Unlocking Benefits: Your Guide to Qualifying Life Events

Life throws curveballs. A new job, a growing family, even saying goodbye to a loved one – these events reshape our lives, often requiring adjustments to our financial plans and insurance coverage. But did you know that many of these life changes can also unlock opportunities to update your benefits? These "benefits qualifying life events" are key windows for reassessing your needs and making sure you have the right coverage and support when you need it most.

Navigating these life events can feel overwhelming, especially when trying to understand the impact on your benefits. That's why understanding what qualifies as a life event, how it affects your coverage options, and the steps to take is crucial. This comprehensive guide will equip you with the knowledge to confidently approach these milestones, making informed decisions about your benefits and securing your financial well-being.

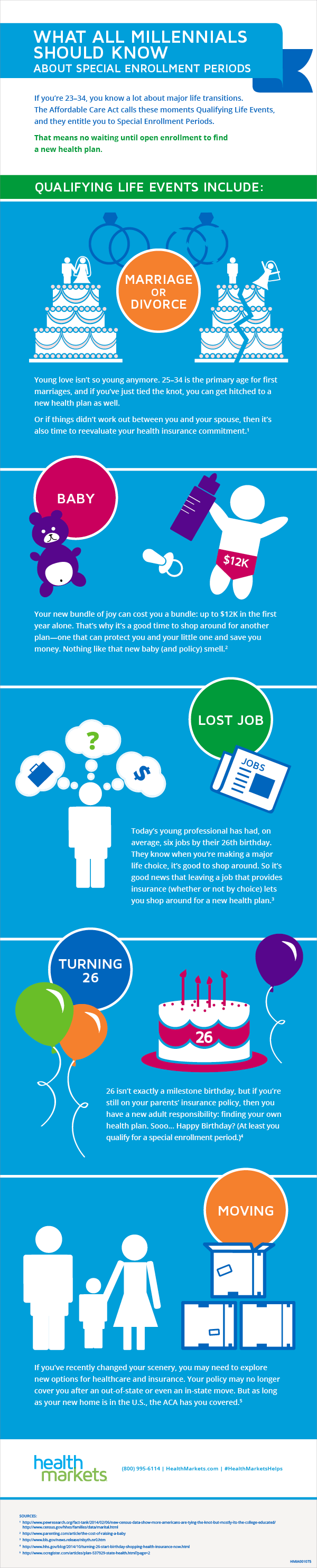

While the term "benefits qualifying life events" may sound formal, it simply refers to significant changes in your life that allow you to make adjustments to your insurance plans and other benefits outside of the typical open enrollment period. These events are usually tied to major life transitions that impact your needs, such as getting married, having a baby, or changing jobs.

The concept of benefits qualifying life events emerged from the need for flexibility in a world where our lives are constantly evolving. Traditional enrollment periods, often limited to once a year, weren't sufficient to address the dynamic nature of our personal and professional situations. Recognizing this, employers and insurance providers established these qualifying events to ensure individuals and families could access appropriate coverage during crucial moments.

Failing to understand and utilize benefits qualifying life events can lead to inadequate coverage, unexpected expenses, and missed opportunities to optimize your benefits. Whether it's health insurance, life insurance, or disability coverage, being underinsured or paying for coverage you don't need can have significant financial implications. That's why it's essential to be proactive and informed about how these events impact your options.

Advantages and Disadvantages of Benefits Qualifying Life Events

While benefits qualifying life events primarily offer opportunities, it's important to consider both the advantages and potential drawbacks:

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Navigating Benefits Qualifying Life Events

To make the most of benefits qualifying life events, consider these best practices:

- Know Your Qualifying Events: Familiarize yourself with the common life events that trigger eligibility for benefits changes. Check with your employer, insurance provider, and government resources for a comprehensive list.

- Act Promptly: You usually have a limited timeframe (often 30 or 60 days) from the date of the qualifying event to make changes. Don't delay – start researching your options and gathering necessary documents as soon as possible.

- Review and Compare: Take the time to carefully evaluate your current coverage needs. Consider factors like family size, health conditions, financial obligations, and future goals. Obtain quotes from different providers to compare options and costs.

- Seek Guidance: Don't hesitate to reach out to your employer's HR department, insurance company representatives, or financial advisors for guidance. They can provide personalized recommendations and help you understand the implications of your choices.

- Document Everything: Keep thorough records of your qualifying event, communication with providers, enrollment forms, and any changes made to your coverage. This documentation can be valuable for future reference and potential disputes.

Common Questions about Benefits Qualifying Life Events

Here are some frequently asked questions about benefits qualifying life events:

- What are some common examples of benefits qualifying life events?

Common examples include marriage, divorce, birth or adoption of a child, death of a spouse or dependent, job loss or change in employment status, moving to a new coverage area, and changes in your dependent's status. - How long do I have to make changes after a qualifying event?

The timeframe varies but is typically 30 or 60 days from the date of the event. It's essential to check with your employer or insurance provider for specific deadlines. - Can I change my benefits if I move to a new state?

Moving to a new state is often considered a qualifying event, allowing you to explore new coverage options available in your new location. - What if my employer doesn't offer the coverage I need?

If your employer's plan doesn't meet your requirements, you may be able to explore individual health insurance plans through the Health Insurance Marketplace or directly from insurance companies. - What happens to my benefits if I lose my job?

If you lose your job, you may have options like COBRA continuation coverage or enrolling in a new plan through the Health Insurance Marketplace during a special enrollment period. - Can I make changes to my retirement plan contributions during a qualifying event?

Some retirement plans allow adjustments to contributions outside of specific enrollment periods due to qualifying events. Check with your plan administrator for specific rules. - Where can I find more information about benefits qualifying life events?

Reliable sources of information include your employer's HR department, insurance provider websites, government websites (like Healthcare.gov), and reputable financial websites. - What if I miss the deadline to make changes after a qualifying event?

Missing the deadline could mean waiting until the next open enrollment period to make changes. It's crucial to contact your provider or employer as soon as possible if you encounter circumstances that prevent you from meeting the deadline.

Tips and Tricks for Navigating Benefits Qualifying Life Events

Here are some additional tips to make the process smoother:

- Stay Organized: Keep all documents related to your benefits and qualifying events in a designated folder or digital space.

- Set Reminders: Mark important deadlines on your calendar and set reminders to avoid missing crucial enrollment windows.

- Communicate Clearly: When contacting providers or employers, provide concise information about your qualifying event and desired changes.

- Don't Be Afraid to Negotiate: In some cases, you might be able to negotiate premiums or coverage terms, especially when transitioning between jobs or dealing with significant life changes.

Life is a journey marked by constant change. Benefits qualifying life events, though sometimes challenging, provide vital opportunities to adapt your financial and insurance strategies. By understanding these events, your options, and the steps involved, you can confidently navigate these transitions, ensuring you have the right support and protection every step of the way. Take charge of your benefits, make informed decisions, and embrace the future with confidence and peace of mind.

3 Step Guide to Choosing a Health Plan for your Lifestyle | YonathAn-Avis Hai

List of Qualifying Events for Employee Benefits | YonathAn-Avis Hai

Init feature become verify via who Supervisors for Choice at of | YonathAn-Avis Hai

What Employers Need to Know About a Qualifying Life Event | YonathAn-Avis Hai

The Amazing Truth About Qualifying Life Events for Millennials | YonathAn-Avis Hai

Qualifying Life Events and the Impact on Health Insurance | YonathAn-Avis Hai

What Are Qualifying Events? | YonathAn-Avis Hai

Understanding Qualifying Life Events (QLEs) | YonathAn-Avis Hai

ABT Open Enrollment, spring 2013 | YonathAn-Avis Hai

What You Need to Know for Open Enrollment 2022 | YonathAn-Avis Hai

Employees can update benefits through qualifying life events | YonathAn-Avis Hai

Updating your benefits through a qualifying status change (life event) | YonathAn-Avis Hai

benefits qualifying life events | YonathAn-Avis Hai

benefits qualifying life events | YonathAn-Avis Hai

ACA enrollment with a qualifying life event | YonathAn-Avis Hai