Unveiling Your Financial Footprint: A Guide to Cara Semak Bayaran Balik PTPTN

In the mosaic of life, where ambition often intertwines with financial realities, access to education emerges as a potent force for personal and societal transformation. Yet, the path to knowledge can sometimes be paved with financial complexities, requiring thoughtful navigation and responsible stewardship. In Malaysia, the National Higher Education Fund Corporation (PTPTN) plays a pivotal role in realizing educational aspirations, providing loans that empower countless individuals to pursue their academic dreams. As beneficiaries of this support embark on their professional journeys, understanding the intricacies of loan repayment becomes paramount. This brings us to the heart of our exploration - "cara semak bayaran balik PTPTN" - a phrase that encapsulates the essence of financial awareness and responsibility.

Imagine stepping into a vast library, each book representing a chapter in your financial journey. "Cara semak bayaran balik PTPTN" acts as your compass, guiding you through the labyrinth of loan repayment, ensuring transparency, and fostering a sense of ownership over your financial obligations. It empowers you to track your repayment progress, identify any discrepancies, and plan your finances with greater clarity. In essence, it's about taking charge of your financial narrative, understanding its nuances, and shaping a future where financial well-being is not a distant aspiration but an integral part of your life's tapestry.

This exploration delves into the multifaceted world of PTPTN loan repayment, unraveling the significance of "cara semak bayaran balik PTPTN." We will journey through its origins, understand its profound impact on individual financial well-being, and shed light on the practical aspects that empower borrowers to navigate this process with confidence and ease.

The introduction of the National Higher Education Fund (PTPTN) in Malaysia marked a pivotal moment in the nation's commitment to fostering a knowledge-based society. Recognizing the transformative power of education, the Malaysian government established PTPTN to provide financial assistance to deserving students, enabling them to pursue higher education without being burdened by exorbitant costs. This initiative opened doors for countless individuals, empowering them to break down socioeconomic barriers and unlock their full potential.

As beneficiaries of PTPTN loans embark on their careers, the importance of "cara semak bayaran balik PTPTN," or checking your PTPTN loan repayment, comes to the forefront. It serves as a cornerstone of responsible financial management, allowing borrowers to stay informed about their repayment progress, ensure accuracy in their payment records, and plan their financial future with a clear understanding of their obligations.

Advantages and Disadvantages of Regularly Checking Your PTPTN Loan Repayment

| Advantages | Disadvantages |

|---|---|

|

|

Best Practices for Managing Your PTPTN Loan Repayment

Effectively managing your PTPTN loan repayment is crucial for maintaining a healthy financial profile. Here are some best practices to consider:

- Understand Your Loan Terms: Familiarize yourself with the terms of your loan, including the repayment period, interest rates, and any applicable penalties.

- Set Up Reminders: Mark your calendar or set up reminders to ensure timely payments and avoid late fees.

- Explore Repayment Options: PTPTN offers various repayment options, such as salary deductions or online payments. Choose the method that aligns best with your financial capabilities.

- Communicate with PTPTN: If you encounter financial difficulties or anticipate delays in repayment, proactively communicate with PTPTN. They offer support and guidance to borrowers facing challenges.

- Consider Early Repayment: If your financial situation allows, explore the option of making early or lump-sum payments to reduce the overall interest incurred.

As you embark on this journey of financial responsibility, remember that every step taken toward understanding and managing your PTPTN loan repayment is a step toward securing a brighter and more financially secure future.

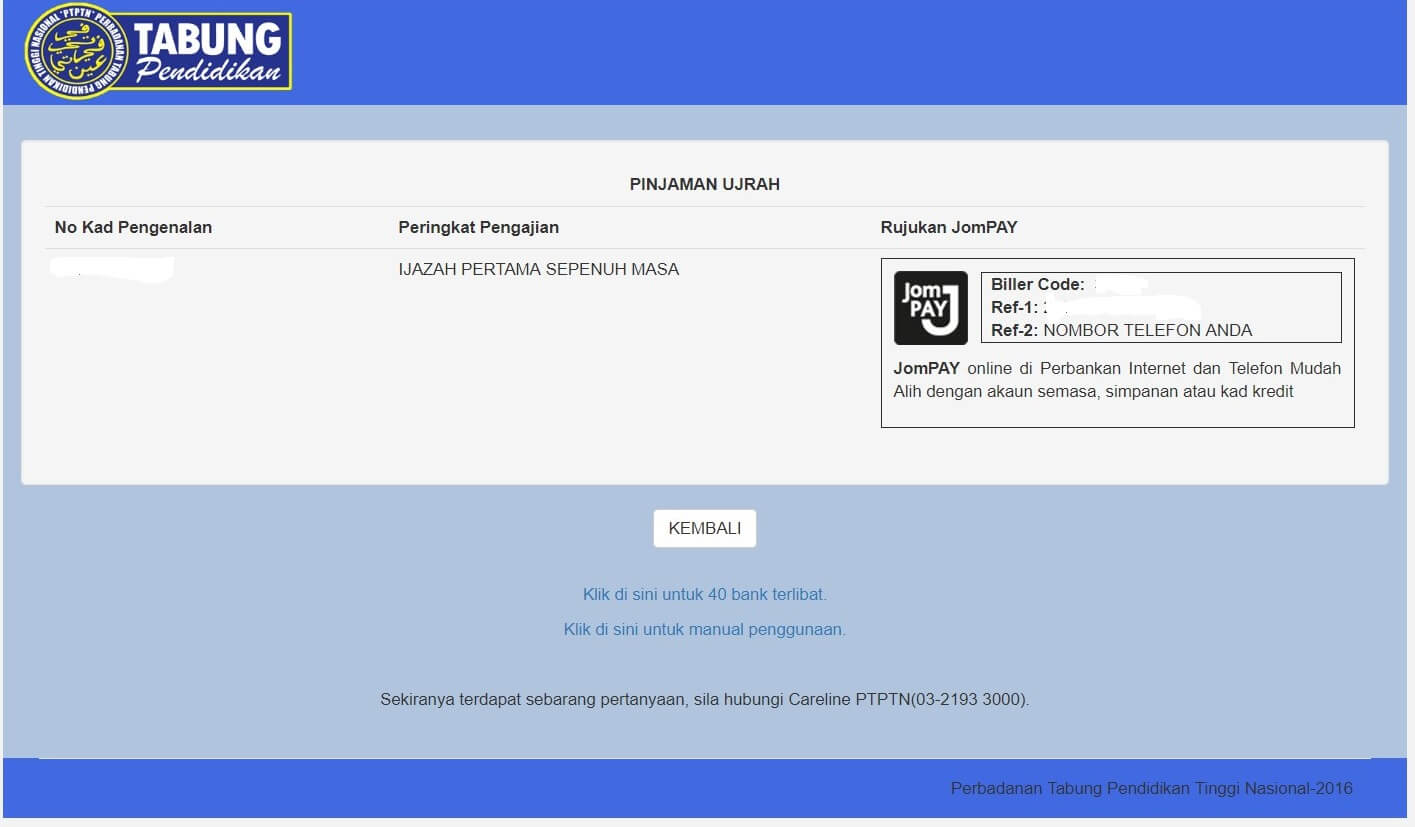

Cara Semak JomPAY Biller Code PTPTN | YonathAn-Avis Hai

Cara Mohon Diskaun & Penangguhan Bayaran Balik PTPTN | YonathAn-Avis Hai

Permohonan Penangguhan Bayaran Balik Pinjaman PTPTN (PKP 3.0 | YonathAn-Avis Hai

cara semak bayaran balik ptptn | YonathAn-Avis Hai

.png)

Selain MARA & PTPTN, Ini Pinjaman Pembelajaran Yang Boleh Bantu Anda | YonathAn-Avis Hai

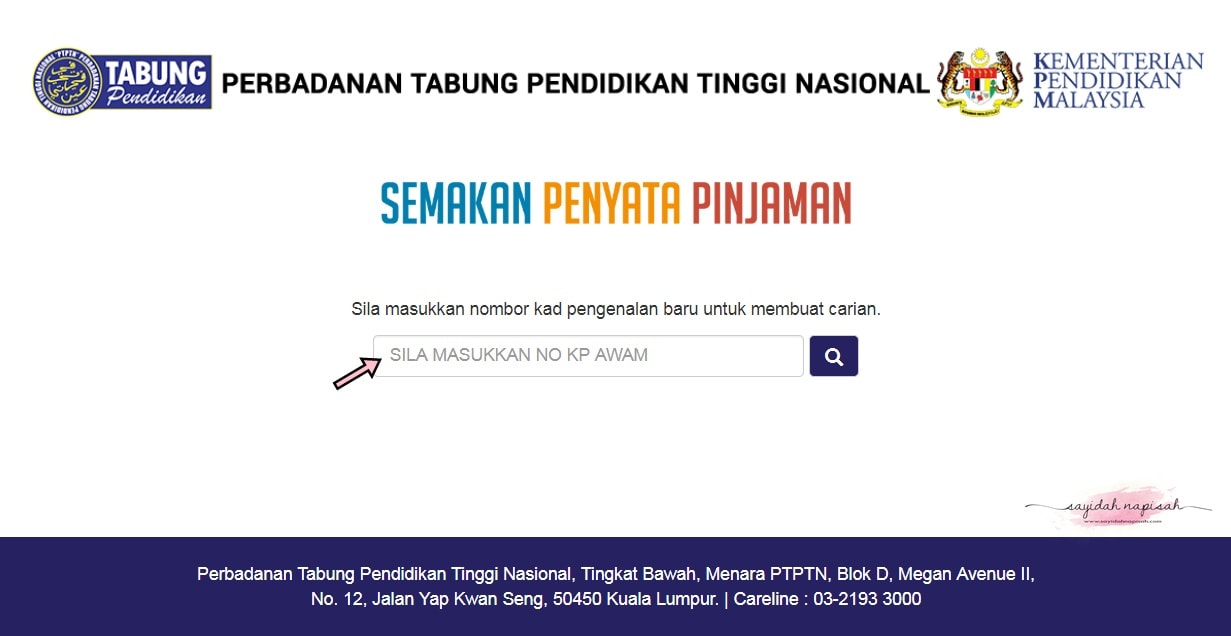

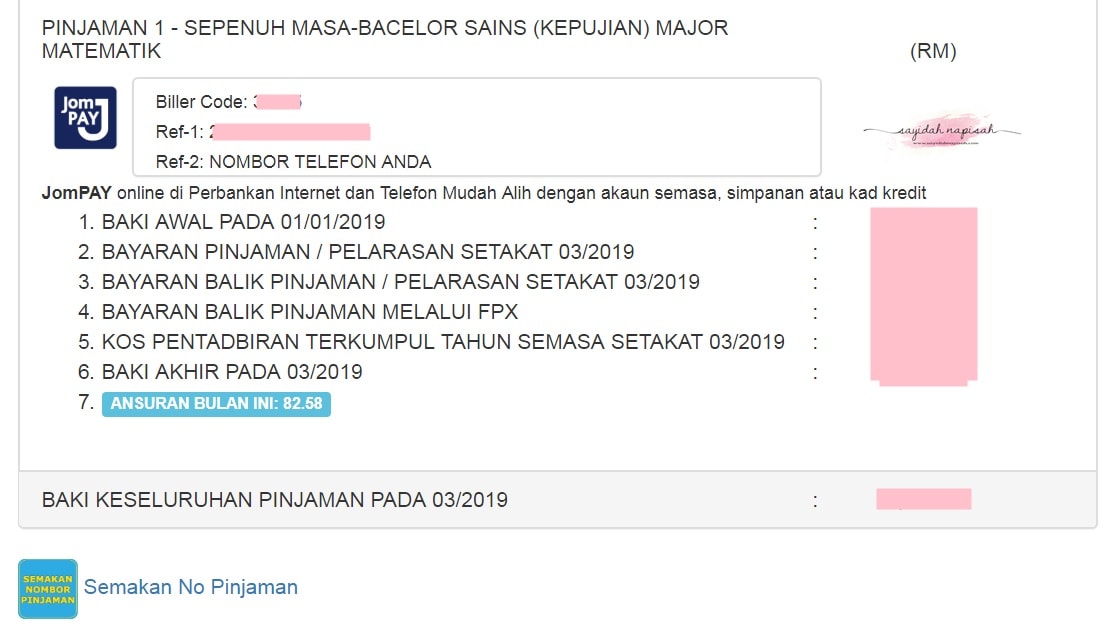

Cara Check Baki Bayaran Balik Pinjaman PTPTN (Online) | YonathAn-Avis Hai

Cara Mohon Pengecualian Bayaran Balik PTPTN Online (Pem | YonathAn-Avis Hai

Cara Semak JomPAY Biller Code PTPTN | YonathAn-Avis Hai

Cara Check Baki Bayaran Balik Pinjaman PTPTN (Online) | YonathAn-Avis Hai

Cara Check Baki Bayaran Balik Pinjaman PTPTN (Online) | YonathAn-Avis Hai

Cara Semak Baki Pinjaman PTPTN Secara Online | YonathAn-Avis Hai

Ini Dia Cara Mudah Buat Bayaran PTPTN Melalui Aplikasi myPTPTN | YonathAn-Avis Hai

Cara Check Baki Bayaran Balik Pinjaman PTPTN (Online) | YonathAn-Avis Hai

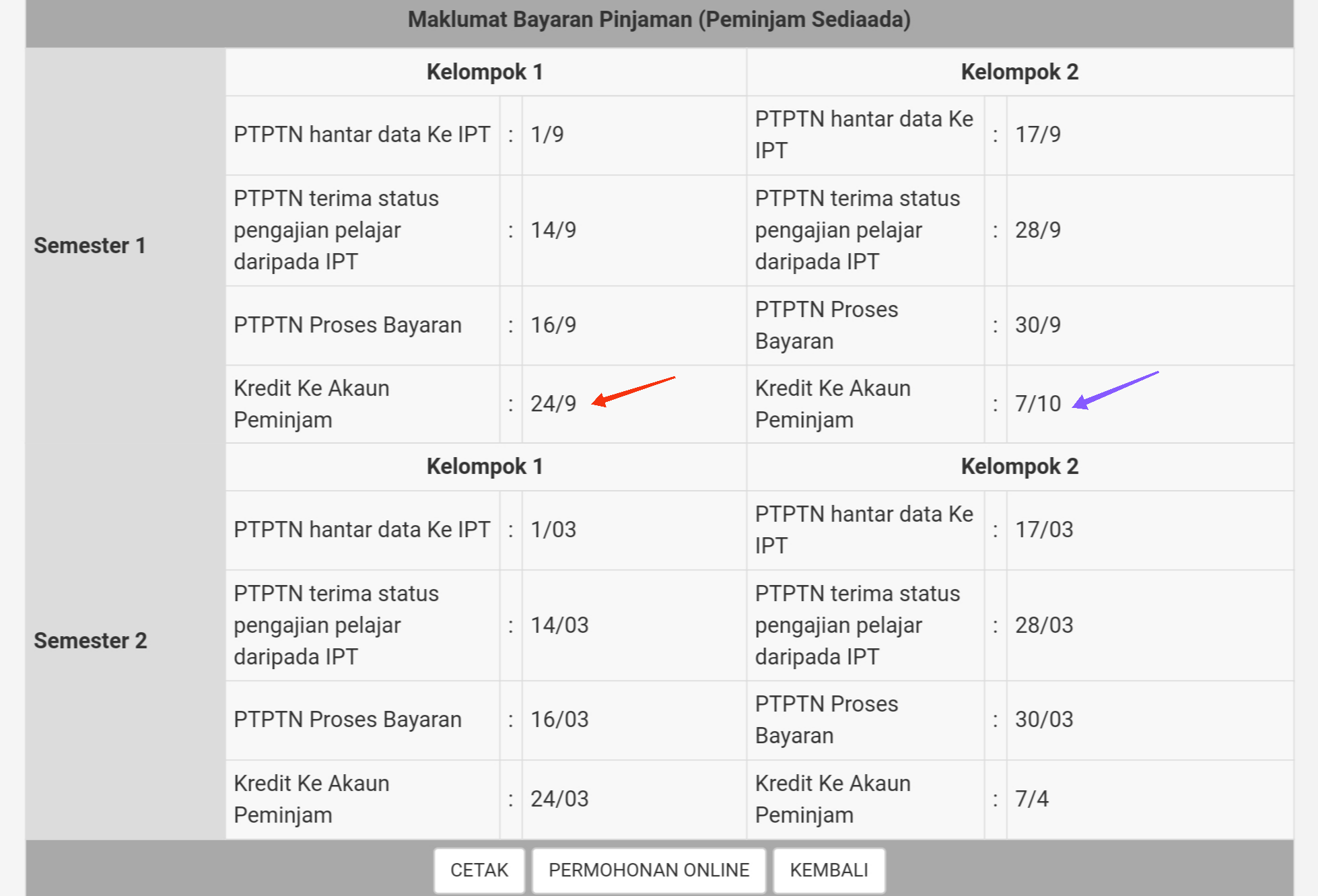

Cara semak tarikh pinjaman PTPTN masuk setiap semester. | YonathAn-Avis Hai

Cara Semak Baki PTPTN Online dan Tunggakan Terkini | YonathAn-Avis Hai