Wells Fargo Sending Out Remediation Checks: What You Need to Know

Have you heard the news? Wells Fargo is sending out remediation checks to customers who were impacted by certain past practices. This has many people wondering why and what it means for them. In this article, we'll break down everything you need to know about Wells Fargo sending out remediation checks, including who's eligible, what to expect, and how it might benefit you.

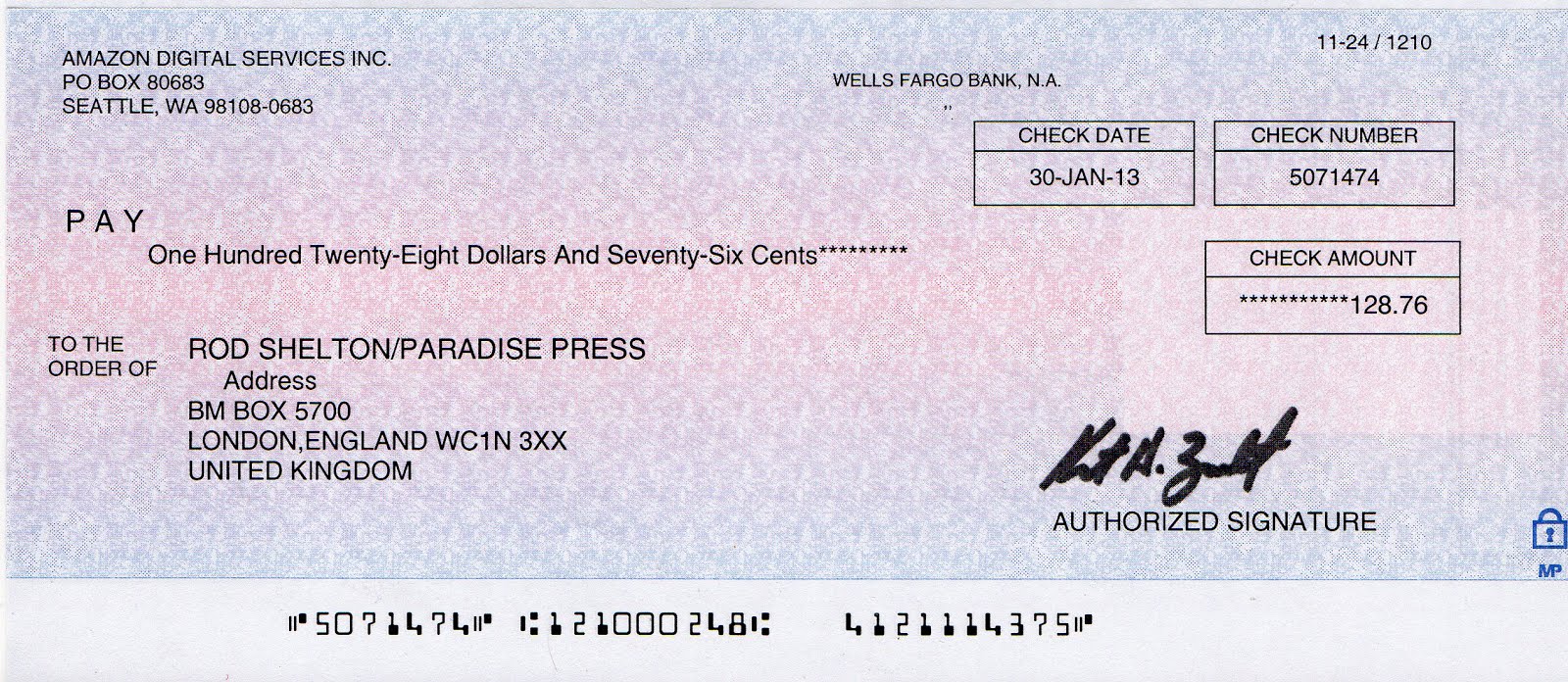

First things first, what are remediation checks? Essentially, they're a way for a company to compensate customers who were negatively affected by its actions. These actions might have been unintentional errors or, in some cases, practices that were deemed unfair. The goal is to make things right with customers and rebuild trust.

In the case of Wells Fargo, the remediation checks stem from various issues that came to light in recent years. These issues involved certain practices that harmed customers, and Wells Fargo has been working to address them. Sending out remediation checks is a key part of their efforts to make amends.

Now, you might be wondering if you're eligible for a remediation check. Eligibility depends on a few factors, such as the specific Wells Fargo products or services you used and the timeframe involved. We'll delve into more specifics later, but it's important to remember that not every Wells Fargo customer will receive a check.

Whether you're expecting a check or just curious about this development, understanding the ins and outs of Wells Fargo sending out remediation checks can help you navigate the situation and potentially benefit from it. So, let's explore this topic further.

Let's say, for example, you were charged unnecessary fees for a certain product during a specific period. Wells Fargo identified this as a practice needing remediation, and their records show you were affected. In this case, you'd likely be eligible for a remediation check covering the amount of those fees.

Wells Fargo sending out remediation checks is a significant event for both the bank and its customers. While it highlights past missteps, it also represents a step towards righting wrongs and rebuilding trust. As we move forward, we'll explore the specifics of these remediation efforts, offering clarity and guidance for those impacted.

Advantages and Disadvantages of Wells Fargo Sending Out Remediation Checks

| Advantages | Disadvantages |

|---|---|

| Provides financial compensation to affected customers | Can be seen as an admission of guilt |

| Helps rebuild trust with customers | May not fully compensate for all losses or inconveniences experienced |

| Demonstrates a commitment to accountability | Could lead to further scrutiny and legal action |

While the specifics of receiving and utilizing a remediation check will be unique to each individual's situation, understanding the overall context and potential impact of Wells Fargo's actions is crucial. Stay tuned as we continue to unravel the intricacies of this complex issue and empower you to make informed decisions.

Wells Fargo Blank Check Template | YonathAn-Avis Hai

Wells Fargo Blank Check Template | YonathAn-Avis Hai

Wells Fargo Printable Checks | YonathAn-Avis Hai

Wells Fargo Customer Care Remediation Check 2024 | YonathAn-Avis Hai

Wells Fargo Printable Checks | YonathAn-Avis Hai

wells fargo sending out remediation checks | YonathAn-Avis Hai

Perla Dahan on LinkedIn: | YonathAn-Avis Hai

How to Notify Wells Fargo of Your Travel Plans | YonathAn-Avis Hai

Wells Fargo Freezing Accounts 2024 | YonathAn-Avis Hai

wells fargo sending out remediation checks | YonathAn-Avis Hai

wells fargo sending out remediation checks | YonathAn-Avis Hai

Review: Wells Fargo Foreign Exchange & Overseas Transfers | YonathAn-Avis Hai

Can I Print A Wells Fargo Deposit Slip | YonathAn-Avis Hai

Wells Fargo Remediation Letter 2024 | YonathAn-Avis Hai

Can I Print My Own Checks Wells Fargo | YonathAn-Avis Hai