Unlocking Your Financial Future: A Guide to Panduan Mengisi Borang Pencen

Imagine this: you're finally free from the shackles of the daily grind, sipping coconut water on a beach somewhere, and laughing in the face of Monday mornings. That, my friend, is the sweet taste of retirement. But reaching this blissful state requires a bit of financial finesse, starting with understanding your pension (or as we say in Malaysia, "pencen").

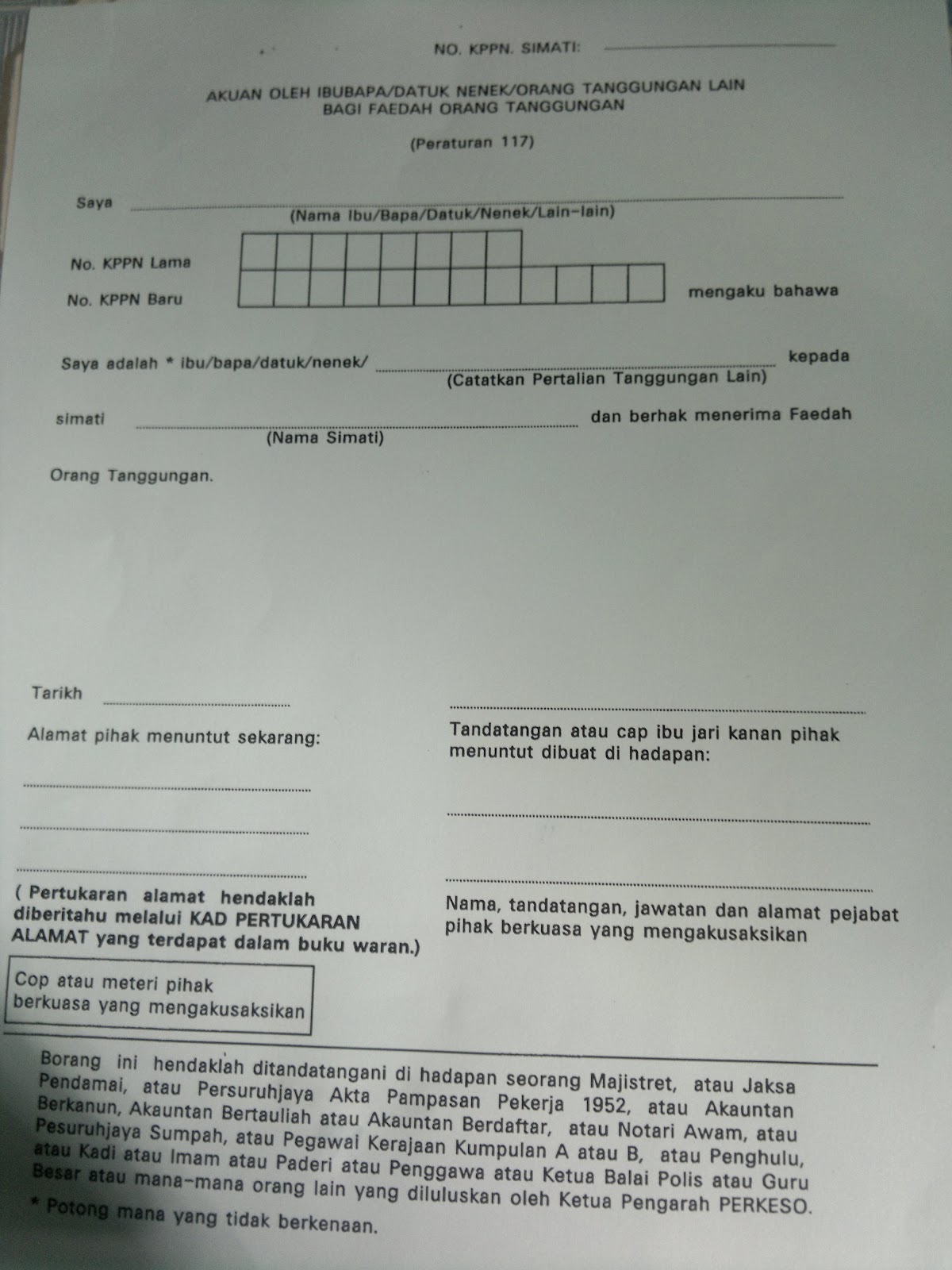

The key to unlocking this treasure chest of retirement funds? Mastering the art of the "panduan mengisi borang pencen" – your guide to navigating the sometimes-daunting world of pension forms. This isn't just about scribbling your name and calling it a day. It's about taking control of your financial destiny and ensuring you receive every Ringgit you've rightfully earned after years of hard work.

Now, you might be thinking, "Forms? Can't I just pay someone to handle this?" Sure, you could. But why throw your hard-earned money at a problem you can easily solve yourself? Remember, every Ringgit you save is another Ringgit you can invest in beachside cocktails later.

This guide will equip you with the knowledge and tools to conquer those pension forms like a financial warrior. We'll delve into the intricacies of the process, decode confusing jargon, and leave you feeling confident and in control of your retirement funds.

Ready to ditch the financial anxiety and embrace a retirement filled with possibility? Let's dive in!

While the specific content of a "panduan mengisi borang pencen" can vary depending on your specific pension scheme and employer, the fundamental principles remain consistent. You'll typically encounter sections requiring personal details, employment history, beneficiary designations, and withdrawal options. Accuracy is crucial here – a tiny error could lead to delays or even financial losses down the line.

Advantages and Disadvantages of Mastering "Panduan Mengisi Borang Pencen"

Let's face it – dealing with paperwork isn't exactly a walk in the park. But, just like that challenging hike that leads to a breathtaking view, the effort you invest in understanding your pension forms pays off big time.

| Advantages | Disadvantages |

|---|---|

|

|

See? The advantages far outweigh the perceived drawbacks. Plus, we're here to guide you every step of the way, minimizing the potential for errors and making the entire process a breeze.

Mastering the art of "panduan mengisi borang pencen" is not just about ticking boxes – it's about embracing a proactive approach to your financial well-being. It's about securing your future and ensuring you can enjoy the fruits of your labor when the time comes to bid farewell to the nine-to-five grind.

So, there you have it! Don't let those pension forms intimidate you. With a little effort and the right guidance, you'll be well on your way to a comfortable and enjoyable retirement. Now go forth and conquer those forms!

Garis Panduan Mengisi Borang Pencen Kod Panduan Mengisi Borang Pencen | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen Cara Panduan Dan Langk | YonathAn-Avis Hai

Panduan Mengisi Borang Persaraan Kod Panduan Mengisi Borang Pencen Buku | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen Jpa Bp Sppp B01a | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen | YonathAn-Avis Hai

Panduan Pengisian Borang Pencen Guru Gobind | YonathAn-Avis Hai

Kod Panduan Mengisi Borang Pencen | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen Jpa Bp Sppp B01a | YonathAn-Avis Hai

panduan mengisi borang pencen | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen Jpa Bp Sppp B01a | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen Panduan Mengisi Borang | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen Cara Mengisi Borang Persaraan Dan Pencen | YonathAn-Avis Hai

Panduan Mengisi Borang Persaraan Kod Panduan Mengisi Borang Pencen Buku | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen | YonathAn-Avis Hai

Panduan Mengisi Borang Pencen Borang Pencen Persaraan Pilihan Kod | YonathAn-Avis Hai