Unlocking Your Future: Understanding Your KWSP Account 1 and 2 Calculations

Imagine this: you're relaxing on a beach, sipping a cool drink, without a worry in the world. That's the dream, right? For many Malaysians, that dream of a comfortable retirement starts with understanding their KWSP (Employees' Provident Fund) savings, specifically the calculations behind Account 1 and 2. It might seem like a jungle of numbers and percentages, but don't worry, we're here to break it down.

In Malaysia, the KWSP is more than just a savings account; it's a safety net for the future. It's designed to ensure that every working individual has something to fall back on once they retire. But here's the catch: it's not just about how much you contribute, but also about understanding how your money grows and how the different accounts work together to build your retirement fund. That's where the importance of understanding the "kiraan KWSP akaun 1 dan 2," or the calculations behind Account 1 and 2, comes into play.

Now, let's talk about these two key players: Account 1 and Account 2. Think of them as two separate piggy banks working in tandem. Account 1 holds the larger portion of your contributions (70%) and focuses on long-term growth for your retirement. Account 2, on the other hand, holds the remaining 30% and allows for pre-retirement withdrawals for specific purposes like housing, healthcare, and education. Each account has its own set of rules and calculations that determine how your money grows and how much you can withdraw.

But why should you even care about these calculations? Well, understanding them empowers you to make informed decisions about your savings. It allows you to project your retirement income, plan for big-ticket expenses before retirement, and potentially explore investment options to further maximize your savings. In short, "kiraan KWSP akaun 1 dan 2" is your key to unlocking the full potential of your KWSP savings and paving the way to a brighter financial future.

Navigating the world of KWSP calculations might seem daunting at first, but remember that knowledge is power. By understanding the breakdown of your contributions, the potential for growth, and the implications of withdrawals, you can take control of your financial well-being and ensure a more secure and fulfilling retirement.

Advantages and Disadvantages of KWSP Account 1 and 2

| Feature | Advantages | Disadvantages |

|---|---|---|

| Account 1 |

|

|

| Account 2 |

|

|

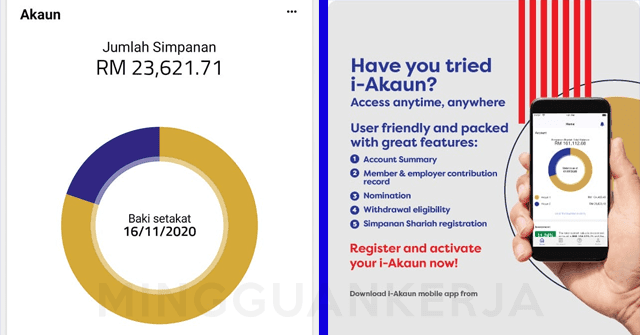

Knowing how to make the most of your KWSP savings can make a world of difference. Start by regularly checking your KWSP statement to track your balance and understand how your money is growing. Utilize the online calculators provided by KWSP to estimate your retirement savings and plan your withdrawals strategically. Remember, every ringgit counts, and making informed decisions about your KWSP savings today will pave the way for a brighter and more secure tomorrow.

INI CARA GANDAKAN DUIT KWSP DARI AKAUN 1 ANDA WALAU SUDAH TIDAK BEKERJA | YonathAn-Avis Hai

KWSP : Ini 18 jenis Pengeluaran Akaun 1 Dan 2 Sebelum Pencarum Berpencen | YonathAn-Avis Hai

Cara Tambah Simpanan KWSP Online Di i | YonathAn-Avis Hai

Cara Semak Akaun KWSP : Akaun 1 dan Akaun 2 | YonathAn-Avis Hai

Pengeluaran KWSP Melalui Akaun 1 Dan 2 | YonathAn-Avis Hai

Tak payah tunggu PM umum pun, ini 17 jenis pengeluaran KWSP yang | YonathAn-Avis Hai

kiraan kwsp akaun 1 dan 2 | YonathAn-Avis Hai

Ini Sebenarnya Fungsi Akaun 1 Dan Akaun 2 KWSP Yang Ramai Keliru | YonathAn-Avis Hai

Pengeluaran KWSP Melalui Akaun 3 | YonathAn-Avis Hai

2 Kategori Pengeluaran Khas KWSP Kini Dibenarkan | YonathAn-Avis Hai

Rujuk Cara Daftar i | YonathAn-Avis Hai

Apa Fungsi Sebenar Akaun 1 dan 2 Dalam KWSP? Ramai Tak Tahu Ni! | YonathAn-Avis Hai

Pengeluaran KWSP Melalui Akaun 1 Dan 2 : Ini Caranya! | YonathAn-Avis Hai

Pengeluaran Simpanan KWSP Melalui Akaun 1 & 2 Diluluskan! | YonathAn-Avis Hai

Caruman KWSP Turun Kepada 9%, Maksudnya gaji kita lebih banyak | YonathAn-Avis Hai