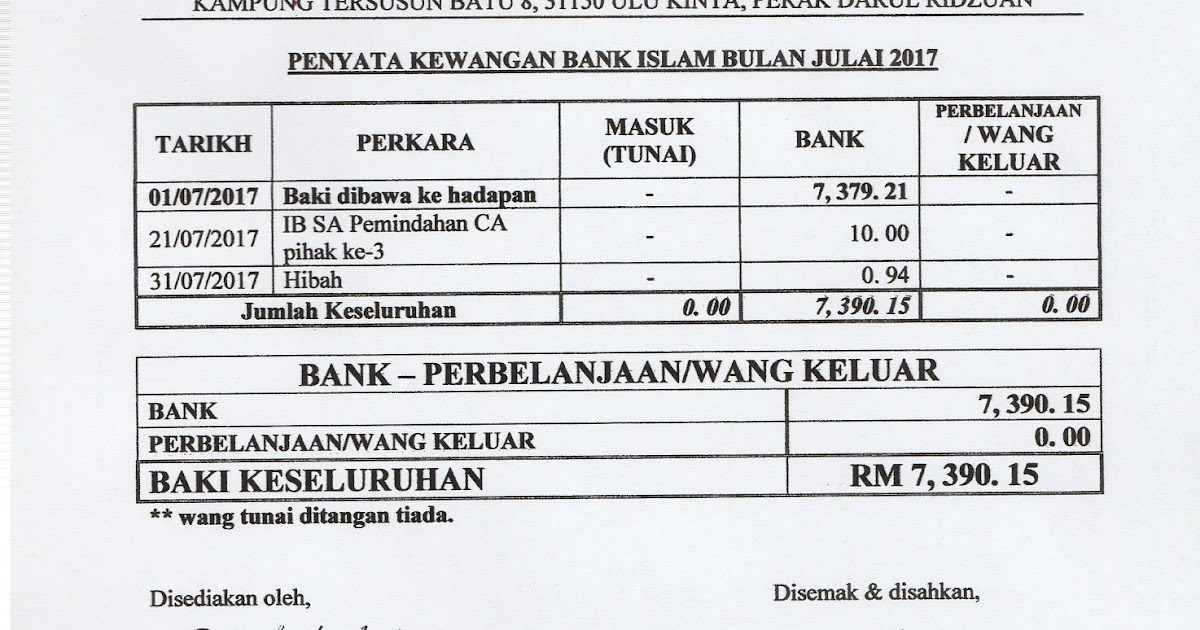

In today's digital age, managing personal finances effectively is crucial, especially for Muslims who adhere to Islamic financial principles. One essential aspect of financial management involves understanding and utilizing bank statements effectively. For those banking with Bank Islam, "salinan penyata akaun Bank Islam" refers to the bank statement provided by the institution, a document that holds immense value beyond merely tracking transactions.

Imagine needing to apply for a housing loan that aligns with Islamic principles. Your salinan penyata akaun Bank Islam becomes a testament to your financial discipline and adherence to Shariah-compliant banking, potentially increasing your chances of approval. This seemingly simple document plays a pivotal role in various financial endeavors.

This comprehensive guide delves deep into the world of salinan penyata akaun Bank Islam. We'll explore its significance, methods of obtaining it, and the numerous benefits it offers. Whether you're new to Islamic banking or seeking to maximize the utility of your bank statements, this guide equips you with the knowledge to navigate your finances confidently.

Let's unravel the intricacies of this essential financial tool and empower you to make informed decisions for a brighter financial future, all while adhering to the principles of Islamic finance. From understanding the various types of statements available to leveraging them for personal financial growth, we'll cover it all.

Join us as we demystify the world of salinan penyata akaun Bank Islam and provide you with actionable insights to manage your finances efficiently and ethically.

Advantages and Disadvantages of Different Bank Statement Options

Bank Islam, like most modern financial institutions, offers several ways to access your account statements, each with its own set of pros and cons:

| Statement Type | Advantages | Disadvantages |

|---|---|---|

| Paper Statements (mailed) |

|

|

| Electronic Statements (e-statements) |

|

|

| Mobile Statements (via Bank Islam app) |

|

|

Best Practices for Managing Your Salinan Penyata Akaun Bank Islam

Here are five best practices to help you make the most of your Bank Islam statements:

- Regularly Review Your Statements: Don't let your statements pile up unread. Make it a habit to review them at least monthly to track your income, expenses, and identify any discrepancies.

- Opt for e-Statements: Embrace paperless banking for its convenience, speed, and environmental benefits. Ensure you have strong passwords and enable two-factor authentication for online banking security.

- Download and Organize: Keep your e-statements organized by creating folders on your computer or utilizing personal finance software. This makes it easier to locate specific statements when needed.

- Utilize Budgeting Tools: Many banks, including Bank Islam, offer budgeting tools within their online or mobile banking platforms. Leverage these tools to analyze your spending habits and set financial goals.

- Seek Professional Advice: If you need help understanding your statement or planning your finances, don't hesitate to contact a qualified Islamic financial advisor.

Common Questions and Answers about Salinan Penyata Akaun Bank Islam

Get answers to frequently asked questions about Bank Islam statements:

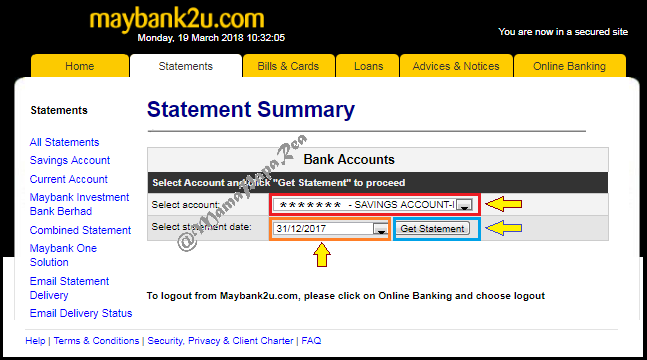

- Q: How can I get a copy of my Bank Islam statement?

A: You can obtain a copy through Bank Islam's online banking platform, mobile app, by visiting a branch, or contacting customer service. - Q: Is there a fee for requesting a statement?

A: It depends on the method of request and the type of statement. Check Bank Islam's fee schedule or contact them directly for details. - Q: How long does Bank Islam keep my statements?

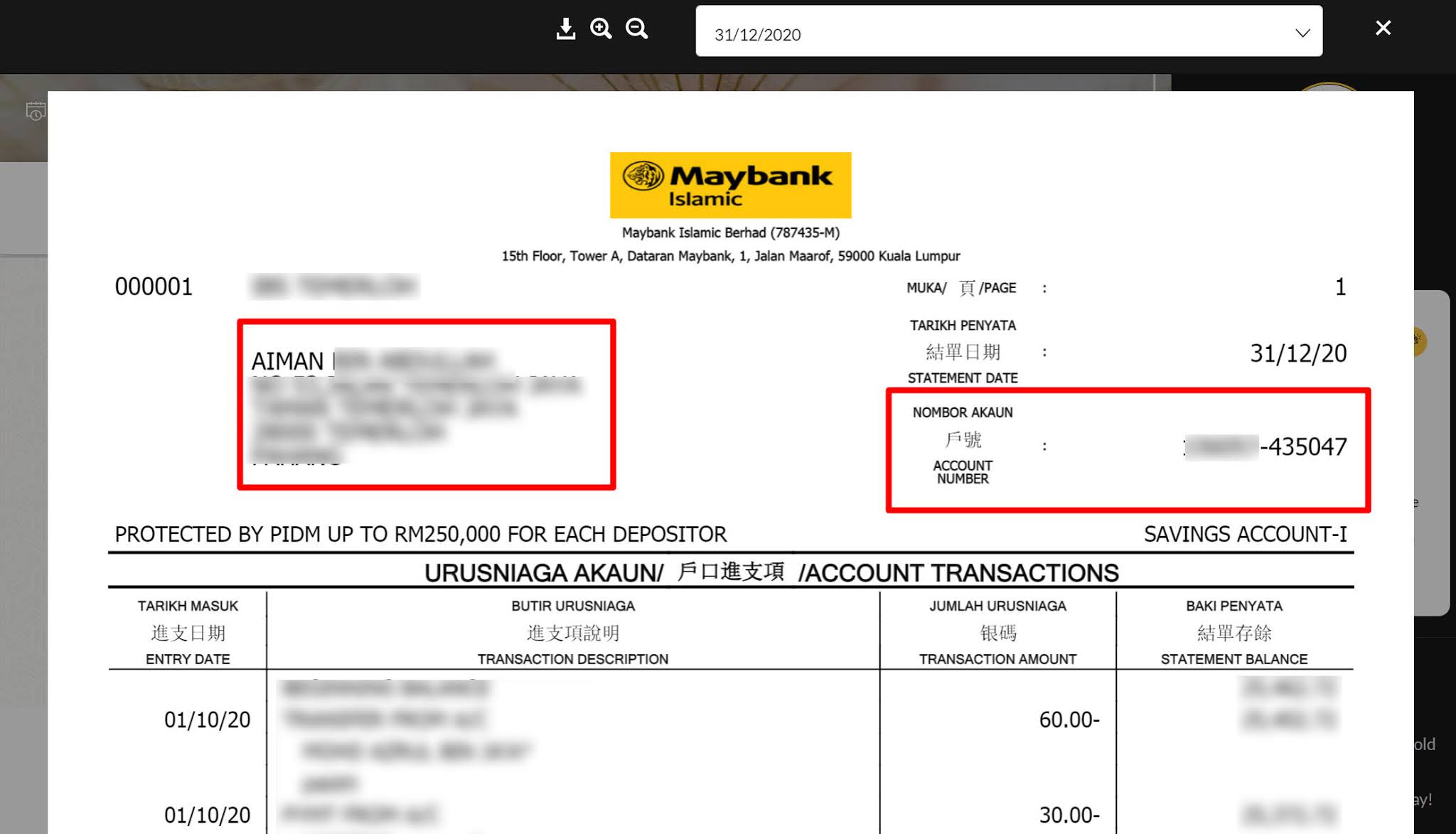

A: Banks typically retain electronic statements for a specific period, but it's advisable to download and store your statements indefinitely for your records. - Q: Can I use my Bank Islam statement as proof of income?

A: Yes, bank statements serve as valid proof of income for various purposes like loan applications, visa applications, and more. - Q: What should I do if I find an error on my statement?

A: Immediately contact Bank Islam's customer service and report the discrepancy. They will guide you through the necessary steps to rectify the error.

Conclusion: Your Salinan Penyata Akaun Bank Islam, Your Financial Guide

Your salinan penyata akaun Bank Islam is more than just a record of transactions; it's a valuable financial tool. By understanding the different types of statements available, their benefits, and how to manage them effectively, you can gain better control of your finances while adhering to Islamic principles. Make it a habit to regularly review your statements, utilize online banking features, and seek professional guidance when needed. Remember, informed financial decisions lead to a more secure and prosperous future.

Cara Dapatkan Bank Statement Bank Penyata Kewangan Jomsimpan | YonathAn-Avis Hai

Contoh Salinan Akaun Bank Islam | YonathAn-Avis Hai

Bank Islam Malaysia Berhad | YonathAn-Avis Hai

Salinan Akaun Bank Islam Tanpa Buku 2024 | YonathAn-Avis Hai

Semakan Penyata Bank Islam Online | YonathAn-Avis Hai

Contoh Salinan Akaun Bank | YonathAn-Avis Hai

Cara Transfer Duit Ke Tabung Haji Melalui Bank Islam Online | YonathAn-Avis Hai

Salinan Slip Muka Depan Akaun Bank 3 Cara Dapatkan Penyata Simpanan | YonathAn-Avis Hai

salinan penyata akaun bank islam | YonathAn-Avis Hai

salinan penyata akaun bank islam | YonathAn-Avis Hai

Contoh Salinan Akaun Bank Islam at Cermati | YonathAn-Avis Hai

salinan penyata akaun bank islam | YonathAn-Avis Hai

Cara Dapatkan Penyata Bank Download Online Direct Lending | YonathAn-Avis Hai

salinan penyata akaun bank islam | YonathAn-Avis Hai

Contoh Penyata Akaun Bank Islam at Cermati | YonathAn-Avis Hai