Unlocking Homeownership Dreams: Your Guide to Pinjaman Perumahan Kerajaan LPPSA

Imagine finally holding the keys to your dream home, a place where memories are made, and aspirations take flight. For many Malaysians, especially those in public service, this dream feels within reach thanks to initiatives like the Pinjaman Perumahan Kerajaan LPPSA. But what exactly is it, and how can it help turn your homeownership aspirations into a tangible reality? Let's dive in.

Navigating the complex world of housing loans can feel like deciphering a foreign language. With countless options and intricate details, it's easy to feel overwhelmed. That's where Pinjaman Perumahan Kerajaan LPPSA comes in, offering a beacon of hope and a clear path for public servants seeking to own their homes. This program, designed specifically for Malaysian government employees, provides a structured and supportive framework to make homeownership a more achievable goal.

Before we delve into the specifics, let's take a step back and understand the broader context. Housing affordability is a global concern, and Malaysia is no exception. The rising cost of living, coupled with stagnant wages, has made it increasingly challenging for individuals and families to enter the property market. In response, the Malaysian government has introduced various initiatives, including the Pinjaman Perumahan Kerajaan LPPSA, to address this pressing issue. This program forms a crucial pillar of the nation's efforts to promote homeownership, particularly among its dedicated public servants.

The significance of Pinjaman Perumahan Kerajaan LPPSA extends far beyond its financial assistance. It represents a commitment from the government to support the well-being and stability of its workforce. By providing access to affordable housing solutions, the program contributes to a more content and productive public sector, ultimately benefiting society as a whole. This initiative acknowledges the invaluable contributions of public servants and aims to reward their dedication with a tangible perk: the opportunity to own a place they can truly call home.

However, like any large-scale program, Pinjaman Perumahan Kerajaan LPPSA isn't without its challenges. Balancing the needs of borrowers with the program's sustainability requires ongoing adjustments and refinements. One of the main issues is ensuring that the program remains accessible to those who need it most, particularly young public servants just starting their careers. Additionally, as the economic landscape evolves, it's crucial to adapt the program's features and eligibility criteria to meet the changing needs of borrowers.

Advantages and Disadvantages of Pinjaman Perumahan Kerajaan LPPSA

| Advantages | Disadvantages |

|---|---|

| Lower interest rates compared to conventional loans | Longer processing times due to government bureaucracy |

| Flexible repayment options and terms | Stricter eligibility criteria limited to public servants |

| Access to government grants and subsidies for eligible borrowers | Potential limitations on property choices based on program guidelines |

Whether you're a seasoned public servant or just beginning your journey, understanding the intricacies of Pinjaman Perumahan Kerajaan LPPSA is essential for making informed decisions about your future. While this program presents a fantastic opportunity for homeownership, it's crucial to weigh the advantages and disadvantages carefully in the context of your personal financial situation and long-term goals.

Koperasi Hartanah Anggun Berhad KOHAB Pinjaman Perumahan Kerajaan LPPSA | YonathAn-Avis Hai

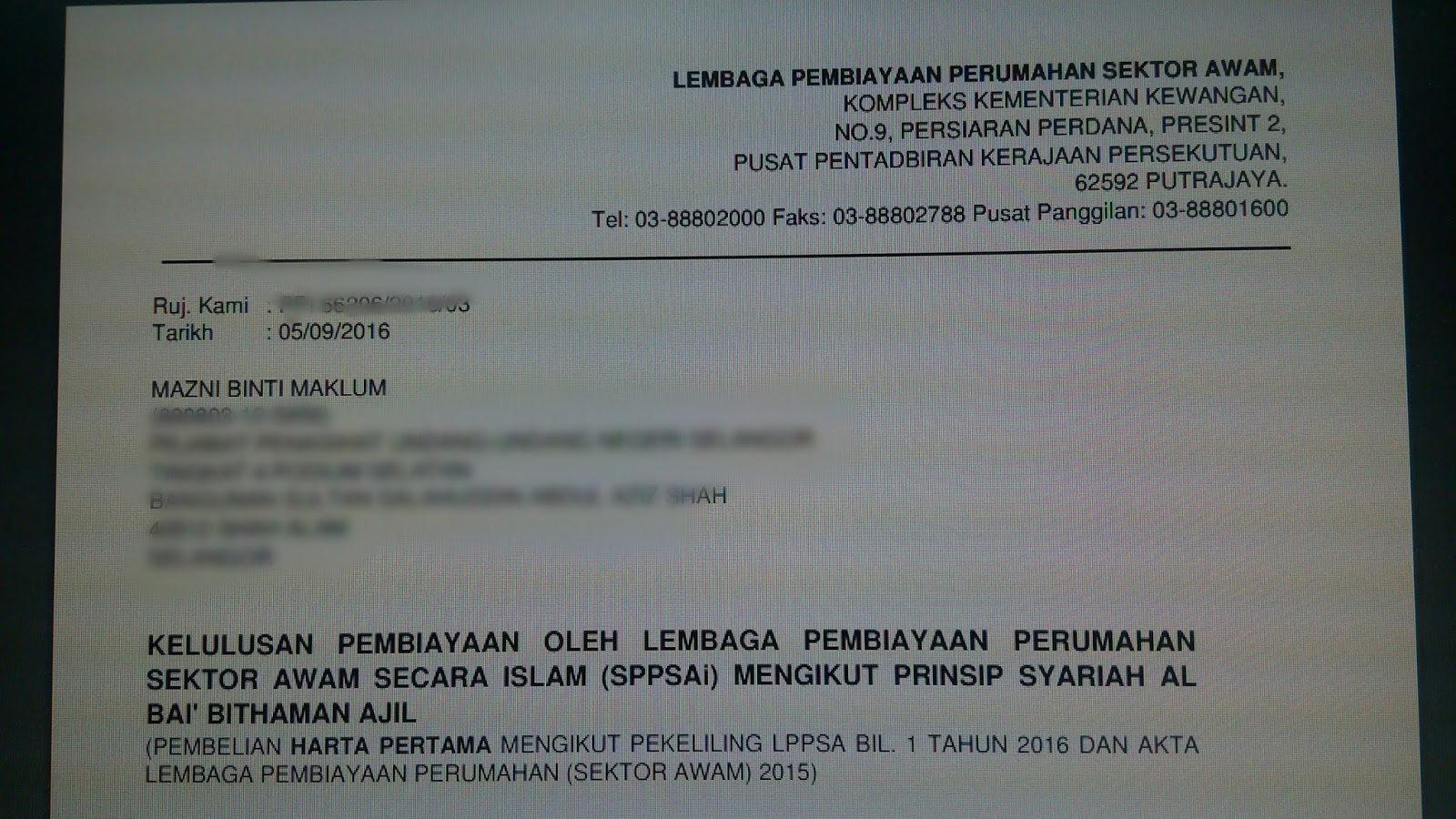

Contoh Surat Kelulusan Pinjaman Perumahan | YonathAn-Avis Hai

pinjaman perumahan kerajaan lppsa | YonathAn-Avis Hai

LPPSA: Syarat Pembiayaan, Kelayakan dan Cara Mohon Terkini! | YonathAn-Avis Hai

Bagaimana Beli Rumah Dengan Permohonan Pinjaman Perumahan Kerajaan | YonathAn-Avis Hai

Permohonan Pembiayaan Pinjaman Perumahan Kerajaan LPPSA 2020 | YonathAn-Avis Hai

.jpg?1611625323)

Pinjaman Perumahan Kerajaan (LPPSA): 7 Soalan Patut Tanya | YonathAn-Avis Hai

RUMAH BANGLO TAMAN HAJI ALI TELONG KANDIS BACHOK UNTUK DIJUAL Kawasan | YonathAn-Avis Hai

Permohonan Pinjaman Perumahan Kerajaan LPPSA 2020 Online | YonathAn-Avis Hai

LPPSA: Daftar, Login, Semak Jadual Kelayakan & Syarat Pinjaman | YonathAn-Avis Hai

Mudahnya Bina Rumah Dengan Pinjaman Perumahan Kerajaan (LPPSA) | YonathAn-Avis Hai

Kelebihan Pembiayaan Pinjaman Perumahan Kerajaan LPPSA Untuk Penjawat | YonathAn-Avis Hai

Eh! Boleh ke Nak Buat Pinjaman Perumahan Kerajaan (LPPSA) Kali Ke 2 | YonathAn-Avis Hai

Permohonan Pinjaman Perumahan Kerajaan LPPSA 2020 Online | YonathAn-Avis Hai

pinjaman perumahan kerajaan lppsa | YonathAn-Avis Hai