Unlocking Your Paycheck: Understanding Your Net Salary

Ever glanced at your paycheck and felt a twinge of confusion? You're not alone. Navigating the world of salaries, deductions, and net income can feel like deciphering a secret code. But understanding how your final paycheck amount is determined is crucial for effective financial planning and ensuring you're being compensated fairly. Let's demystify the process of salary calculation and empower you to take control of your earnings.

At its core, your salary is more than just the number you negotiate with your employer. It's a multi-faceted figure influenced by taxes, insurance premiums, retirement contributions, and other potential deductions. Grasping the difference between your gross pay (the amount before deductions) and your net pay (your take-home amount) is fundamental to financial literacy.

The concept of calculating net salary has been around as long as formal employment and taxation systems have existed. As labor laws evolved and social safety nets like retirement and health insurance emerged, salary calculations became more complex, reflecting the growing need to balance employee compensation with societal contributions.

In today's world, understanding your net salary is paramount. It directly impacts your budgeting, saving, and overall financial well-being. Without a clear picture of your take-home pay, making informed financial decisions – from monthly expenses to long-term investments – becomes significantly more challenging.

Unfortunately, many individuals face obstacles when it comes to comprehending their pay stubs. Complex terminology, varying deduction structures, and a lack of accessible information can create confusion and hinder financial clarity. This is where empowering yourself with knowledge becomes essential.

While the specific elements of your salary calculation will vary depending on your location, employment contract, and individual choices, several common components typically come into play. Understanding these factors is key to deciphering your paycheck and identifying any discrepancies.

First and foremost, taxes are a significant portion of most salary calculations. These can include federal income tax, state and local taxes, and social security contributions. The exact percentage deducted varies based on your income level and where you live.

Next, insurance premiums often play a role in determining your net pay. Health insurance, dental, vision, and life insurance are common benefits offered by employers, with a portion of the premium typically deducted from your paycheck.

Retirement contributions are another crucial element. Whether you contribute to a 401(k), IRA, or another retirement savings plan, these contributions are usually deducted pre-tax, meaning they lower your taxable income.

Other deductions might include contributions to flexible spending accounts (FSAs) for healthcare or dependent care, wage garnishments for court-ordered payments, or union dues.

Mastering the art of deciphering your paycheck and understanding the components that contribute to your net salary is an empowering financial skill. By gaining clarity on these factors, you can advocate for yourself, make informed financial decisions, and ensure you're being compensated fairly for your hard work. Remember, knowledge is power, especially when it comes to your finances.

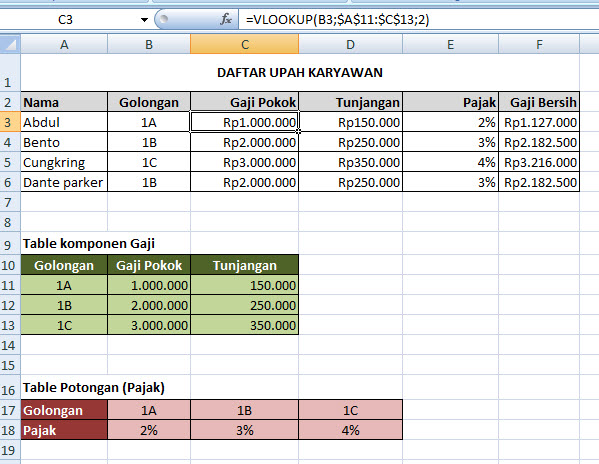

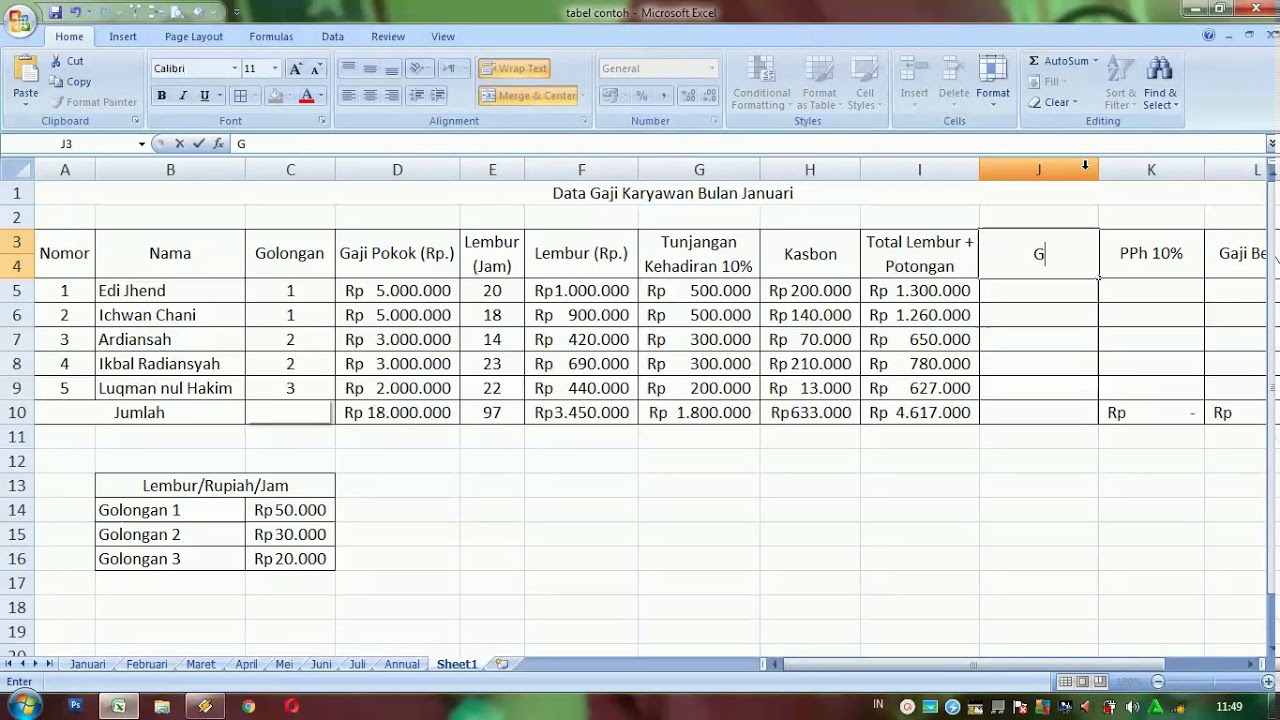

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai

cara menghitung gaji bersih | YonathAn-Avis Hai